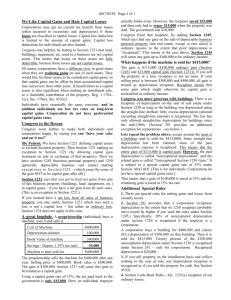

SECTION 1250 GAIN Basically, for most of us, there is NO 1250

advertisement

SECTION 1250 GAIN Basically, for most of us, there is NO 1250 RECAPTURE anymore (it is for assets in service after 1970 and before 1981 or real estate between 1980 and 1987). It will soon be extinct. So that leaves us with UNRECAPTURED 1250 gain: Basically: Gain from straight-line depreciation is capital gain Nonresidential real property held more than one year, accelerated depr used = Treated as Sec 1245 100% ordinary Nonresidential real property held more than one year, Straight Line depr used = 100% Section 1231 treated as CAP GAIN Residential rental real property held 1+ years, extent of 1250 = Ordinary as to excess over SL Note: 1250 property disposed of after May 6, 1997 is gain to the extent of depreciation claimed (other than that subject to Sec 1250 ordinary income recapture RARE) AND IS TREATED AS unrecaptured section 1250 gain.taxed AT MAX OF 25%. From TheTaxBook: Unrecaptured 1250 gain is the part of any long-term capital gain on Section 1250 property (real property) that is due to depreciation. Unrecaptured 1250 gain cannot be more than the net Sec 1231 gain or include any gain otherwise treated as ordinary income. From other sources: A type of depreciation-recapture income that is realized on the sale of depreciable real estate. Unrecaptured Section 1250 income is taxed at a 25% maximum capital-gains rate (or less in some cases). Unrecaptured Section 1250 gains are only realized when there is a net Section 1231 gain that is not subject to recapture as ordinary income. A Section 1250 gain is recaptured upon the sale of depreciated real estate, just as with any other asset; the only difference is the rate at which it is taxed. Assets that do not qualify under Section 1250 are taxed at a different rate. Unrecaptured Section 1250 gains and losses are not reported on Schedule D, but on worksheets within the Schedule D instructions, and are carried to the 1040.