Intermediate Workshop Return 13

advertisement

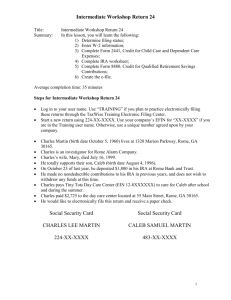

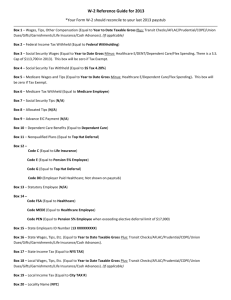

Intermediate Workshop Return 13 Title: Summary: Intermediate Workshop Return 13 In this lesson, you will learn the following: 1) Create multiple W-2s; 2) Complete Schedule A, Itemized Deductions; 3) Complete Form 2441, Credit for Child and Dependent Care Expenses; 4) Enter other income; 5) Create the e-file. Average completion time: 50 minutes Steps for Intermediate Workshop Return 13 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 213-XX-XXXX. Use your company’s EFIN for “XXXXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Andrew Taylor and his wife, Barbara, are both tax preparers. They have a daughter, Janet. They live at 18 Sycamore Drive, Rome, GA 30165. Andrew’s birth date is January 1, 1966. Barbara’s birth date is December 4, 1970. Janet’s birth date is July 7, 1996. Barbara received $50 for jury pay. She was not required to turn this in to her employer. They paid Little Tykes Day Care, EIN 11-1XXXXXX, at 2236 Redmond Circle, Rome, GA 30161 $3,500 during the year to care for Janet while they both worked. They would also like to itemize their deductions if they are able. Medical Insurance .......$1,500 United Way .................$3,754 Doctor bills..................$1,900 American Red Cross ...$1,476 Glasses and contacts ......$110 Personal property taxes ..$560 Dentist ............................$215 Tax preparation ..............$350 Andrew and Barbara would like to electronically file the return and, if they are due a refund, would like to receive a paper check. Social Security Card Social Security Card ANDREW THOMAS TAYLOR BARBARA ANN TAYLOR 213-XX-XXXX 464-XX-XXXX 1 Intermediate Workshop Return 13 Social Security Card JANET ELIZABETH TAYLOR 465-XX-XXXX RECIPIENT’S name, address, and telephone number OMB No. 1545-0901 20XX Rome Financial 15 Martha Berry Hwy Rome, GA 30165 1 Mortgage interest received from payer(s)/borrower(s) $ 6,400.00 2 Points paid on purchase of principal residence Street address (including apt no.) $ 3 Refund of overpaid interest $ 4 Real Estate Taxes – $ 2,987.00 Rome, GA 30165 Account number (optional) Form 1098 Interest Statement Form 1098 RECIPIENT’S Federal PAYER’S social security no. identification no. 11-2XXXXXX 213-XX-XXXX PAYER’S/BORROWER’S name Andrew and Barbara Taylor 18 Sycamore Street City, State, and ZIP code Mortgage Copy C For Recipient For Privacy Act And Paperwork Reduction Act Notice, see the 20XX General Instructions for Forms 1099, 1098, 5498, and W-2G. Department of the Treasury – Internal Revenue Service 2 Intermediate Workshop Return 13 A Control number OMB No. 1545-0008 B Employer Identification Number 11-3XXXXXX C Employer’s name, address, and ZIP code Ted’s Tax Service 909 Broad Street Rome, GA 30165 D Employee’s social security number 464-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 22,600.00 3 Social security wages $ 23,600.00 5 Medicare wages and tips $ 23,600.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Barbara Taylor 18 Sycamore Street Rome, GA 30165 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 11-3XXXXXX $ 22,600.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan X 2 Federal income tax withheld $ 2,260.00 4 Social security tax withheld $ 1,463.20 6 Medicare tax withheld $ 342.20 8 Allocated tips $ 10 Dependent care benefits $ 1,000.00 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 1,039.78 $ $ Department of the Treasury – Internal Revenue Service Center 3 Intermediate Workshop Return 13 A Control number OMB No. 1545-0008 B Employer Identification Number 11-3XXXXXX C Employer’s name, address, and ZIP code Ted’s Tax Service 909 Broad Street Rome, GA 30165 D Employee’s social security number 213-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 26,500.00 3 Social security wages $ 26,500.00 5 Medicare wages and tips $ 26,500.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Andrew Taylor 18 Sycamore Street Rome, GA 30165 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 11-3XXXXXX $ 26,500.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 2,650.00 4 Social security tax withheld $ 1,643.00 6 Medicare tax withheld $ 384.25 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 1,300.00 $ $ Department of the Treasury – Internal Revenue Service Center 4