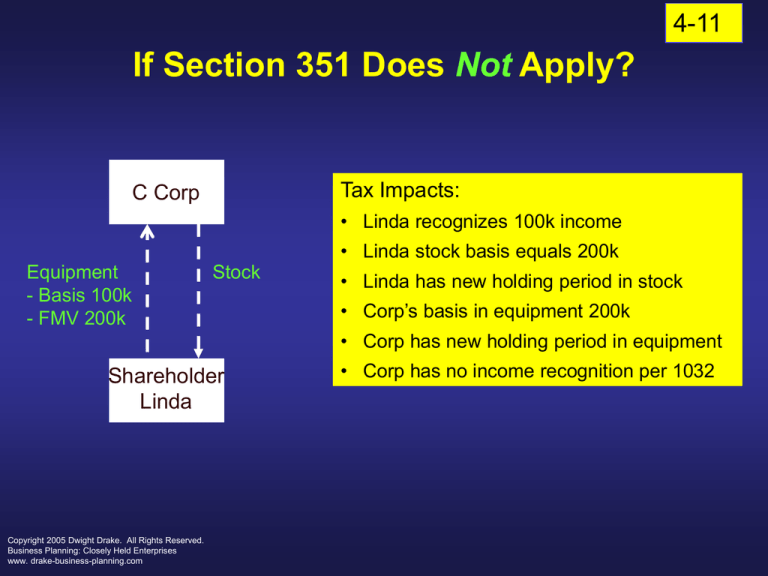

4-11

If Section 351 Does Not Apply?

Tax Impacts:

C Corp

• Linda recognizes 100k income

• Linda stock basis equals 200k

Equipment

- Basis 100k

- FMV 200k

Stock

• Linda has new holding period in stock

• Corp’s basis in equipment 200k

• Corp has new holding period in equipment

Shareholder

Linda

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

• Corp has no income recognition per 1032

4-12

Rule 1: The 351 Rule

No gain or loss is recognized by the transferor on the transfer of

property to a corporation in exchange for stock of the corporation if:

1. Property is transferred

2. Solely in exchange for stock

3. Transferor(s) in “control” “immediately after exchange.

Two 80% requirements – 80% of all voting stock and 80% of total

shares of all classes of stock.

Example: XYZ Inc issues 100 share of its stock to its sole

shareholder Jim for equipment worth 200k that has a basis of 100k.

Jim recognizes no gain or loss on the exchange.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

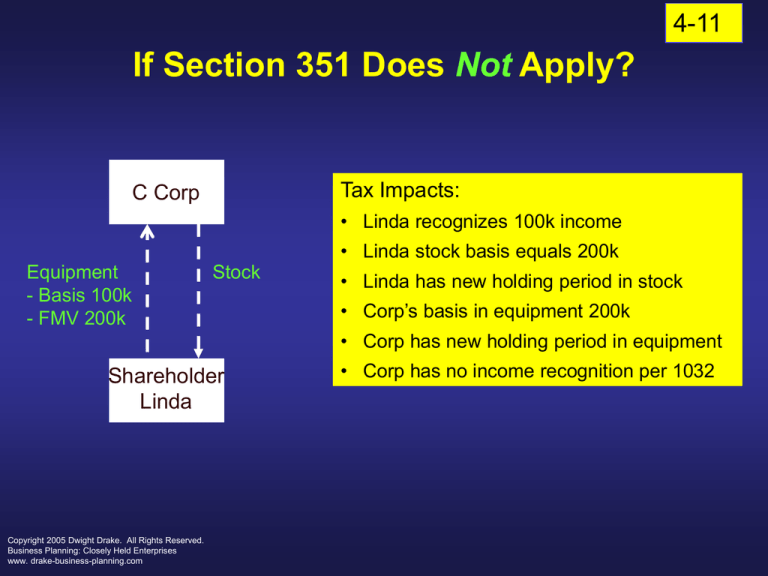

4-13

If Section 351 Does Apply?

Tax Impacts:

C Corp

• Linda recognizes no income (Rule 1)

• Linda stock basis equals 100k (Rule 3)

Equipment

- Basis 100k

- FMV 200k

Stock

Shareholder

Linda

• Linda has tacked holding period in stock

(Rule 4)

• Corp’s basis in equipment 100k (Rule 6)

• Corp has tacked holding period in equipment

(Rule 7)

• Corp has no income recognition per 1032

(Rule 5)

Note: Double basis impact trade-off for shareholder

non-recognition. What is future impact?

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-14

Section 351 Eligibility Traps

Trap

Solution

Stock for services

Keep under 20% or have dual consideration

and meet 10% standard of Rev. Proc. 77-37

Multiple transfers

at different times

Document part of integrated plan

Subsequent stock sale

Prohibit; require time lapse; no prearrangement;

gifts generally not a problem

Accommodation transfers

Meet 10% threshold of Rev. Proc. 77-37

Subsequent corp property

sales

Consistent with ordinary business or insure

time lapse and no pre-arrangement

Nonvoting stock

80% of each class. Only direct ownership counts

Nonqualified preferred

Boot for income recognition purposes

Investment company risk?

Diversification issue is ballgame

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Rule 2: The 351(b) Boot Rule

4-15

If 351 would apply except that corporation issues property in

addition to stock (“boot”) to the shareholder, then shareholder

recognizes gain on the property transferred to corporation equal to

the lesser of:

1. The built-in gain on the property transferred – the excess of

FMV over basis

2. The FMV of boot received by the shareholder.

Example: XYZ Inc issues 100 share of its stock and 80k cash to its

sole shareholder Jim for equipment worth 200k that has a basis of

100k. Jim recognizes gain equal to boot – 80k. If 120k boot was

paid by XYZ Inc in addition to stock, Jim would recognize gain

equal to 100k – excess of 200k FMV over 100k basis.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-16

Section 351 With Boot

Tax Impacts:

C Corp

• Linda recognizes 80k income (Rule 2)

• Linda stock basis equals 100k (Rule 3)

Equipment

- Basis 100k

- FMV 200k

Stock

and 80k

cash

Shareholder

Linda

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

• Linda has tacked holding period in stock

(Rule 4)

• Corp’s basis in equipment 180k (Rule 6)

• Corp has tacked holding period in equipment

(Rule 7)

• Corp has no income recognition per 1032

(Rule 5)

Rule 3: The 358 Basis Rule

4-17

If 351 applies to an exchange of property for stock in a corporation, the

basis of the stock received by the shareholder equals:

1. The basis of the property transferred to the corporation in the

hands of the shareholder, plus

2. Any gain recognized the shareholder ala the 351(b) rule, less

3. The FMV of any boot received.

Example: XYZ Inc issues 100 share of its stock and 80k cash to its sole

shareholder Jim for equipment worth 200k that has a basis of 100k. Jim

recognizes gain equal to boot – 80k. Jim’s basis in stock is equal to 100k

(basis in equipment), plus 80k gain less 80k boot = 100k.

If 120k boot was paid by XYZ Inc in addition to stock, Jim would

recognize gain equal to 100k. Basis in stock would equal 100k, plus

100k gain, less 120k boot = 80k basis.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-18

Rule 4: The Shareholder Tacking Rule

If 351 applies to an exchange of property for stock in a

corporation, the holding period of the property transferred

by the shareholder is “tacked on” to the holding period of

the stock if the transferred property was a capital asset or a

1231 asset (asset used in trade or business). No inventories

or receivables.:

Example: XYZ Inc issues 100 share of its stock and 80k

cash to its sole shareholder Jim for equipment worth 200k

that has a basis of 100k. Jim’s holding period of equipment

is “tacked on” in determining holding period of stock.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-19

Rule 5: The 1032 Rule

Corporation recognizes no gain or loss on receipt of

money or property in exchange for its own stock

Example: XYZ Inc issues 100 share of its stock and 80k

cash to its sole shareholder Jim for equipment worth

200k that has a basis of 100k. XYZ Inc recognizes no

gain or loss.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-20

Rule 6: The 362 Rule

A corporation’s basis in property acquired in exchange for

its stock in a transaction that qualifies under 351 equals

the shareholder’s basis in the property’s basis plus any

gain recognized by the shareholder. But if net built-in loss,

basis limited to FMV of property unless all elect to reduce

stock basis of shareholder to FMV.

Example: XYZ Inc issues 100 share of its stock and 80k

cash to its sole shareholder Jim for equipment worth 200k

that has a basis of 100k. Jim recognizes gain equal to boot

– 80k. XYZ Inc.’s basis in equipment is 100k (Jim’s basis

in equipment), plus 80k gain recognized by Jim = 180K.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-21

Rule 7: The Corp Tacking Rule

If 351 applies to an exchange of property for stock in a

corporation, the holding period of the property

transferred by the shareholder is “tacked on” in

determining the holding period of the property in the

hands of the corporation.

Example: XYZ Inc issues 100 share of its stock and 80k

cash to its sole shareholder Jim for equipment worth

200k that has a basis of 100k. Jim’s holding period of

equipment is “tacked on” in determining XYZ Inc.’s

holding period of equipment.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-22

Rule 8: The Assumed Liability Rule

General Rule: If corporation assumes liability of shareholder

in 351 exchange:

1. Assumption not considered “boot” for gain or loss

purposes. 357(a)

2. Assumption does reduce shareholder stock basis by

debt amount. 358(d)

Exception: Debt treated as “boot” for gain purposes if:

1. Tax avoidance purpose or not bona fide business

purpose. Burden on taxpayer to prove by clear

preponderance of evidence.

2. Debt exceeds basis of all property transferred to corp –

then excess treated as taxable boot.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-23

Section 351 With Assume Debt

Tax Impacts:

C Corp

• Linda recognizes 20k income (Rule 8)

• Linda stock basis equals 0 (Rule 3)

Equipment

- Basis 100k

- FMV 300k

Stock

and 120k

debt

assumed

Shareholder

Linda

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

• Linda has tacked holding period in stock

(Rule 4)

• Corp’s basis in equipment 120k (Rule 6)

• Corp has tacked holding period in equipment

(Rule 7)

• Corp has no income recognition per 1032

(Rule 5)

4-24

Section 351 Assumed Debt Traps

Trap

Solution

Tax avoidance purpose

Bad purpose taints all debt. Proof burden on

taxpayer. Recent debts suspect.

Lingering shareholder

Liability

Leave no doubt as to parties’ expectations.

Nonrecourse debts

Specify amount to be paid from outside assets.

Amount should never exceed FMV.

Future accountable debts

Not debt for 351 purposes. Identity and exclude.

Both deductibles (cash basis APs) and capital

expenditures excluded. Rev. Rule 95-74

Basis pumping

Helps to avoid debt in excess of basis problem.

Will personal notes do job? The Peracchi impact.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-30

Partnership Rules Comparison

Corporate

Partnership

Rule 1: The 351 Rule

721: No gain or loss to partner and

control requirement. But built-in

gain allocated back to partner on

sale per 704(c)

Rule 2: The 351(b) Boot Rule

Allocate portion of contributed

property basis to Boot and treat

Boot portion of transaction as

sale or exchange. Reg. 1.707-3(f)

Example 1.

Rule 3: The 358 Basis Rule

722: Carryover basis plus any

investment company gain

recognized under 721(b).

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

4-31

Partnership Rules Comparison

Corporate

Partnership

Rule 4: Shareholder Tacking Rule

Same per 1223 (1)

Rule 5: The 1032 Rule

Same per 721 if for property

Rule 6: The 362 Rule

Same per 723, but no built-inloss rule

Rule 7: The Corp Tacking Rule

Same per 1223(2)

Rule 8: The Assumed Liability Rule

New Game

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Partnership Liability Game

4-32

1. 752 Upside Twist: Increase in partner’s share of partnership’s liabilities

deemed contribution of money to partnership. Basis increase.

2. 752 Downside Twist: Decrease in partner’s share of partnership’s

liabilities deemed money distribution. If money distribution exceeds

basis before distribution, then gain recognized to extent of excess per

731. No negative basis.

3. Recourse liability allocation: Allocated to partners according to how

partners agree to bear ultimate risk for liability.

4. Non-recourse liability: Allocated to partners according to profits

interests with some flexibility. But if property contributed with NR

debt in excess of basis, debt first allocated to contributing partner to

amount of gain allocated to such partner under 704(c) if property

sold for debt.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Partnership Capital Interest For Services

4-33

Capital Interest: An interest that gives service partner a share of the partnership’s

existing capital and future profits. A profits interest only gives share of future

profits. Test: If partnership liquidated now, would service partner get

anything?

Triple Impact: Capital interest for services

1. Partner has section 61 compensation income equal to FMV of interest,

subject to section 83 game.

2. Partnership gets section 162 deduction in same amount, allocated to

existing partners (not new partner)

3. Existing partners may share gain equal to FMV of interest transferred

over allocable basis of each partner. Deemed sale from existing to new.

Proposed Regs would eliminate deemed sale

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com