Allocation of Boot in 351 Transactions

advertisement

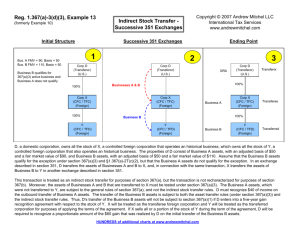

3. Details of § 351: Boot and Basis PB §§ 2105-2160, pp. 89-98; Problems p.98; Code §§ 1012, 1032. Regs § 1.1032-1 Boot in Section 351 Transactions General Effect of Boot o At the Shareholder Level Nonrecognition of gain does not apply to the extent that transferor receives in the exchange, in addition to nonrecognition stock, any nonqualifying “boot” like cash and certain other property. Instead, realized gain (but not loss) must be currently recognized to the extent the gain is “cashed out” through the receipt of boot. § 351(b) §§ 358 and 362: Receipt of boot results in recognition of gain under § 351(b) in turn, affects o adjusted basis of the stock and other property the transferor receives from the corporation; and o adjusted basis to the corporation for the transferred property Realized losses remain unrecognized, regardless of the receipt of boot (property other than nonrecognition stock of the transferee corporation) E,g. Transferor contributes property w/ basis of $75 and FMV of $100 to a corporation in exchange for $100 worth of property from the corporation ($90 of stock and $10 cash) Transferor must currently recognize $10 of the $25 realized gain as a result of receiving the $10 of boot property o At the Corporate Level § 351(f): Sec. 311 governs whether Corp. has recognized gain or loss on the transfer of boot to the transferor shareholder(s) §§ 311(b) and 1032: Corporation recognizes gain on the transfer of appreciated boot unless it is a debt obligation of the corporation or is nonqualified preferred stock § 311(a): Corporation does not recognize loss on transfer of depreciated boot property Allocation of Boot o Issues More complex boot rules when transferor who receives the boot transfers more than one item of property to the corporation allocation must be made among the various properties (regardless of their FMVs relative to basis) transferred to calculate the amount and character of the gain recognized by transferor on each property and the respective new basis of each for the transferee-corporation Boot property in the form of the corporation’s own debt obligation (and maybe nonqualified preferred stock) raises the Q of whether transferor can report the gain from that boot under Sec. 453 installment sale method o Rev. Rul. 68-55 (p. 90): Sec. 351(b) Takeaway: To determine the gain recognized when multiple properties have been transferred under a 351 exchange, each asset transferred must be considered to have been separately exchanged Cannot total the bases of the assets transferred (wouldn’t be able to tell the type/character of gain – LT/ST CG vs. ordinary) FMV of each category of consideration must be separately allocated to the transferred assets in proportion to the relative FMV of the transferred assets Then, determine the type of gain realized Allocation of boot among transferred assets (if transferor exchanges several assets) o The boot is allocated by percentage of total FMV to EACH asset and is recognized if the asset has a net gain Corp Y was organized by X and A (individual who owned no stock in X). A transferred 20x dollars to Y in exchange for stock of Y with FMV of 20x dollars and X transferred to Y three separate assets and received in exchange stock of Y with FMV of 100x dollars plus cash of 10x dollars. Asset I: LT capital asset; Asset II: ST capital asset; Asset III: Sec. 1245 property How to determine amount of gain recognized under Sec. 351(b)? General Rule: Each asset transferred must be considered to have been separately exchanged (no netting of gains and losses for sections 367 and 356(c)) In doing a 351(b) calculation, it is not proper to total the bases of the assets transferred and to subtract this total from the FMV of the total consideration received in the exchange. Only an asset by asset approach avoids allowing losses that are specifically disallowed by sec. 351(b)(2) For Sec. 351(b) purposes, how to allocate the cash and stock received to the amount realized as to each asset transferred in the 351 exchange? Asset by Asset Approach: requires for this purpose the FMV of each category of consideration received to be separately allocated to the transferred assets in proportion to the relative FMVs of the transferred assets. See Reg. 1.12454(c)(1) (uses same category allocation in proportion to FMV approach in computing gain applicable to Sec. 1245) Under Sec. 351(b)(2), the loss of 18x dollars realized on the exchange of Asset I is not recognized loss can be used to offset gains realized on exchanges of Assets II and IIs TOTAL ASSET I ASSET II ASSET III FMV of Asset Transferred $110x $22x $33x $55x % of Total FMV 20% 30% 50% FMV of Y Stock Received in Exchange $100x $20x $30x $50x CASH received in exchange 10x 2x 3x 5x Amount Realized $110x $22x $33x $55x Adjusted Basis 40x 20x 25x GAIN/LOSS REALIZED ($18x) $13x $30x *Under 351(b)(2) the loss of 18x realized on the exchange of Asset I is NOT recognized. 13x will be recognized as short-term capital gain in the amount of 3x, the amount of cash received (351(b)(1)). 30x will be recognized as ordinary income in the amount of 5x, the amount of cash received (351(b)(1) and 1245(b)(3)) Timing of Boot Recognition o General Rule: SH who receives boot in connection with 351 exchange must currently recognize the realized gain up to the FMV of the boot. Exception: If the boot consists of Corp.’s own debt obligation, may be possible to report the gain on the sale only as the debt representing the boot is collected Absent a regulation permitting installment sales-type treatment, nonqualified preferred stock does not appear sufficiently analogous to debt to qualify for the installment sale method Basis Adjustments and Related Consequences of a Section 351 Incorporation Basis at the Shareholder Level o General Rule: Basis in Stock Received is typically the same basis as SH had in the property contributed in the exchange E.g. TP in 351(a) exchange transfers property with basis of $75 and FMV of $100 to Corp X in exchange for transferee-corporation’s common stock worth $100, the $25 gain realized by transferor-shareholder on the exchange would not be recognized currently. Recognition deferred and reflected in a substituted basis of $75 assigned to the stock (worth $100) received in the exchange. Sec.358(a)(1) Note: In some circumstances, Corp and SH can elect to have SH hold stock with FMV basis when the transferred property has a built-in loss o Where taxable boot is involved, the aggregate basis gets adjusted to ensure the gain is not recognized again when the stock is sold E.g. TP in above example received stock of Corp with FMV of $90 plus other non-cash property with a value of $10. If transaction otherwise qualifies under 351(a), the presence of boot ($10 value on transfer of property with realize gain of $25) results in recognition of gain up to the value of the boot received ($10) Recognition of transferor’s $15 additional realized gain is deferred and reflected in the $85 basis for the properties received in the exchange. Sec. 358(a)(1) o Transferor’s former $75 basis in the property transferred plus transferor’s $10 of recognized gain on the exchange Basis is allocated first to the boot property based on its FMV of $10 and then the remaining $75 of basis is allocated to the stock received in the exchange. Sec. 358(a)(2) o If more than one class of stock is received in exchange of an item of property, basis as determined under Sec. 358(a) is allocated to the classes in proportion to their respective FMVs. Reg. 1.358-2(b)(2) Basis at the Corporate Level o General Carryover Basis Rule (Sec. 362(a)(1)): When corporate transferee acquires appreciated properties (FMV at time of transfer > basis in transferor’s hands) or properties with basis equal to FMV, transferee corporation’s basis = the pre-existing bases for the properties “carryover basis” for each of those properties from the shareholders to the corporate transferee Corporation’s 362(a) Basis = SH’s Basis in Property Transferred plus SH’s Recognized Gain [from Boot] (if any) Carryover Basis for Sec. 362 property acquired by the corporation in the form of a SH contribution to capital. Sec. 362(a)(2) E.g. No Boot: In 351 transfer by SHs of property with AB of $75 and value of $100 in exchange for stock worth $100, corporation’s basis in the property is a carryover basis of $75 under Sec. 362(a) Preserves the gain in the property for possible future recognition E.g. with Boot: If corporation instead transfers other property with FMV of $10 and common stock worth $90 for property worth $100, the basis for the property for corporation is $85 (carryover basis of $75 plus transferor-shareholder’s $10 of recognized gain) Impact of Carryover Basis: Duplicates Gains and Losses Because of Sec. 358, SH will hold the stock it receives with a basis that preserves the gain/loss not recognized in the transaction o E.g. No boot: SH holds the stock with $25 built-in gain o E.g. $10 gain recognized currently due to the boot: SH holds the stock with $15 built-in gain Meanwhile because of Sec. 362(a), corporation holds the property it received in the 2 example exchanges with $25 built-in gain (e.g. no boot) and $15 built-in gain (e.g. with boot) Result: Duplicates gain on a sale by the corporation of the transferred property and by the SH of the stock Consequences o May make it undesirable to do a 351 for an incorporation transfer involving gain property o Transferor may prefer to qualify under Sec. 351 in an incorporation transfer involving loss property because of the duplicate built-in losses o Built-In Loss Property: Sec. 362(e)(2) Sec. 362(e)(2) aims to prevent loss duplication transactions using Sec. 351 Single Transfer of Property to Corporation with Built-in Loss: 362(e)(2) Rule: Either corporate-transferee must hold the property at a FMV basis, or if parties jointly elect, corporate transferee can hold the property with a carryover basis and the SH-transferor will then hold its stock with a FMV value basis o Election ensures that built-in loss can be realized at either SH or corporate level (but not both) on future transfer of stock/property Election not available to SH-transferors who are non-US taxpayers or tax-exempt entities E.g. Domestic taxable SH transfers property with FMV of $75 and basis of $100 to Corp for stock valued at $75 in a 351 exchange o Corporation must hold the property w/ basis of $75 FMV unless parties jointly elect to have SH’s basis in the stock lowered to the FMV of the property transferred ($75) If election is made, Corp holds the property with $100 basis and can take advantage of depreciation deductions using $100 basis or realize the loss on a later sale. 351 Exchange with Transfer of Multiple Properties to Corporation Determine whether there is a net built-in loss on a transferor by transferor basis (not a property by property basis under Sec. 362(e)(2)) For each SH making a contribution of property, the aggregate adjusted bases of the properties transferred by the SH are compared with the aggregate FMV of those properties. Sec. 362(e)(2)(A), Prop. Reg. 1.362-4(b)(2) o If aggregate adjusted bases > aggregate FMV, aggregate ABs of the property must be reduced to match the aggregate FMVs. 362(e)(2)(A) Reduction in basis then gets allocated among the transferred properties in proportion to their respective built-in losses immediately prior to the transaction. 362(e)(2)(B) Impact: prevents any allocation of basis reduction to properties not having built-in loss before the transfer and prevents any upward adjustment to the bases of properties having built-in gain before the transfer E.g. Transferor contributes 3 properties in a 351 transaction Property A: FMV of $500, basis of $200 Property B: FMV of $200, basis of $500 Property C: FMV of $100, basis of $400 o Aggregate FMV of Properties = $800 o Aggregate Adjusted Bases = $1,100 o Net Built-in Loss = -$300 (AR – AB = -$300) o Absent an election to reduce SH’s basis in his stock under 362(e)(2)(C), a $300 reduction in corporation’s basis must be allocated among the 3 properties in proportion to their respective built-in losses Corporation’s Bases in Properties B and C are reduced by $150 (each had built-in loss of $300 pre-transfer;$300 x $300/$600) Basis in Property B = $350 Basis in Property C = $250 None of the $300 reduction gets allocated to Property A (it had pre-transfer built-in gain) Loss Importation Prevention: Sec. 362(e)(1) If a “transaction” otherwise qualifying under 351(a) or (b) would result in an “importation of a net built-in loss,” then the basis of the transferred properties in the hands of the corporate transferee = FMV of the properties at the time of the transfer (i.e. not the carryover basis) o “Importation:” situation where there would have been no fed. income tax consequences to the seller if the property had been sold in a transaction not covered by Sec. 351 but there will be tax consequences if the property is sold by corporate-transferee in a hypothetical subsequent disposition. Sec. 362(e)(1)(B) o Result: Forecloses transactions where foreign or tax-exempt transferor transfers built in loss property to US corp in a 351 exchange so that the corp can realize the loss for US tax purposes on the later sale of the property In a 351 transfer involving importation of multiple properties, to determine whether there is a net built-in loss, compare aggregate FMV of the transferred properties with their aggregate bases. o If aggregate ABs > FMV = “net built-in loss” 362(e)(1)(C) o Basis of each of the transferred properties is adjusted to FMV basis adjustment is multi-directional Properties with built-in gain: basis is stepped up to FMV Properties with built-in loss: basis is stepped down to FMV If there are multiple transferors, examine each transferor separately: compare aggregate FMVs and ABs of the properties each transferor transferred Holding Period o Transferor-Shareholder: Sec. 1223(1) Rule: Holding period for stock received in 351 transaction includes (or is “tacked” on to) the holding period of the property transferred in exchange for that stock, provided the property is a capital asset or Sec. 1231 property. If multiple properties are transferred, the respective holding periods will attach to shares having a value equal to each property Different shares can have different holding periods and bases Cannot allocate specific shares received to specific properties transferred to the corp Holding periods and basis are allocated across the shares received in proportion to their values whether they represent one or multiple classes of stock. See rev. Rul. 85-164 o Transferee-Corporation: Sec. 1223(2) Rule: For both gain and loss assets, corporation’s holding period for each asset acquired in Sec. 351 exchange includes (has tacked on to it) the transferor-SH’s holding period for that asset. 4. Section 351: Liabilities PB §§ 2170-90, 2205, 2220, 2225-45, pp. 99-108, 113-14, 121, 122-36; Problems pp. 112-13 Code §§ 357, 358(d), 362(d). Regs § 1.357-1, -2 Assumption of Liabilities by the Corporation Nonrecognition under § 357(a) o Absent Sec. 357, TP’s transfer of property subject to a debt to a transferee corporation would be considered “boot” and taxable under351(b). o Sec. 357(a): General Rule: In a 351 exchange, the assumption of liabilities by corporation is not treated as boot to the transferor transferor SH does recognize gain Tax on gain, if any, attributable to those liabilities is deferred through a reduction in transferor’s basis in the stock received in the exchange. 358(a)(1)(A)(ii) and (d)(1) o Two Exceptions: 357(b) [Tax Avoidance Purpose] and 357(c) [Liabilities > Bases] 357(b): All transferred liabilities are treated as boot if the transfer of any of them had a tax-avoidance purpose or lacked a business purpose 357(c): SH must in any event recognize gain to the extent that the total liabilities assumed by corporation EXCEED total bases of properties transferred in the exchange (applied on transferor-by-transferor basis) Determination of Amount of Liabilities Assumed: 357(d) o Contains Rules for determining whether and to what extent a liability is assumed for 357 purposes and applies to transactions subject to 357(a)-(c) and the corresponding basis rules in 358 and 362 Treats recourse and nonrecourse liabilities differently General Rule: Corp. is treated as assuming a recourse liability to the extent that corp. agrees to assume the liability, while a nonrecourse liability is treated as assumed only if the assets subject to the liability are transferred o Assumption of Recourse Liabilities: 357(d)(1)(A) Treated as having been assumed if, based on facts and circumstances, Corp. has agreed to, and is expected to, satisfy the liability (or portion thereof), regardless of whether the SH has been relieved of the liability Corp. of property securing a recourse liability is not treated as assuming the liability without an agreement if Corp. does not agree to satisfy the liability, or agrees but is not excepted to satisfy it (e.g. SH agrees to indemnify Corp. viz. the liability), the SH avoids 357(c) gain on the transfer of a recourse liability, even when the amount of the liability > the basis of the property transferred o Assumption of Nonrecourse Liabilities: 357(d)(1)(B) Rule: Except as otherwise provided in the regs, a nonrecourse liability (or any portion) generally is treated as having been assumed by the Corp. of any asset that is subject to the liability Under 357(d), Corp. is treated as assuming all or a portion of a NRD only if assets that are subject to the liability are transferred to it Exception – 357(d)(2): Where NRD is secured by both transferred property and other assets that are not transferred Amount of the liability treated as assumed is reduced by the lesser of o (a) The amount of the liability that the transferor agrees to, and is expected to, satisfy; and o (b) FMV of the other assets securing the liability Exception 1: Assumption of Liability Tainted By Improper Purpose - 357(b) o Rule: Corporate assumption of all transferred liabilities from transferor-SH is treated as boot in if SH’s primary purpose for shifting any of the liabilities to the corporation was to avoid federal income tax purposes or was not a bona fide business purpose Total amount of liabilities is treated as boot and SH recognizes any gain realized on the exchange, to the extent of the amount of the deemed boot received (i.e. amount of the liabilities assumed) o Reg. 1.357-1(c): 357(b) applies because the transaction has tax avoidance purpose or lacks business purpose, the total amount of liabilities assumed (not only the particular liability viz. the tax avoidance/non-business purposes is connected) is treated as money received by the SH. o Because 357(b) treats a liability as boot, adverse consequences follow only if SH realizes gain in the 351 transaction o Example: SH places mortgage on real property very shortly before transferring the encumbered property (but not the cash received in the mortgage) to the corp. in an attempt to get tax-free cashing out of gain inherent in the encumbered property o Burden of Proof: § 357(b)(2) In any proceeding in which burden of proof is on the TP to prove that an assumption of liability is not to be treated as money received by the TP, the burden is not satisfied unless the TP sustains that burden by a clear preponderance of the evidence Reg. 1.357-1(c): TP must prove his case by a clear preponderance of all the evidence that the absence of a purpose to avoid federal tax on the exchange or the presence of a bona fide business purpose is unmistakable Drybrough v. Commissioner (6th Cir. 1967): 357(b) Application o Rule: If in making the exchange, the principal purpose of the SH-TP with respect to the assumption or acquisition was a purpose to avoid federal income tax “on the exchange,” or if not such purpose, was not a bona fide business purpose, then the assumption or acquisition should in the total amount therefore be considered as money received (i.e. boot) by the SH-TP on the exchange. o 5 corporations formed by TP assumed two sets of motives. Court held that the assumption by 4 of the corporations of the first set of mortgages was for valid business purposes and second set was to avoid federal income taxation on the transfer o First Set = Valid Business Purpose – 357(b) does not apply Incurred 4 years before the transfer and not primarily for avoiding income taxes The 4 corporations were incorporated to reduce the TP’s gross estate, to enable him to make gifts to his son (thereby perpetuating family control of the assets), to provide more flexible management for the business, and to limit TP’s personal liability TP used proceeds of this loan for personal reasons. Under 357, court said it was required to consider only the motivation for the assumption of the liabilities on the exchange, not the motivation for borrowing the money that created the assumed obligation o Second Set of Mortgages by 5th Corporation = To Avoid Fed. Income Tax on Transfer Principal purpose of the assumption was tax avoidance on the transfer – 357(b) applies Had been incurred shortly before the transfer, in anticipation of the transfer, and the proceeds of the mortgages were used to purchase tax-exempt securities (not to carry on the purposes of the business enterprise or to further the TP’s general real estate investments) o Court considers two factors in its 357(b) analysis: (1) Length of Mortgage Prior to 351 and (2) Communications (1) Taking Mortgage 3 months before 351 transaction (2) Letter stating intent of transfer (communications) Here, money was parked in tax-free bonds o Probably no tax avoidance purpose if the liability had not been incurred immediately prior to the transfer and was not incurred in anticipation of the forming of the corporations No Tax Avoidance Purpose if (1) Takes mortgage out 4 years ago and (2) no letter stating intent of tax avoiding transfer Three Months and No Letter = Wishy Washy o Note: Had both sets of mortgages been assumed by a single corporation, 357(b) would have required TP to recognize gain with respect to the total amount of liabilities assumed, not simply with respect to the liability assumed for an improper purpose o To avoid income tax = “with respect to the assumption” and to avoid income tax “on the exchange” excludes the original and unrelated motivation for borrowing the money which created the original obligation o Rearranging one’s business affairs in such a way as to minimize taxes in the future ≠ illegitimate purpose o 357(b) is met when TP incurs liabilities to which transferred securities were subject immediately prior to the transfer and solely in anticipation thereof Exception 2: Liabilities in Excess of Basis: § 357(c) o General Rule: If the sum of the amount of liabilities assumed > total adjusted basis of transferred property, the excess of liabilities is considered gain from the sale/exchange of property SH must recognize gain to the extent that total liabilities assumed by the corp. exceed the total basis of the properties transferred in the exchange Liabilities assumed include recourse and nonrecourse liabilities to the extent specified in § 357(d) Applies separately to each transferor (RR. 66-142), w/r/t adjusted bases of property transferred by other transferors or amount of liabilities assumed by the corp viz. other transferors o Purpose: Prevents possibility of negative basis for the stock received by the transferor. o Ordering Rule: If both 357(b) and (c) apply: 357(b) takes precedence entire amount of assumed liabilities to be treated as boot (not just the excess of liabilities over bases of transferred properties) Recognition of gain under 357(c) occurs notwithstanding a valid business purpose for corp’s assumption of the debt o Note: Planning possibilities exist to avoid all/part of 357(c) gain: Reduce the amount of assumed liabilities or increase the basis of assets transferred (e.g. by transferring additional cash) If TP restructures debt and becomes personally liable such that corp. doesn’t assume the debt, then that portion doesn’t get included in the computation o RR 66-142: 357(c) is applied on a transferor-by-transferor basis. 357(c) gain (gets treated as recognized gain, not boot) is allocated among all of the properties (including loss properties) transferred by that SH in proportion to their respective FMVs and is characterized as either LT/ST CG or ordinary income based on the nature and holding period of each property transferred. Reg. 1.357(b)-2(b) 357(c) gain is taken into account for basis purposes in the same way as recognized boot gain under 358(a)/362(a) but 362(d)(1) prevents any increase in the basis of transferred property above its FMV as a result of the assumption of liabilities by the corporation o Character of Gain Recognized in Sec. 357(c) Depends on whether transferred asset is a capital asset (And if so, on the holding period of the asset) and on whether all or a portion of the capital gain may be recharacterized as ordinary income under other Code sections Reg. 1.357-2: If SH transfers multiple properties: the total recognized gain is allocated ratably over the various items transferred in accordance with their relative FMVs. Notwithstanding that liabilities may encumber only capital assets, gain is allocated among all transferred assets, whether capital or noncapital, based on their relative FMVs Because Reg. 1.357-2(b) doesn’t refer to the AB of the transferred property gain can be attributed to property in a manner that is disproportionate to the gain actually generated by the property o 357(c)(3): Purpose: To achieve parity for cash-method TPs (cf. accrual-method TPs) General Rule: Certain liabilities are not considered for 357(c) purposes. These excluded assets are: (1) Liabilities the payment of which by the SH would give rise to a deduction; o E.g. trade accounts payable, interest and taxes, and other liabilities related to a transferred trade or business Excluded to the extent the transferor would have been allowed a deduction had the liability been paid by the transferor If transferor has already deducted the liability, it is not excluded under 357(c)(3) Also not excluded to the extent the incurrence thereof resulted in the creation of or increase in the basis of any property. 357(c)(3)(B) (2) Liabilities the payment of which is described in 763(a): i.e. payments to a retiring or deceased partner’s successor in interest 357(c)(3)(A)(i) and (B): a liability that, when paid, would give rise to a deduction or creation of or increase in the basis of the property is excluded for purposes of 357(c) in determining the amount of liabilities assumed Corollary: 358(d)(2): such a liability does not reduce transferor’s Sec. 358 substituted basis in the stock received on the exchange Not Excluded (i.e. Considered for 357(c) Determination): Liabilities that neither give rise to a deduction nor increase in the basis of property when paid Reason: Ignoring them would allow transferor an undue benefit Comparison: 357(c) vs. 357(b): Two Key Differences o 357(c) doesn’t apply to any transaction subject to 357(b). (357(c)(2)) o (1) If 357(b) applies, SH is considered to have received boot in an amount equal to the total liabilities assumed by transferee corp. But if 357(c) applies, only the difference between the amount of liabilities assumed and the basis of the property transferred is considered gain from sale/exchange of transferred assets o (2) If 357(b) applies, the liabilities are treated as boot and therefore the amount of gain recognized is limited by the amount of gain realized on the exchange. 357(b)(1). The boot is not recognized to the extent it is allocated to assets viz. no gain or loss is realized. But if 357(c) applies, the excess of liabilities assumed over the basis of the assets transferred is treated as gain from sale/exchange. Therefore, the excess is recognized even if allocated in part to loss assets. Effect of an Assumed Liability on Basis Shareholder Level – 358(a) o 358(a): SH’s basis in nonrecognition property received = (1) Basis of property transferred, minus FMV of any boot property (except money) received; and Amount of money received; o 357(c)(3): an assumed liability – other than a liability excluded under 357(c)(3) – is treated as money received for purposes of 358(a) (2) Increased by the Amount of Gain (if any) SH recognizes on the exchange Corporate Level – 362(a) and 362(d) o General Rule (362(a): Basis of property received by Corp. in 351(a) exchange is generally the basis of the property to the SH increased by any gain recognized to the SH o Limitation on Basis Increase Attributable to Assumption of Liability (362(d)(1)) : The gain SH recognizes as a result of the Corp.’s assumption of a liability of the SH cannot increase the Corp.’s basis of the property to more than the FMV of the property 362(d)(2): if SH recognizes gain as a result of the assumption by a Corp. of a nonrecourse liability that is also secured by assets that are not transferred to the Corp. and no one is subject to tax on that gain, then in determining Corp.’s basis in the property: the amount of gain SH recognized as a result of assumption of the liability is determined as if the liability assumed by the Corp. equaled the SH’s ratable share of such liability based on the ratio of the value of the property transferred to the transferee to the value of all the property securing the liability Scenario: transferor is tax-exempt entity or foreign corporation Attempts by Transferor to Avoid Section 357(c) Gain 357(c): Liabilities in excess of tax basis of the transferred property produce a gain amount o Total of the liabilities in excess of the total of asset bases triggers applicability of this provision o The excess is treated as gain from the sale/exchange of the property o Exception for those liabilities that are deductible when paid. 357(c)(3) Purpose: Enables avoiding a gain problem for a cash basis TP (i.e. accounts payable) Ways to solve the excess liabilities problem to avoid gain recognition at incorporation time: o Contribute cash to equalize o Contribute high-basis debt-free property o Contribute a promissory note in an amount at least equal to the “negative basis” (see Perrachi) o Remain personally liable on the debt. Sec. 357(d) Owen v. Commissioner (9th Cir. 1989) o Under 357(c), Os’ continuing personal liability for the loans secured by the transferred equipment is irrelevant So long as transferred property remains liable on the debt such debt can be a 357(c) liability even if TP retained personal unrelieved liability on it. Smith o Note: 357(d)(1)(A) was enacted in 1999. Owen might be decided differently under 357(d)(1) if the facts established that the corporation had not agreed to and was not expected to satisfy the transferred liability Transferor of recourse debt must only have corporation agree that it will not pay the debt to exclude the debt from the operation of 357 Peracchi v. Commissioner: Does SH’s promissory note have a basis in his hands for purposes of 357(c)? o Perrachi contributes real estate to wholly-owned corporation (“NAC”) with a basis of $0 and subject to a $500k mortgage. The property is thus subject to debt in excess of its tax basis. The taxpayer also contributes a promissory note for $1.06m, claiming that it’s basis (face value in excess of §357(c) amount) o Held: SH’s personal note has a tax basis equivalent to its face amount, eliminating the 357(c) problem. SH Note is either to be paid by the TP or collected in the corporation’s bankruptcy estate. The SH Note is not a sham. o Rule: : If risk of bankruptcy to corp. is significant enough to be recognized, SH contributing the promissory note should get basis in the note equal to its face value because it has substantial economic effects which reflect the true economic investment in the enterprise (subject to creditors) The SH is entitled to a step-up basis to the extent he will be subjected to economic loss if the underlying investment turns unprofitable But, if the risk of bankruptcy is trivial, basis = $0 o 357(b) Analysis: Giving Guarantee has a bona fide Business Purpose SH is “guaranteeing” the loan that the Corp. would have taken, just by contributing instead Rev. Rul. 68-629: Gain is recognized under 357(c) when the SH issues and transfers to the Corp. a promissory note for the excess of liabilities over the adjusted basis of assets of a sole proprietorship transferred to a corporation o IRS’s View: Transferor does not incur any cost in issuing the promissory note and so has a basis in the note of zero under Sec. 1012