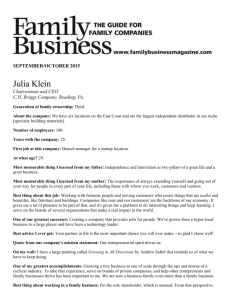

CH 19

advertisement

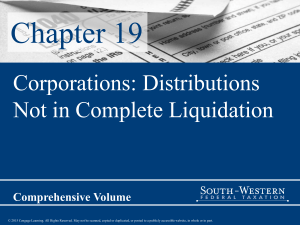

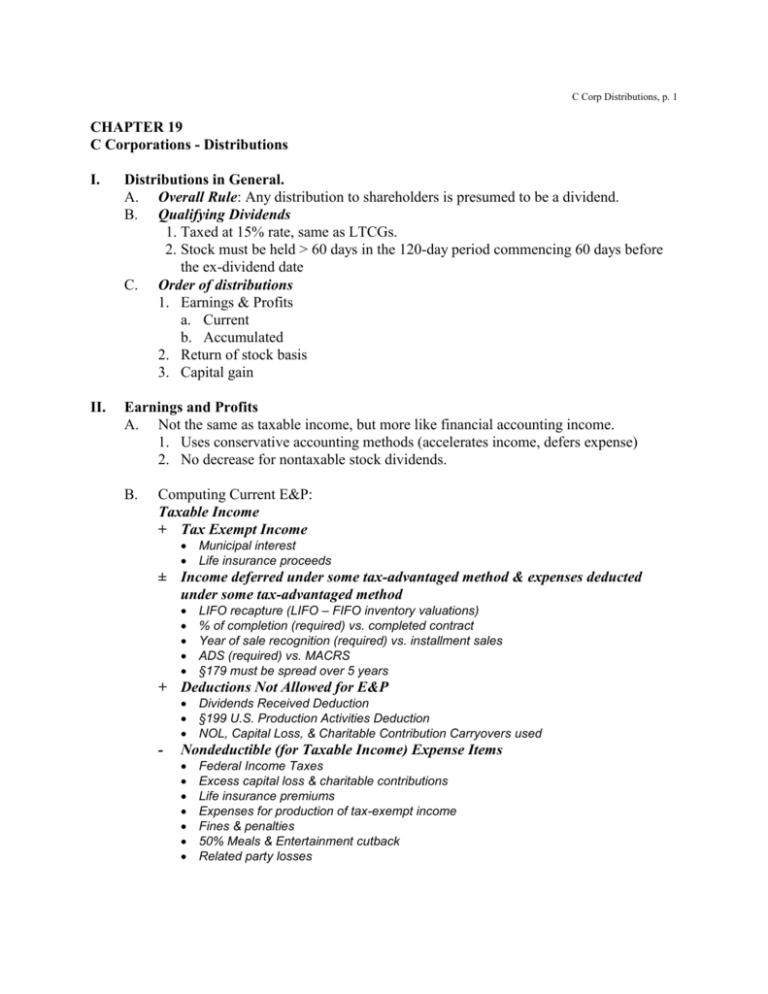

C Corp Distributions, p. 1 CHAPTER 19 C Corporations - Distributions I. Distributions in General. A. Overall Rule: Any distribution to shareholders is presumed to be a dividend. B. Qualifying Dividends 1. Taxed at 15% rate, same as LTCGs. 2. Stock must be held > 60 days in the 120-day period commencing 60 days before the ex-dividend date C. Order of distributions 1. Earnings & Profits a. Current b. Accumulated 2. Return of stock basis 3. Capital gain II. Earnings and Profits A. Not the same as taxable income, but more like financial accounting income. 1. Uses conservative accounting methods (accelerates income, defers expense) 2. No decrease for nontaxable stock dividends. B. Computing Current E&P: Taxable Income + Tax Exempt Income Municipal interest Life insurance proceeds ± Income deferred under some tax-advantaged method & expenses deducted under some tax-advantaged method LIFO recapture (LIFO – FIFO inventory valuations) % of completion (required) vs. completed contract Year of sale recognition (required) vs. installment sales ADS (required) vs. MACRS §179 must be spread over 5 years + Deductions Not Allowed for E&P Dividends Received Deduction §199 U.S. Production Activities Deduction NOL, Capital Loss, & Charitable Contribution Carryovers used - Nondeductible (for Taxable Income) Expense Items Federal Income Taxes Excess capital loss & charitable contributions Life insurance premiums Expenses for production of tax-exempt income Fines & penalties 50% Meals & Entertainment cutback Related party losses C Corp Distributions, p. 2 III. Sources of dividends from E&P A. Order of E&P B. Handling Negative E&P: 1. AE&P = ($50,000), CE&P = $10,000. Distribution = $15,000 2. AE&P = $20,000, CE&P = ($60,000). Distribution = $10,000 on 4/1. C. Handling Multiple Distributions: 1. AE&P = $25,000, CE&P = $45,000. Distributions = $60,000 on 6/1 and $30,000 on 12/1. IV. Property Dividends A. Appreciated Property 1. Corporation recognizes gain (as if sold) 2. Corporations reduces E&P by FMV 3. Shareholder has taxable dividend = to _______ 4. Shareholder basis = _______ B. Depreciated Property 1. Corporation does NOT recognize loss 2. Corporation reduces E&P by BASIS 3. Shareholder has taxable dividend = to _______ 4. Shareholder basis = _______ C Corp Distributions, p. 3 C. V. Property Subject to Debt 1. Corporation recognizes gain = to greater of: a. FMV - basis b. Debt - basis 2. Corporation reduces E&P by a. Greater of (FMV or basis), MINUS b. Debt transferred 3. Shareholder has taxable dividend = to _______ 4. Shareholder basis = ___________ Constructive Dividends A. Unreasonable compensation, rent, interest B. Below-market loans C. Bargain sales D. Advances E. Personal use of corporate property VI. Stock Dividends A. Nontaxable 1. Proportionate 2. Based on common stock 3. Any class okay, as long as uniform 4. No impact on corporation's E&P 5. Shareholder impact: B. Taxable 1. Types a. Disproportionate b. Elections to receive cash or stock c. Based on preferred stock 2. Corporation's E&P reduced 3. Shareholder impact C Corp Distributions, p. 4 VII. Stock Rights A. Rules for determining taxable or nontaxable are same as stock dividends. Everything you need to know in a handy table: If Taxable Impact on Corporation’s E&P Reduce by FMV If Nontaxable No effect Taxable amt to shareholder FMV -0- Basis of rights to shareholder FMV @ exercise, stock basis = Basis of Rts (FMV) + Exercise Price New (starts day after exercise) Allocate stock basis (required if FMV Rts > 15% FMV stk) Basis of Rts (allocated) + Exercise Price New (starts day after exercise) Stock’s holding period VII. STOCK REDEMPTIONS A. General Rules 1. Defn: the acquisition by a corporation of its own stock in exchange for property. The acquired stock may be canceled, retired or held as treasury stock. 2. Effect on the Shareholder. a. Qualified redemption treated as a sale or exchange of stock. b. Nonqualified redemption treated as a dividend. 3. Effect on the Corporation a. Qualified - Contraction of the company. E&P reduced proportionately. b. Nonqualified - Dividend. E&P reduced by FMV of property distributed. B. Qualified Stock Redemptions 1. Substantially disproportionate 2. Complete termination of shareholder interest 3. Not essentially equivalent to a dividend 4. Death tax payments C Corp Distributions, p. 5 C. Attribution Rules of §318. 1. Family Attribution. a. Individual owns all the stock owned by spouse, children, grandchildren, and parents. b. NOT considered to own stock owned by brothers, sisters, or grandparents. c. No reattributions from one family member to another. Example: George, his wife Jane, their daughter Judy, and George’s dad Mr. Spacely, each own 25 of the 100 shares of Jetson Co. How much does each constructively own? 2. Attribution from Entities to shareholder a. Corporation ownership - considered to be owned proportionally ONLY by any shareholders owning directly or indirectly 50% or more in value of the stock. b. Partnerships - considered to be owned proportionately by the partners, regardless of partnership interest. c. Estates and trusts - same as partnership attribution, using actuarial interests. 3. Attribution to Entities from shareholder a. Corporations - All stock owned by 50% or more shareholder is deemed owned by the corporation. b. Partnerships - All stock owned by a partner is deemed owned by the partnership. c. Estates and trusts - All stock owned by a beneficiary is deemed owned by the estate or trust. E. Details on Qualifying Redemptions 1. Substantially Disproportionate Redemptions. a. Requirements 1) After the redemption, the shareholder owns less than 50% of all voting stock; 2) After the redemption, the shareholder owns less than 80% of his percentage ownership before the redemption. Example: A owns 60 of 100 shares of X Co. (60%), with a basis of $100 per share. X Co. redeems 25 of A's shares for $5,000. C Corp Distributions, p. 6 2. Complete Termination of the Shareholder's Interest. a. Family attribution rules waived and family members may continue to own the stock, IF: 1) The shareholder must not retain any interest in the corporation after the redemption except as a creditor. 2) The shareholder must not acquire any such interest (other than by bequest or inheritance) for at least 10 years from the date of the redemption. 3) The shareholder must file a written agreement that the IRS will be notified if any prohibited interest is acquired. 3. Redemptions Not Essentially Equivalent to a Dividend. a. Must be a "meaningful reduction" in the shareholder's proportionate interest in the corporation after taking into account the constructive ownership rules. b. Because of the ambiguity of this provision, not very reliable. 4. Redemptions to Pay Death Taxes. a. Requirements 1) The value of the redeeming corporation's stock is more than 35% of the value of the adjusted gross estate. 2) The maximum amount of the redemption distribution that can qualify for sale treatment is the sum of all federal and state estate and inheritance taxes, plus administrative expenses.