9.1

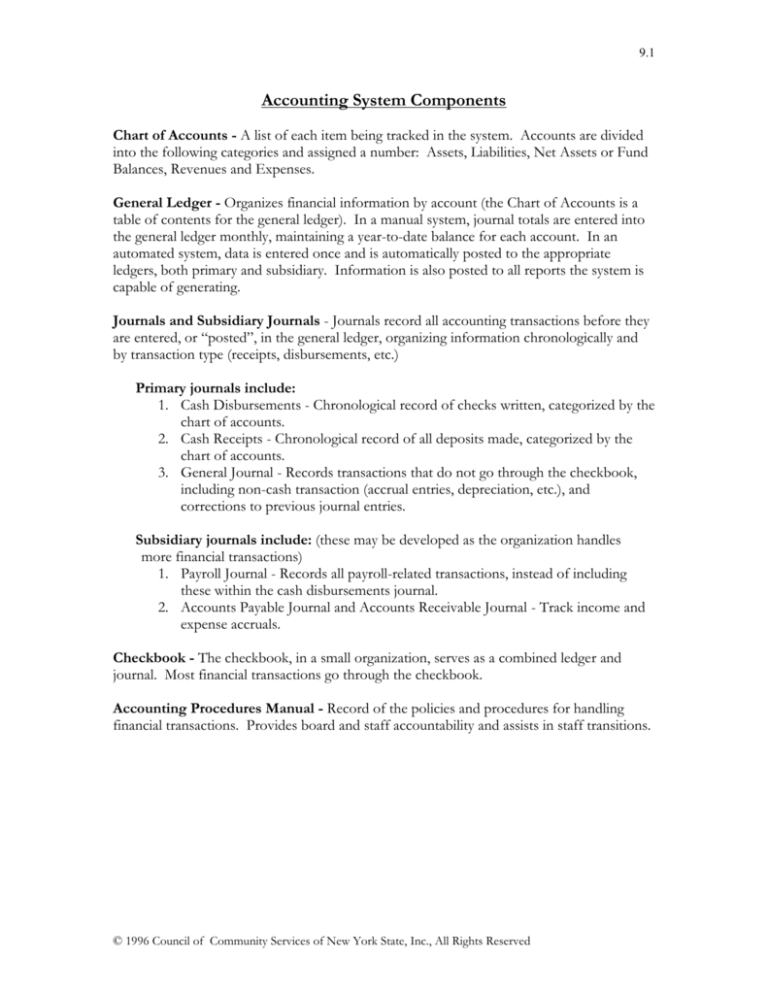

Accounting System Components

Chart of Accounts - A list of each item being tracked in the system. Accounts are divided

into the following categories and assigned a number: Assets, Liabilities, Net Assets or Fund

Balances, Revenues and Expenses.

General Ledger - Organizes financial information by account (the Chart of Accounts is a

table of contents for the general ledger). In a manual system, journal totals are entered into

the general ledger monthly, maintaining a year-to-date balance for each account. In an

automated system, data is entered once and is automatically posted to the appropriate

ledgers, both primary and subsidiary. Information is also posted to all reports the system is

capable of generating.

Journals and Subsidiary Journals - Journals record all accounting transactions before they

are entered, or “posted”, in the general ledger, organizing information chronologically and

by transaction type (receipts, disbursements, etc.)

Primary journals include:

1. Cash Disbursements - Chronological record of checks written, categorized by the

chart of accounts.

2. Cash Receipts - Chronological record of all deposits made, categorized by the

chart of accounts.

3. General Journal - Records transactions that do not go through the checkbook,

including non-cash transaction (accrual entries, depreciation, etc.), and

corrections to previous journal entries.

Subsidiary journals include: (these may be developed as the organization handles

more financial transactions)

1. Payroll Journal - Records all payroll-related transactions, instead of including

these within the cash disbursements journal.

2. Accounts Payable Journal and Accounts Receivable Journal - Track income and

expense accruals.

Checkbook - The checkbook, in a small organization, serves as a combined ledger and

journal. Most financial transactions go through the checkbook.

Accounting Procedures Manual - Record of the policies and procedures for handling

financial transactions. Provides board and staff accountability and assists in staff transitions.

© 1996 Council of Community Services of New York State, Inc., All Rights Reserved