Selecting a Form of Business

advertisement

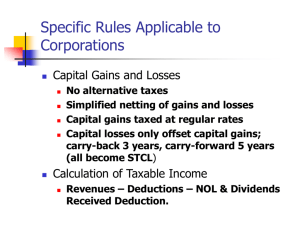

SELECTING A FORM OF BUSINESS I. Forms A. Sole proprietorship - Schedule C B. Regular or “C” corporations - 1120 C. Partnership or LLC - 1065 D. S corporations - 1120S II. Operating a Business A. Is the entity taxed? B. Treatment of losses C. Tax rates D. Can the owner by an employee? E. Special allocations F. Accounting periods and methods choices III. Organizing the Business A. Generally, tax-free B. Corporations have to worry about control requirement IV. Distributions A. Taxable or not taxable B. Gains on distributed property C. Basis of property distributions V. Liquidation of Business A. Tax consequences to business B. Tax consequences to owner VI. Sale of business A. Character of income B. Sale of assets vs sale of entity V. Nontax considerations SELECTING A FORM OF BUSINESS REGULAR CORPORATE FORM I. Business planning has traditionally favored “C” corporations. For new business, this preference has been based to a large extent on limited shareholder liability and treatment of the regular corporation as a taxpaying entity separate and apart from its owners. II. Corporate Taxpayer - Operations A. Reports income annually on Form 1120. However, quarterly estimated tax payments must be made. B. Maximum marginal tax rate is 35% 1. Lower tax rates are phased-out if income > $100,000. 2. PSCs tax rates are flat 35%. No benefit of two graduated tax rates schedules. C. Tax Formula Income broadly conceived - Exclusions Gross income - Deductions Taxable income * Tax rate Tax Liability D. Deductions peculiar to corporations 1. Dividends Received Deduction % depends upon stock ownership 2. Organization costs can be deducted over 60 months 3. Charitable deduction limited to 10% of taxable income 4. Capital losses a. Only offset capital gains b. Carryback 3 years; carryforward 5 years Example: X Inc. has net capital loss in 1995 = ($125,000) 1994 Capital gains = $30,000 1993 Capital gains = $60,000 1996 Anticipated capital loss = ($40,000) E. Capital gains taxed at corporate rate F. NOLs do not flow through G. Owner-employee transactions 1. Reasonable compensation issue 2. Employees can have fringe benefits which are deductible by corporate employer but not taxable to employee 3. Trade-off between debt and equity (Thin capitalization) H. Fiscal year choices and accounting method III. Organization of Corporation A. Sec. 351 Example: George transfers building (FMV = !00,000; basis = $20,000) to corporation for 50% interest. Maria transfers cash = $100,000 for 50% interest 1. Mandatory 2. Property requirement 3. Solely stock 4. Control requirement 5. Basis of property carries over. Gain or loss is deferred. B. If receive stock for services, taxed on FMV of stock. Assume same facts as above except that Maria transfers services (FMV = $100,000) IV. Distribution of Profits A. Double taxation Example: Could result in effective tax rate of 60.74% Corporate pretax income Less: tax at 35% Dividend Distribution Less: tax at 39.6% After-tax benefit $100,000 35,000 65,000 25,740 39,260 B. How to avoid cost of double taxation. C. Penalties for not paying out dividends 39.6% 1. Accumulated earnings tax 2. Personal holding company tax D. Proposed corporate integration E. Property distributions 1. Corporation effects Corporation subject to tax on gain on nonliquidating distributions 2. Shareholder tax consequences Example: Corporation distributes land (FMV = $60,000; basis = $10,000) to shareholder. V. Liquidation A. Double taxation again B. Corporation distributes land (FMV = $60,000; Basis = $10,000) to shareholder in liquidating distribution. Shareholder’s basis in stock = $25,000. VI. Why incorporate? Nontax advantages A. Limited liability B. Free transferability of interest (easier to sell stock) VII. Why incorporate? Tax advantages A. Spreading income between two taxpaying entities. Not possible with PSC. B. Fringe benefits Example: Corporation pays $600/ month in medical insurance for employee. C. Not taxed on income until received D. Two leading scholars have compared the corporation to a lobster pot: a thing that is easy to enter, difficult to live in, and almost impossible to escape from. VIII. Disadvantages of incorporation A. Control requirement of incorporation B. Double taxation C. No flowthrough of losses SELECTING A FORM OF BUSINESS PARTNERSHIPS I. Aggregate vs Entity theory of partnerships A. A partnership is merely an aggregation of the proprietary interest of partners in the underlying operation and assets. B. Partners and partnerships are separate units and the partnership has its own “personality.” II. Operations of Partnership A. Partnership is not a taxpaying entity, but is a tax reporting entity. B. Distributive shares of taxable items are generally allocated based on each partner’s interest in the p/s capital. Income increases basis; deductions decrease basis. Example: P/S Balance Sheet 1/1/95 Income Cash 20,000 2,000 Partner A Partner B 10,000 10,000 C. Special Allocations 12/31/95 22,000 D. Flowthrough of losses and limitations 1. Basis and liabilities 2. Passive losses E. Because a p/s is a mere aggregation of its owners, partners cannot be employees for tax purposes. However, can receive compensation for services. F. Self-employment tax on trade or business income + guaranteed payments Example: Partnership income before guaranteed payment to Partner A(50%) = $100,000 Guaranteed payment = $20,000 G. Character of income flows through H. Choice of tax year and method III. Formation of Partnership A. General Rule: Sec. 721. Realized gain or loss on property is not recognized. Example: Partner A contributes land (FMV = $100,000; Basis = $20,000) Partner B contributes cash = $100,000 B. Basis carries over. Precontribution gain and loss allocated to contributing partner. Example: Land in above example is sold for $120,000. IV. Distributions A. Generally, tax-free B. Basis carries over Example: Land ( FMV = $10,000; Basis = $3,000) is distributed partner with a basis of $8,000) V. Liquidations A. Generally, tax-free B. Basis carries over VI. Advantages - nontax A. Flexibility B. Simplicity VII.Advantages A. No double taxation problem B. Losses flowthrough C. Basis includes liabilities (an advantage over S corporation) D. Special allocations VIII. Disadvantages A. Liability of general partners is not limited. B. Owners are taxed currently on earnings even if the earnings are not distributed. C. Not an employee. SELECTING A FORM OF BUSINESS “S” CORPORATIONS I. A hybrid entity with some of the characteristics of both C corporations and partnerships. II. Election of Subchapter S Provisions The following conditions must be met: A. The corporation must be a domestic corporation with only one class of stock outstanding. However, can have different voting rights. B. All stockholders must be individual citizens or residents, estates, or certain trusts. No corporate or partnership shareholders. C. There must be 75 or fewer shareholders. D. Every stockholder must consent in writing to the original election. III. Termination of S status A. Can be revoked by election (more than 50% of stock must vote to revoke). B. Can terminate because no longer qualifies as an S corporation. IV. Operation of S corporation A. Like a partnership in that S corporation does not pay taxes. B. Losses flow through C. Taxable items are allocated pro rata to stock ownership. D.Employee status for some aspects. Nonemployee for others. V. Organization Just like a C corporation VI. Distributions and Liquidations A. Distributions are generally tax-free. Example: S corporation distributes $18,000 cash to shareholder with a basis of $30,000 at the beginning of the year and allocated income of $20,000. B. Gains on distribution of appreciated property are recognized by corporation. Flows through to the shareholders. Example: S corporation distributes land (FMV = $30,000; basis = $12,000) to shareholder with a basis of $45,000. What if this were a partner in partnership? What if this were a C corporation? VII. Advantages of S corporation A. Limited liability B. No double taxation C. Losses flow through D. Net income of entity is not subject to SE tax. VIII. Disadvantages A. Types and number of shareholders are limited B. Taxed on earnings even if not distributed C. No additional basis for liabilities of S Corporation D. No special allocations E. Timing of gains on distributions