14_H_Managing_the_Business_R09-0602

advertisement

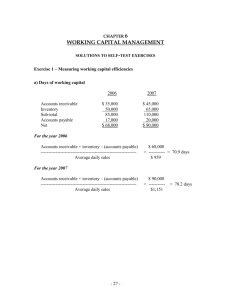

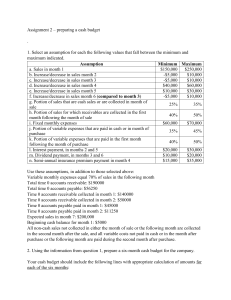

14_Managing_the_Business Entrepreneurs most often focus on “high visibility” areas of the business (for example: sales & marketing, customer service, cash flow, and profits). To be profitable and grow, they must increase sales and/or control costs. “Managing the Business” focuses on controlling business costs, which requires skillful management of operations, assets, and risks. Managers’ key contributions are to plan, organize, lead/direct, control, and evaluate. Some of these duties include: Operations include a wide variety of business activities: Operations Process: creating the product or service for customers o o o o o o o o Purchasing Inventory management Production planning and scheduling Manufacturing Maintenance Productivity improvement Quality management Information systems Managing Assets: enabling the entrepreneur to successfully control the daily flow of resources. Managing Risks: consists of all efforts to preserve assets and earning power. Operations Management including both service and manufacturing processes. All businesses have operations or work flow to be managed. Managing Assets Managing assets refers to controlling the daily flow of resources within the working capital cycle through the company’s working capital accounts. Thus, Accounting Systems and the Working Capital Cycle are at the core. Accounting Systems enable the management of cash, accounts receivable, inventories, accounts payable, and many other transactions or “book keeping” functions. Working Capital management is managing current assets (for example: cash, accounts receivable, inventory) and current liabilities (for example: accounts payable, accrued expenses, short term notes) Why Managing Working Capital Is Important Working capital is one of two key tools that enable the entrepreneur to manage the receipt and payment of dollars. Cash Budget: a planning document only concerned with the receipt and payment of dollars The mantra is – cash flow, cash flow, cash flow! Working Capital Cycle Step 1: Accumulate inventory for sale Step 2: a) Sell the inventory for cash (which increases cash) or b) Sell the inventory for credit (which increases accounts receivable) Step 3: a) Pay the accounts payable (which decreases accounts payable and decreases cash) or b) Pay operating expenses and taxes (which decreases cash) Step 4: Collect the accounts receivable when due (which decreases accounts receivable and increases cash) Step 5: Begin the cycle again. Cash Budget – the single most important planning document Inflows Outflows Cash sales Payment of expenses Owner's investment Payment for inventory Borrowed funds Payment of dividends Sale of fixed assets Purchase of fixed assets Collection of accounts receivable No single planning document is more important in the life of a small company, either in avoiding cash flow problems when cash runs short or for anticipating short term investment opportunities if excess cash becomes available. Example Monthly Cash Budget Estimate Managing Risk Risk is a condition in which there is a possibility of an adverse deviation from a desired outcome. Two types of small business risks: 1. Market Risk – uncertainty associated with an investment decision 2. Pure Risk – a situation where only loss can occur. This is the only insurable risk. Pure Risks Examples: Property Risk o Real Property (land, buildings) o Personal property (machinery, equipment, vehicles) Liability Risk o Statutory liability (workers’ compensation) o Contractual liability (leases, sales contracts, supplier agreements) o Tort liability Personal Risk o Premature death, poor health, insufficient retirement income Risk Management Risk Control – minimizing loss through o Loss prevention (eg., contingency planning) o Loss avoidance (eg., hazard identification) o Loss reduction (eg., crisis planning) Risk Financing – covering losses o Risk transfer (eg., insurance, sub-contracting) o Risk retention (eg., self insurance) Homework Apply the learning from 14_Managing_the_Business to your business plan.