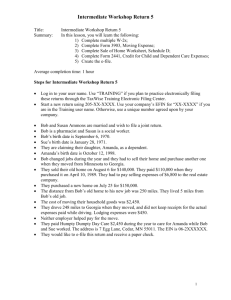

Steps for Advanced Workshop Return 37

advertisement

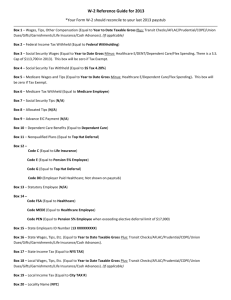

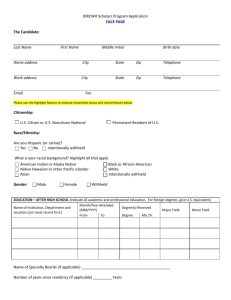

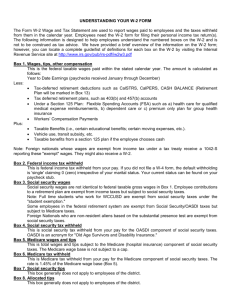

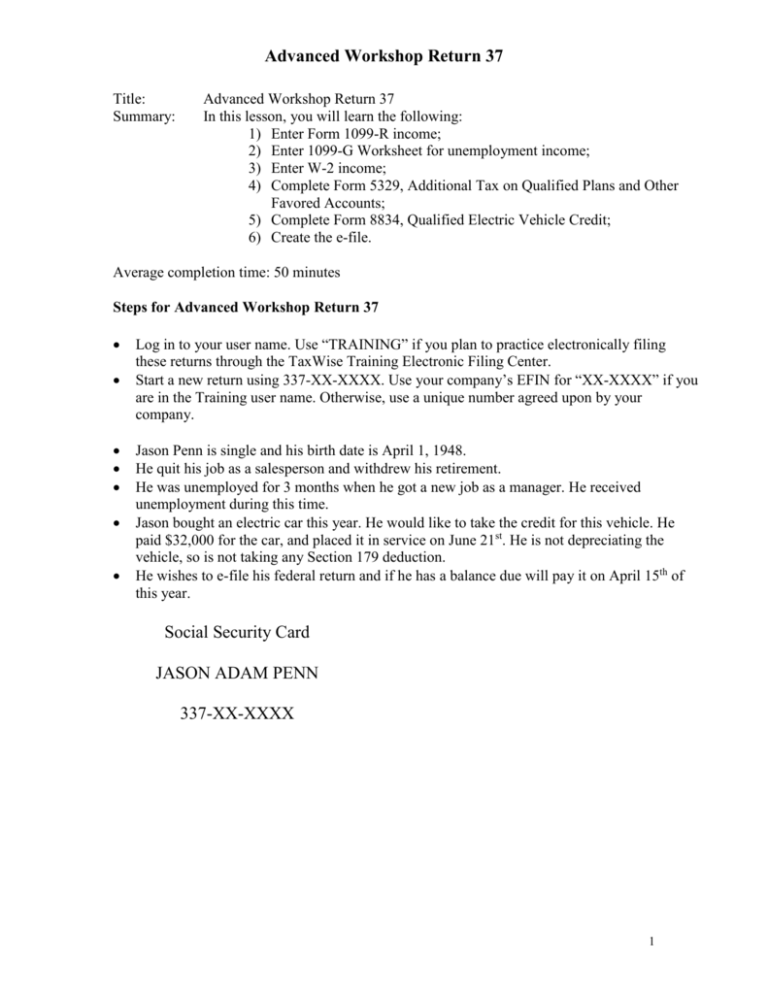

Advanced Workshop Return 37 Title: Summary: Advanced Workshop Return 37 In this lesson, you will learn the following: 1) Enter Form 1099-R income; 2) Enter 1099-G Worksheet for unemployment income; 3) Enter W-2 income; 4) Complete Form 5329, Additional Tax on Qualified Plans and Other Favored Accounts; 5) Complete Form 8834, Qualified Electric Vehicle Credit; 6) Create the e-file. Average completion time: 50 minutes Steps for Advanced Workshop Return 37 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 337-XX-XXXX. Use your company’s EFIN for “XX-XXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Jason Penn is single and his birth date is April 1, 1948. He quit his job as a salesperson and withdrew his retirement. He was unemployed for 3 months when he got a new job as a manager. He received unemployment during this time. Jason bought an electric car this year. He would like to take the credit for this vehicle. He paid $32,000 for the car, and placed it in service on June 21st. He is not depreciating the vehicle, so is not taking any Section 179 deduction. He wishes to e-file his federal return and if he has a balance due will pay it on April 15th of this year. Social Security Card JASON ADAM PENN 337-XX-XXXX 1 Advanced Workshop Return 37 A Control number OMB No. 1545-0008 B Employer Identification Number 23-7XXXXXX C Employer’s name, address, and ZIP code Cook’s Accounting 86 Juniper Road Carrollton, GA 30117 D Employee’s social security number 337-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 18,500.00 3 Social security wages $ 18,500.00 5 Medicare wages and tips $ 18,500.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Jason Penn 88 Gardenia Street Rome, GA 30161 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 23-7XXXXXX $ 18,500.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 2,850.00 4 Social security tax withheld $ 1,147.00 6 Medicare tax withheld $ 268.25 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 1,938.66 $ $ Department of the Treasury – Internal Revenue Service Center 2 Advanced Workshop Return 37 A Control number OMB No. 1545-0008 B Employer Identification Number 10-9XXXXXX C Employer’s name, address, and ZIP code Happy Feet Shoes 10 North Star Mall Pennington, NJ 08534 D Employee’s social security number 337-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 4,500.00 3 Social security wages $ 4,500.00 5 Medicare wages and tips $ 4,500.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Jason Penn 88 Gardenia Street Rome, GA 30161 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 10-9XXXXXX $ 4,500.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 450.00 4 Social security tax withheld $ 279.00 6 Medicare tax withheld $ 65.25 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 200.68 $ $ Department of the Treasury – Internal Revenue Service Center 3 Advanced Workshop Return 37 PAYER’S name, street address, city, state, and ZIP code 1 Gross distribution $ 9,750.00 2a Taxable amount 20XX Happy Feet Shoes 10 North Star Mall Pennington, NJ 08534 Form 1099-R $ 9,750.00 2b Taxable amount not determined PAYER’S federal identification no. RECIPIENT’S identification no. Total Distribution X 3 Capital gain (included in box 2a) 4 Federal income tax withheld 10-9XXXXXX 337-XX-XXXX RECIPIENT’S name $ 5 Employee contributions or insurance premiums Jason Penn Street address (including apt. no.) $ 7 Distribution code $ 950.00 6 Net unrealized appreciation in employer’s securities $ 8 Other 1 88 Gardenia Street City, state, and ZIP code Rome, GA 30161 Account number (optional) Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Copy A For Internal Revenue Service Center OMB No. 1545-0119 IRA/SEP /SIMPLE $ For Privacy Act And Paperwork Reduction Act Notice, see the 20XX General Instructions for Forms 1099, 1098, 5498, and W-2G. % 9a Your percentage of total distribution % 9b Total employee contributions 10 State tax withheld 11 State/Payer’s state no. 12 State distribution $ 97.50 13 Local tax withheld GA 10-9XXXXXX 14 Name of locality $ 9,750.00 15 Local distribution $ Form 1099-R Cat. No. 14436Q $ Department of the Treasury – Internal Revenue Service 4 Advanced Workshop Return 37 PAYER’S name, street address, city, state, ZIP code, and telephone no. Georgia Department of Labor 194 Riverside Drive Rome, GA 30161 1 Unemployment compensation $ 1,027.36 2 State or local income tax refunds, credits, or offsets $ PAYER’S Federal identification no. RECIPIENT’S identification no. 3 Box 2 amount is for tax year 027-XX-XXXX RECIPIENT’S name 337-XX-XXXX Jason Penn Street address (including apt. no.) 88 Gardenia Street City, state, and ZIP code Rome, GA 30161 Account number (optional) 5 Qualified state tuition program earnings $ 7 Agriculture payments $ OMB No. 15450120 20XX Form 1099-G 4 Federal income tax withheld $ 6 Taxable grants $ 8 The amount in box 2 applies to income from a trade or business ► Certain Government And Qualified State Tuition Program Payments Copy A For Internal Revenue Service Center File with form 1096. For Privacy Act and Paperwork Reduction Act Notice, see the 20XX General Instructions for Forms 1099, 1098, 5498, and W2G 5