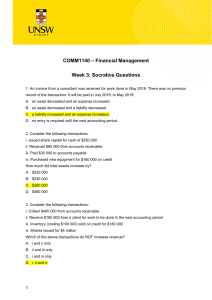

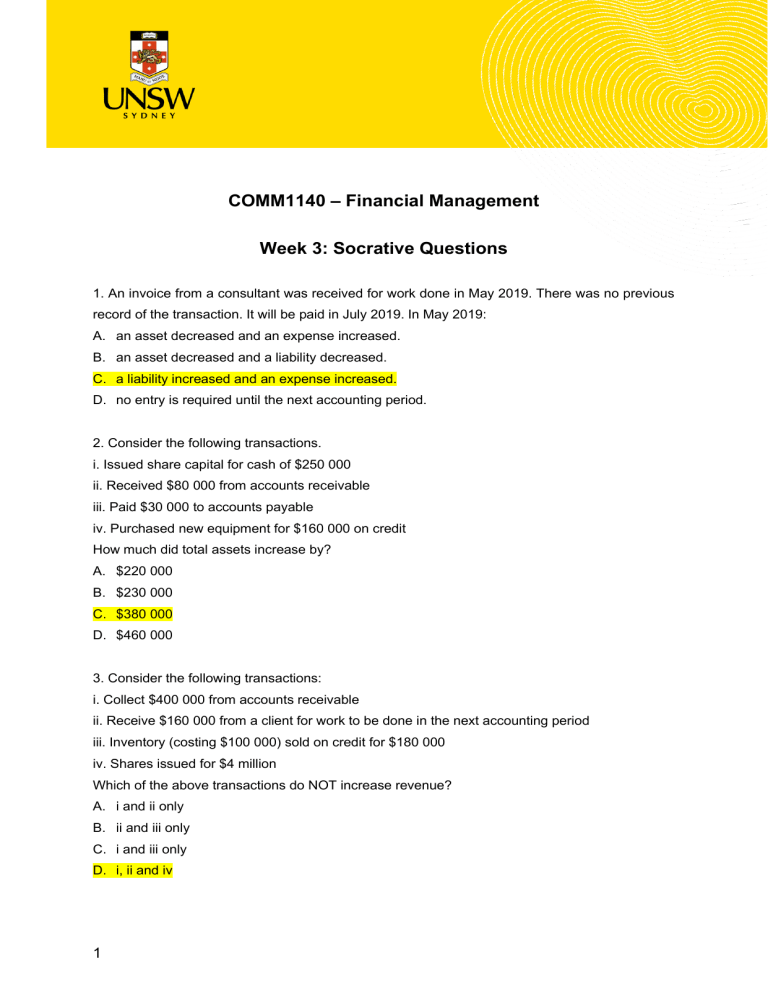

COMM1140 – Financial Management Week 3: Socrative Questions 1. An invoice from a consultant was received for work done in May 2019. There was no previous record of the transaction. It will be paid in July 2019. In May 2019: A. an asset decreased and an expense increased. B. an asset decreased and a liability decreased. C. a liability increased and an expense increased. D. no entry is required until the next accounting period. 2. Consider the following transactions. i. Issued share capital for cash of $250 000 ii. Received $80 000 from accounts receivable iii. Paid $30 000 to accounts payable iv. Purchased new equipment for $160 000 on credit How much did total assets increase by? A. $220 000 B. $230 000 C. $380 000 D. $460 000 3. Consider the following transactions: i. Collect $400 000 from accounts receivable ii. Receive $160 000 from a client for work to be done in the next accounting period iii. Inventory (costing $100 000) sold on credit for $180 000 iv. Shares issued for $4 million Which of the above transactions do NOT increase revenue? A. i and ii only B. ii and iii only C. i and iii only D. i, ii and iv 1 4. For the following transaction, identify the type of change that would have occurred in the accounting equation: Assets = Liabilities + Share capital + Opening retained profits + Revenue – Expenses – Dividends At the end of the accounting period, three months’ interest is owing to the company from the bank on a term deposit with the bank. A. An asset decreases and a liability decreases. B. An asset increases and revenue increases. C. An asset increases and another asset decreases. D. A liability increases and an expense increases 5. Identify the journal entry required to correctly record the following transaction. Purchased goods on credit. A. DR Inventory CR Accounts payable B. DR Inventory CR Accounts receivable C. DR Accounts receivable CR Inventory D. DR Purchases CR Cash at bank 6. Inventory was purchased by a business for $3 000; $2 000 was paid in cash and the rest was put on account. The journal entry will include: A. a credit to inventory of $1 000. B. a credit to accounts payable of $2 000. C. a credit to cash of $3 000. D. a credit to accounts payable of $1 000. 7. A credit balance in which of the following accounts would indicate a likely error? A. Sales revenue B. Inventory C. Share capital D. Accounts payable 8. A debit balance in which of the following accounts would indicate a likely error? A. Salaries expense B. Accounts receivable C. Share capital D. Equipment 9. Additional sales of $2 million (cost price $1.5 million) are made on credit. This transaction will: A. increase net profit, increase cash and increase total assets. 2 B. increase net profit, increase total assets but not affect cash. C. increase net profit, and not affect cash or total assets. D. None of the above. 10. A customer provides a deposit of $500 000 near year-end. The product will not be delivered until next year. This transaction will: A. increase net profit, total assets and cash. B. increase net profit and cash but not total assets. C. increase total assets and cash but not net profit. D. increase cash but not increase net profit or total assets. 11. Identify the journal entry required to correctly record the following transaction. Received cash from customer. A. DR Accounts receivable and CR Cash B. DR Cash and CR Accounts payable C. DR Cash and CR Accounts receivable D. None of the above 3