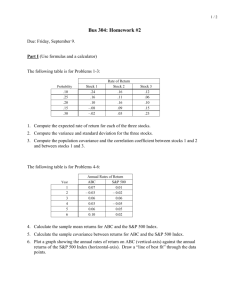

Risk and Return

advertisement

Risk and Return Intro Returns HPR CAGR YTM, RCYTM APR and APY DY NPV, IRR Average Annual Return Geometric Return 1 Holding Period Return (HPR) Holding Period Return The total return earned from holding an investment for a specified holding period (usually 1 year or less) Holding period return Current income Capital gain (or loss) during period during period Beginning investment value Capital gain (or loss) Ending Beginning during period investment value investment value 2 Using HPR Advantages of Holding Period Return Easy to calculate Easy to understand Considers current income and growth Disadvantages of Holding Period Return Does not consider time value of money Inaccurate and irrelevant if time period if longer than one year 3 Using IRR Advantages of Internal Rate of Return Uses the time value of money Allows investments of different investment periods to be compared with each other If the yield is equal to or greater than the required return, the investment is acceptable Disadvantages of Internal Rate of Return Calculation is complex Results may not be unique 4 Interest on Interest Using YTM and IRR assumes: that all income earned over the investment horizon is reinvested at the same rate as the original investment. Reinvestment Rate is the rate of return earned on interest or other income received from an investment over its investment horizon. Fully compounded rate of return is the rate of return that includes interest earned on interest. 5 Risk Risk-Return Tradeoff Eis(R)the between risk and Pr(relationship r) r return, in which investments with more risk should provide higher returns, and vice versa Return, for purposes of planning, is the expected return. E( R) Pr(r ) r Risk is the chance that the actual return from an investment may differ from what is expected. Measured as the standard deviation of the expected return. 6 Risk and Prices andexpected Coupon Return Rates E(r) Risk r 7 Sources of Risk Business Risk uncertainty associated with an investment’s earnings and ability to pay returns owed investors. Affects Common stocks Preferred stocks Examples Decline in company profits or market share Bad management decisions 8 Sources of Risk (cont’d) Currency Exchange Risk variation in exchange rates. Affects International stocks, ADRs International bonds Examples U.S. dollar appreciates against foreign currency, reducing value of foreign investment 9 Sources of Risk (cont’d) Financial Risk uncertainty attributable to the mix of debt and equity used to finance a business; more debt, greater this risk. Affects Common stocks Corporate bonds Examples Company unable to obtain credit to fund operations Company defaults on bonds 10 Sources of Risk (cont’d) Purchasing Power Risk changing price levels (inflation or deflation) that adversely affect investment returns. Affects Bonds (fixed income) Certificates of deposit Examples Barrel of oil $66.00 last year is $89.00 this year 11 Sources of Risk (cont’d) Interest Rate Risk changes in interest rates that adversely affect a security’s value. Affects Bonds (fixed income) Preferred stocks Examples Market values of existing bonds decrease as market interest rates increase Income from an investment is reinvested at a lower interest rate than the original rate 12 Sources of Risk (cont’d) Liquidity Risk not being able to liquidate an investment conveniently and at a reasonable price. Affects Some small company stocks Real estate Examples Selling a low volume stock reduces the price of the stock, consider blockage discounts 13 Sources of Risk (cont’d) Tax Risk Congress may introduce unfavorable tax laws, driving down the after-tax returns and market values of certain investments. Affects Municipal bonds Real estate Examples Lower tax rates reduce the tax benefit of municipal bond interest Limits on deductions from real estate losses 14 Sources of Risk (cont’d) Market Risk decline in investment returns because of market factors independent of the given investment. Affects All types of investments Examples Stock market decline on bad news Political upheaval Changes in economic conditions 15 Sources of Risk (cont’d) Event Risk unexpected events that have significant and immediate effect on the underlying value of an investment. Affects All types of investments Examples Decrease in value of insurance company stock after a major hurricane Decrease in value of real estate after a major earthquake The BP oil spill 16 Measures of Risk: Single Asset Standard deviation is a statistic used to measure the CV dispersion (variation) of returns around an asset’s average or expected return. Coefficient of variation is a statistic used to measure the relative dispersion of an asset’s returns; it is useful in comparing the risk of assets with differing average or expected returns. CV Higher values for both indicate higher risk 17 Historical Returns and Risk 18 Risk-Return Tradeoffs 19 The Decision Process: Combining Return and Risk Estimate the expected return using present value methods and historical/projected return rates. Assess the risk of the investment by looking at historical/projected returns using standard deviation or coefficient of variation of returns. Evaluate the risk-return of each investment alternative to make sure the return is reasonable given the level of risk. Select the investment vehicles that offer the highest expected returns associated with the level of risk you are willing to accept. 20