Chapter 4

advertisement

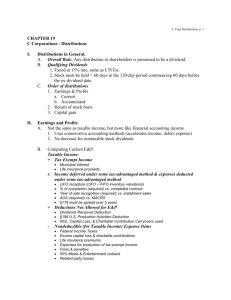

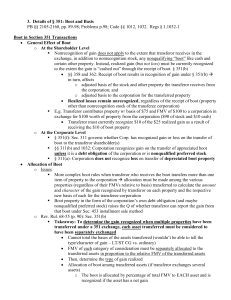

Chapter 4: "Corporations: Organization and Capital Structure" Read all pages for Learning Objectives 1 through 3, and read the Sec. 351 material in L.O. 7 Organization of and Transfers to Controlled Corporations Shareholder transfers of property to a corporation in exchange for stock of the corporation will either be a recognition or nonrecognition event. If certain conditions are met, §351 dictates nonrecognition treatment. §351 can apply at incorporation and also when transfers are made to existing corporations. Reasons for nonrecognition treatment: Basic result of nonrecognition treatment: substitute and carryover basis Example: A incorporates her business by transferring assets with AB = 40,000 and FMV = 65,000 to X Corporation in exchange for all of the stock of X. Result if there is recognition treatment: Double tax nature of C Corporation under Sec. 351: Two levels of gain are created. Two levels of loss would be created, but additional rules result in just one loss being preserved. See notes on AB of Assets for Corporation. 24, 25 Section 351(a) General rule No gain or loss shall be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock …and immediately after the exchange such person(s) are in control of the corporation. Three important elements: property is transferred; solely in exchange for stock; transferor(s) in control after transfer (at least 80%) Solely turns out not really to mean solely because boot can be part of the transaction. Section 351 can still apply. 1 Property: Property is broadly defined and includes tangible and intangible assets. Stock: Stock includes common stock and most preferred stock. Stock rights are not included. Corporate debt that is transferred to a shareholder is boot. Control (§368(c)): Immediately after the exchange, transferors own stock with at least 80% of (1) the total combined voting power and (2) the total number of all other shares. 27, Handout #1 Property issues: Services do not constitute property. However, if a person contributes both property and services and the value of the property equals at least 10% of the value of the services, the person can count all the stock in the ownership/control test. Otherwise, none of the stock is counted. With respect to services, the treatment by the corporation will be to report an immediate expense or to capitalize and then amortize. The service provider recognizes ordinary income = FMV of stock received for the services. AB of stock received for services = FMV services provided. 32, 33, 31, 11 HW 9, 35 Control issues: "Immediately after" does not require simultaneous transfer, but transfers at different dates should be close in date and in accordance with an agreement or plan. 30 Momentary control is not sufficient if there is a disposition of stock that is part of an agreement or plan. Momentary control is probably sufficient if there is not a plan. Handout #2 HW 3, 6, 10, 16, 28, 29, 41, 42 Boot If assets other than stock are transferred to the shareholder, realized gain is recognized to the extent of boot. Losses are not affected. Boot = cash + FMV of non-stock property received. Boot affects the stock basis calculation. The basis of the boot = FMV. 2 Calculation of Basis of Stock for Shareholder Shareholder stock basis (§358) = AB of property transferred to corporation (“substitute”) Minus FMV of boot received and/or liabilities relieved of Plus gain recognized = AB of Stock Calculation of AB of Assets to Corporation General rule: AB of property transferred (“carryover”) + Plus any gain recognized by shareholder = AB of Property Exception to carryover basis (applied on a shareholder by shareholder basis): If the sum of the AB of assets > sum of the FMV of assets (“built in” loss), the corporation will use the sum of the FMV for its AB in assets received. To determine AB for each asset, the overall reduction from AB to FMV is done prorata based on relative amounts of built in losses. Election available: the reduction can be done for shareholder stock basis instead Handout #3, 39 HW 2, 5 Assumption of Shareholder Liabilities by the Corporation §357(a) general rule: shareholder relief from liabilities is not boot. (In other settings, being relieved of liabilities is boot). Liability relief affects the stock basis calculation (see above). Two exceptions to non-boot treatment (if both apply, follow rule of §357(b)): 1. §357(b): If the principal purpose of the liability transfer by the shareholder is to avoid tax or if there is no bona fide business purpose for the liability assumption, then the entire amount of liabilities transferred is treated as boot. 2. §357(c): If the sum of the [FMV of] liabilities transferred by the shareholder is greater than the sum of the adjusted bases of the properties transferred, then the excess amount is a taxable gain. (The stock basis will turn out to be zero.) When measuring liabilities for this test, ignore liabilities that would have been deductible by the transferor/shareholder if the liabilities had been paid before the transfer (e.g., Accounts Payable of cash basis taxpayer). 8, 13, 40, 26 (comprehensive), 38 HW 12, 14, 15, 36 3 Holding periods for stock and property Shareholder holding period for stock: "Tack on" with respect to capital and §1231 assets transferred day of transfer with respect to ordinary income assets Corporation holding period for property: "Tack on" Depreciation recapture In a §351 transaction, recapture potential remains with an asset that is transferred to the corporation. 43 HW 17 4