Slide 1

advertisement

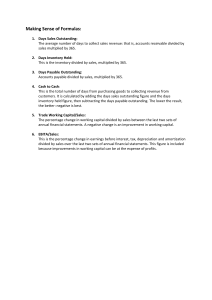

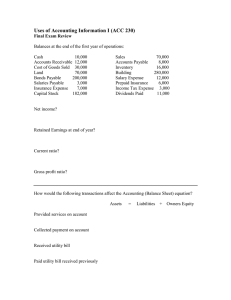

Create a Strong Cash Flow Cycle Lori Supinie Senseney Music Agenda • Define Cash Cycle • Discuss Cash Cycle components • Ways to strengthen Cash Cycle Cash Cycle Defined • Length of time needed to turn economic inputs/resources into cash flows • Economic inputs: Accounts Receivable, Inventory, and Accounts Payable (working capital) Why Analyze your Cash Cycle? • Cash is king • Operations are a cash pump • Financial effectiveness – reducing inefficiencies (yours, your suppliers, and your customers) Components of Cash Flow Cycle: Ratios • Accounts Receivable Outstanding in Days (A/R OD) • Inventory Turnover (I/T) • Accounts Payable Outstanding in Days (A/P OD) Components of Cash Flow Cycle: Formula A/R OD + I/T – A/P OD = Cash Flow Cycle (# Days) Accounts Receivable (average) Sales (annual) Inventory (average) COGS (annual) Accounts Payable (average) Accounts Receivable Outstanding in Days: • A/R / Sales X 365 • For example: 500,000 / 2,000,000 X 365 = 91 days Inventory Turnover • Average Inventory / COGS X 365 • For example: 500,000 / 1,200,000 X 365 = 152 days Accounts Payable Outstanding in Days: • A/P / COGS X 365 • For example: 200,000 / 1,200,000 X 365 = 61days Cash Flow Cycle A/R OD + I/T – A/P OD = Cash Flow Cycle 91 + 152 – 61 = 182 days What’s a good number? • It depends! • Benchmarking is difficult; moving your own needle is not • Some general observations: – – – – The more “retail” you are, the lower the number tends to be The more “financing” you do, the higher the number tends to be The more stores you have, the higher the number tends to be Vendor financing results in a lower number Ways to Lower Cash Cycle Number of Days • Whole store approach – Accounting – Inventory Purchasing – Sales & Marketing Ways to Lower Cash Cycle Number of Days • Accounting – Credit & Collection policies (tighten terms, take action earlier, offer early pay discounts) – Bill immediately or align your statement cycle – Reduce errors Ways to Lower Cash Cycle Number of Days • Inventory Purchasing – Negotiate with vendors (schedule deliveries, consignment, terms) – Reduce errors – Increase turns (balance between acquisition costs of smaller quantity orders and carrying costs) Ways to Lower Cash Cycle Number of Days • Sales & Marketing – Reduce customer service errors – Better forecasting (Hope is not a plan!) – Less in-house financing – Sales and product training for staff Conclusion & Cautions • Importance of Strong Cash Cycle • Don’t squeeze vendors • Verify improvements • Questions? Lori Supinie Senseney Music Lori@senseneymusic.com 316-262-1487