VCE Accounting Unit 3

advertisement

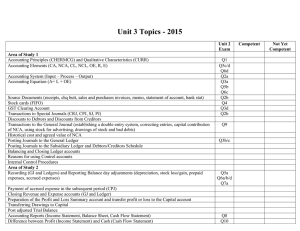

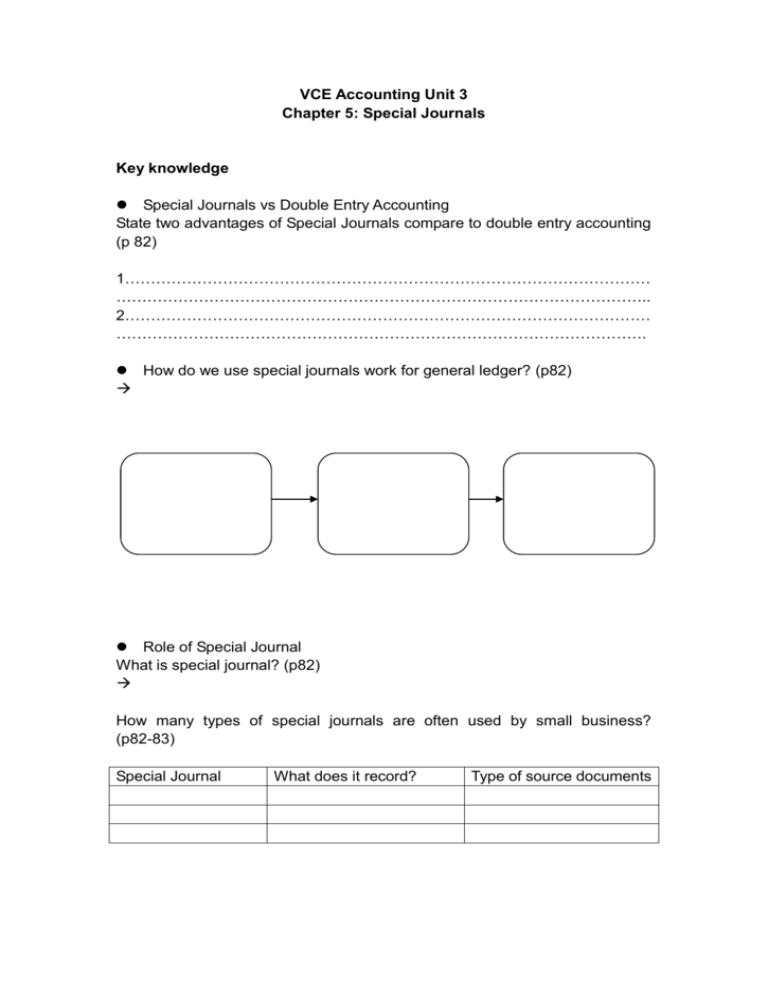

VCE Accounting Unit 3 Chapter 5: Special Journals Key knowledge Special Journals vs Double Entry Accounting State two advantages of Special Journals compare to double entry accounting (p 82) 1………………………………………………………………………………………… ………………………………………………………………………………………….. 2………………………………………………………………………………………… …………………………………………………………………………………………. How do we use special journals work for general ledger? (p82) Role of Special Journal What is special journal? (p82) How many types of special journals are often used by small business? (p82-83) Special Journal What does it record? Type of source documents Example of Cash Receipts Journal (Figure 5.2, p 84) Business name: name of special journal + reporting period Date Details Rec. Bank Debtors Cost Sales no $ of sales Transaction details *write debtors name if there are many Write Rec. No. of cash GST Sundries GST received (Increas e L) Bank (increase cash at bank) = Total of other columns Totals of cash receipts for each vertical column=total Dr. or Cr for related Ledger Accounts. Key Ledger Accounts relate to CRJ CRJ Cash Sales Cost of Sales Debtors GST (received) Sundries Ledger Accounts Sales Cash at Bank Cost of sales Stock control Debtors Control (under different debtor’s name) Cash at Bank GST Clearing Depends -Capital -Interest on Investment/received **************************************Your work******************************* Example of Cash Payments Journals (Figure 5.4, p87)