Social Security Card

advertisement

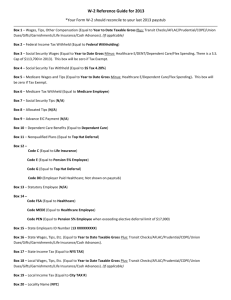

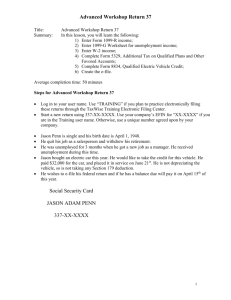

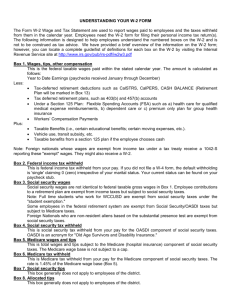

Intermediate Workshop Return 2 Title: Summary: Intermediate Workshop Return 2 In this lesson, you will learn the following: 1) Entering multiple W-2s; 2) Complete Form 2106, Employee Business Expense; 3) Calculate expenses for a Qualified Performing Artist; 4) Complete Bank Application for Bank Product; 5) Create the e-file. Average completion time: 45 minutes Steps for Intermediate Workshop Return 2 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 202-XX-XXXX. Use your company’s EFIN for “XXXXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Hannah is an actress. She received a W-2 from each studio that she worked for during the year. She also had some expenses for her acting. These are listed below. Air fare .............$1,086.25 Hotel ....................$423.65 Transportation .......$58.60 Meals .....................$84.52 Makeup .................$46.96 Costume ..............$625.31 None of these expenses were reimbursed. Hannah is single and would like a RAL if she receives a refund. The phone number for Paramount Studios is (310) 555-1212. The phone number for Broadway Theatre is (212) 555-8621. The phone number for Shakespeare Theatre is (205) 555-5689. Her birth date is July 24, 1971. Her home phone number is (770) 555-5585. This is the number where she can be reached all day. Social Security Card HANNAH ELISABETH GRANT 202-XX-XXXX 1 Intermediate Workshop Return 2 A Control number OMB No. 1545-0008 B Employer Identification Number 05-9XXXXXX C Employer’s name, address, and ZIP code Paramount Studios 1521 Movie Boulevard Los Angeles, CA 90032 D Employee’s social security number 202-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 3,624.62 3 Social security wages $ 3,624.62 5 Medicare wages and tips $ 3,624.62 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Hannah E. Grant 5233 Northwest Drive Birmingham, AL 35266 13 15 State Employers State ID no. 16 State wages, tips, etc. AL 05-9XXXXXX $ 3,624.62 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 362.15 4 Social security tax withheld $ 224.73 6 Medicare tax withheld $ 52.56 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 124.32 $ $ Department of the Treasury – Internal Revenue Service Center 2 Intermediate Workshop Return 2 A Control number OMB No. 1545-0008 B Employer Identification Number 06-0XXXXXX C Employer’s name, address, and ZIP code Broadway Theatre 1632 Broadway Avenue New York, NY 10121 D Employee’s social security number 202-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 4,263.16 3 Social security wages $ 4,263.16 5 Medicare wages and tips $ 4,263.16 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Hannah E. Grant 5233 Northwest Drive Birmingham, AL 35266 13 15 State Employers State ID no. 16 State wages, tips, etc. NY 06-0XXXXXX $ 4,263.16 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 414.86 4 Social security tax withheld $ 264.32 6 Medicare tax withheld $ 61.82 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 362.14 $ $ Department of the Treasury – Internal Revenue Service Center 3 Intermediate Workshop Return 2 A Control number OMB No. 1545-0008 B Employer Identification Number 06-1XXXXXX C Employer’s name, address, and ZIP code Shakespeare Theatre 8623 Romeo Drive Birmingham, AL 35266 D Employee’s social security number 202-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 4,136.23 3 Social security wages $ 4,136.23 5 Medicare wages and tips $ 4,136.23 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Hannah E. Grant 5233 Northwest Drive Birmingham, AL 35266 13 15 State AL Employers State ID no. 16 State wages, tips, etc. 06-1XXXXXX $ 4,136.23 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 415.11 4 Social security tax withheld $ 256.45 6 Medicare tax withheld $ 59.98 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 213.22 $ $ Department of the Treasury – Internal Revenue Service Center 4