Unit 3 Topics orientation 2015

advertisement

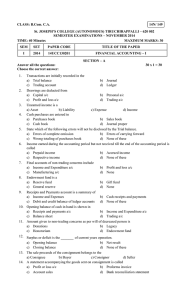

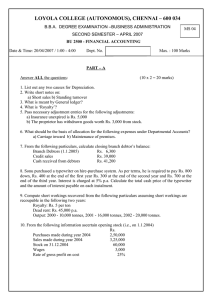

Unit 3 Topics - 2015 Unit 2 Exam Area of Study 1 Accounting Principles (CHERMCG) and Qualitative Characteristics (CURR) Accounting Elements (CA, NCA, CL, NCL, OE, R, E) Accounting System (Input – Process – Output) Accounting Equation (A= L + OE) Source Documents (receipts, chq butt, sales and purchases invoices, memo, statement of account, bank stat) Stock cards (FIFO) GST Clearing Account Transactions to Special Journals (CRJ, CPJ, SJ, PJ) Discounts to Debtors and Discounts from Creditors Transactions to the General Journal (establishing a double-entry system, correcting entries, capital contribution of NCA, using stock for advertising, drawings of stock and bad debts) Historical cost and agreed value of NCA Posting Journals to the General Ledger Posting Journals to the Subsidiary Ledger and Debtors/Creditors Schedule Balancing and Closing Ledger accounts Reasons for using Control accounts Internal Control Procedures Area of Study 2 Recording (GJ and Ledgers) and Reporting Balance day adjustments (depreciation, stock loss/gain, prepaid expenses, accrued expenses) Payment of accrued expense in the subsequent period (CPJ) Closing Revenue and Expense accounts (GJ and Ledger) Preparation of the Profit and Loss Summary account and transfer profit or loss to the Capital account Transferring Drawings to Capital Post adjusted Trial Balance Accounting Reports (Income Statement, Balance Sheet, Cash Flow Statement) Difference between Profit (Income Statement) and Cash (Cash Flow Statement) Q1 Q5c/d Q6d Q2a Q3a Q5b Q6c Q2b Q4 Q3d Q2b Q9 Q3b/c Q5a Q6a/b/d Q7a Q8 Q10 Competent Not Yet Competent