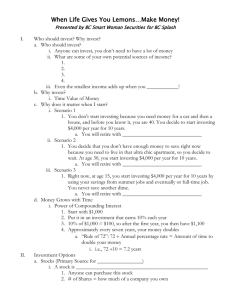

Primer: Why Are You Here

advertisement