Holding Period Capital Gain Tax Rates for Sales in 2011 Reporting

advertisement

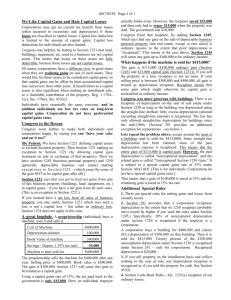

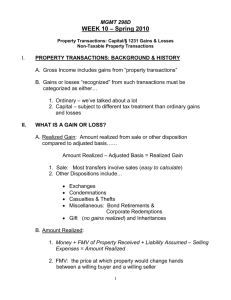

Musical compositions. Taxpayers can elect to treat musical compositions they created (or copyrights to the work) as a capital asset, qualifying any gain on the sale for the 15% maximum rate if the asset was held over one year [IRC §1221(b)(3)]. This election also applies to works or copyrights received as a gift from the person who created them. Holding Period Capital gains and losses must be separated according to how long the property was held. Short-term. The holding period for short-term capital gains and losses is one year or less. Long-term. The holding period for long-term capital gains and losses is more than one year. To figure the holding period, begin counting on the day after the day the property is acquired and include the date of disposition (Rev. Rul. 66-7). Exceptions: Property that is acquired by inheritance (other than from a decedent for whom the special 2010 election was made) is treated as long-term property, regardless of how long actually held. A nonbusiness bad debt must be treated as a short-term capital loss. Securities traded on an established market. For securities traded on an established securities market, the holding period begins the day after the trade date the securities are purchased, and ends on the trade date the securities are sold. Note: The trade date is different than the settlement date, which is the date the stock must be delivered and payment must be made. Example: Eric purchased stock (which is traded on an established market) that has a trade date of August 28, 2010. In order to qualify for the long-term holding period, the stock would have to be sold with a trade date on or after August 29, 2011. Capital Gain Tax Rates for Sales in 2011 For 2011, the long-term capital gains tax rates are 0%, 15%, 25% or 28%. See the Capital Gain and Dividend Tax Rates—2011 table on Page 7-1. Alternative minimum tax (AMT). The long-term capital gain tax rates also apply for AMT purposes. 28% rate. The 28% maximum tax rate applies to gain from the sale of (1) collectibles held more than one year, and (2) gain from the sale of Section 1202 stock held more than five years (the portion of the gain that is not excluded from income). To the extent a taxpayer is in a tax bracket below 28%, the lower tax rate applies. Reporting Separate Long-Term Rates All long-term capital gains and losses are entered on Part II of Form 8949, regardless of whether they are subject to the 0%, 15%, 25% or 28% rates. If the taxpayer has a net capital gain (that is, net long-term capital gain exceeds net short-term capital loss): •Unrecaptured Section 1250 gains are carried to the Unrecaptured Section 1250 Gain Worksheet in the Schedule D (and Form 8949) instructions to calculate the net gain subject to the 25% rate. This amount is then carried to Line 19 of Schedule D. •Gains subject to the 28% rate are carried to the 28% Rate Gain Worksheet in the Schedule D (and Form 8949) instructions to calculate the net gain subject to the 28% rate. This amount is then carried to Line 18 of Schedule D. Taxpayers with any net gains subject to the 25% or the 28% rates must use the Schedule D Tax Worksheet in the Schedule D (and Form 8949) instructions. Partnerships and S corporations. Pass-through entities must provide the necessary information on Schedule K-1 to determine gains eligible for the different maximum tax rates. Unrecaptured Section 1250 Gain For sales of Section 1250 property (most depreciable real property), any long-term capital gain attributable to depreciation (other than depreciation recaptured as ordinary income) is taxed at a maximum rate of 25%. In general, unrecaptured Section 1250 gain is the gain to the extent of straight-line (SL) depreciation allowed. Calculation. Generally, the unrecaptured Section 1250 gain is the smaller of (1) depreciation claimed or (2) total gain less any recaptured depreciation that is taxed at ordinary rates (that is, accelerated depreciation in excess of SL). This amount is then limited to the net Section 1231 gain. Finally, any net 28% rate loss is used to offset the unrecaptured Section 1250 gain. Example: Harry sold rental property for $150,000. He paid $100,000 for the property several years ago and had depreciated $20,000 under MACRS (SL depreciation). Of his total $70,000 gain ($150,000 proceeds – $80,000 adjusted basis), $50,000 is attributable to appreciation (which is taxed at a maximum rate of 15%), and $20,000 is attributable to depreciation (which is taxed as unrecaptured Section 1250 gain at a maximum rate of 25%). 28% Rate Gain Collectibles gain or loss. A collectibles gain or (loss) is any longterm gain or deductible long-term loss from the sale or exchange 25% rate. The 25% maximum tax rate applies to unrecaptured of a collectible that is a capital asset. Collectibles include works Section 1250 gain on sales of property held more than one year. of art, rugs, antiques, metals (such as gold, silver and platinum To the extent a taxpayer is in a tax bracket below 25%, the lower bullion), gems, stamps, coins, alcoholic beverages and certain tax rate applies. other tangible property. Also include any gain (but not loss) from 15% rate. The 15% rate (0% for taxpayers in the 10% and 15% the sale or exchange of an interest in a partnership, S corporation brackets) applies to long-term gains and qualified dividends. See or trust held for more than one year and attributable to unrealized Dividends on Page 5-23 for definition of qualified dividends. appreciation of collectibles. Caution: The 0% capital gains tax rate applies when ordinary25% Qualified small business stock. Up to 50% (60% for certain taxable income (Form 1040 line 43 less qualified dividends and Empowerment Zone Business Stock—see IRS Pub. 954) of the long-term capital gain) is less than the beginning of the 28% tax gain from the sale of Section 1202 qualified small business stock bracket. However, should line 43 exceed the beginning of the 28% (QSBS) is excluded from gross income if held for more than five tax bracket, any long-term capital gains contributing to the amount years. The taxable portion of the gain is included in income as in excess of the 28% tax bracket will be taxed at 15%. See Planning long-term capital gain subject to the 28% rate. for the 0% Capital Gain Rate in the Tax Planning for Individuals Note: A 75% gain exclusion rate applies to QSBS (including Quickfinder® Handbook for more information. 25% QSBS stock in certain empowerment zone businesses) acquired Installment payments. The tax rate that applies under the installfrom February 18, 2009–September 27, 2010. A 100% gain exclusion ment method is determined by the rates in effect on the date an applies to QSBS acquired from September 28, 2010–December 31, installment payment is received, not the rate that applies at the 2011. However, the 75% and 100% gain exclusions will not apply to time of sale. See Installment Sales on Page 7-11. 2011 sales since the five-year holding period will not be met. U 7-4 2011 Edition | 1040 Quickfinder ® Handbook