Steps for Intermediate Workshop Return 5

advertisement

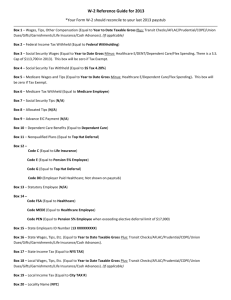

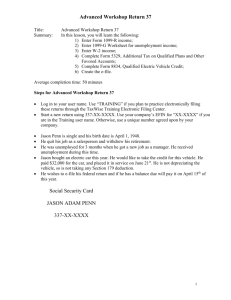

Intermediate Workshop Return 5 Title: Summary: Intermediate Workshop Return 5 In this lesson, you will learn the following: 1) Complete multiple W-2s; 2) Complete Form 3903, Moving Expense; 3) Complete Sale of Home Worksheet, Schedule D; 4) Complete Form 2441, Credit for Child and Dependent Care Expenses; 5) Create the e-file. Average completion time: 1 hour Steps for Intermediate Workshop Return 5 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 205-XX-XXXX. Use your company’s EFIN for “XX-XXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Bob and Susan Ammons are married and wish to file a joint return. Bob is a pharmacist and Susan is a social worker. Bob’s birth date is September 6, 1970. Sue’s birth date is January 28, 1971. They are claiming their daughter, Amanda, as a dependent. Amanda’s birth date is October 12, 1998. Bob changed jobs during the year and they had to sell their home and purchase another one when they moved from Minnesota to Georgia. They sold their old home on August 6 for $140,000. They paid $110,000 when they purchased it on April 10, 1989. They had to pay selling expenses of $6,800 to the real estate company. They purchased a new home on July 25 for $150,000. The distance from Bob’s old home to his new job was 250 miles. They lived 5 miles from Bob’s old job. The cost of moving their household goods was $2,450. They drove 248 miles to Georgia when they moved, and did not keep receipts for the actual expenses paid while driving. Lodging expenses were $450. Neither employer helped pay for the move. They paid Humpty Dumpty Day Care $2,450 during the year to care for Amanda while Bob and Sue worked. The address is 7 Egg Lane, Cedar, MN 55011. The EIN is 06-2XXXXXX. They would like to e-file this return and receive a paper check. 1 Intermediate Workshop Return 5 Social Security Card Social Security Card BOB RAYMOND AMMONS SUSAN LEIGH AMMONS 205-XX-XXXX 451-XX-XXXX Social Security Card AMANDA SARAH AMMONS 452-XX-XXXX A Control number OMB No. 1545-0008 B Employer Identification Number 06-3XXXXXX C Employer’s name, address, and ZIP code Eckerd’s Drug Store 77 Crestwood Street Cedar, MN 55011 D Employee’s social security number 205-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 17,500.00 3 Social security wages $ 17,500.00 5 Medicare wages and tips $ 17,500.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Bob R. Ammons 33 Round Rock Road Cedar, MN 55011 13 15 State Employers State ID no. 16 State wages, tips, etc. MN 06-3XXXXXX $ 17,500.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 2,150.00 4 Social security tax withheld $ 1,085.00 6 Medicare tax withheld $ 253.75 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 1,150.00 $ $ Department of the Treasury – Internal Revenue Service Center 2 Intermediate Workshop Return 5 A Control number OMB No. 1545-0008 B Employer Identification Number 06-4XXXXXX C Employer’s name, address, and ZIP code Minnesota Department of Labor 6 Cedar Bluff Drive Cedar, MN 55011 D Employee’s social security number 451-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 7,800.00 3 Social security wages $ 7,800.00 5 Medicare wages and tips $ 7,800.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Susan L. Ammons 33 Round Rock Road Cedar, MN 55011 13 15 State Employers State ID no. 16 State wages, tips, etc. MN 06-4XXXXXX $ 7,800.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 1,500.00 4 Social security tax withheld $ 483.60 6 Medicare tax withheld $ 113.10 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 800.00 $ $ Department of the Treasury – Internal Revenue Service Center 3 Intermediate Workshop Return 5 A Control number OMB No. 1545-0008 B Employer Identification Number 03-9XXXXXX C Employer’s name, address, and ZIP code CVS 10 Shorter Avenue Rome, GA 30165 D Employee’s social security number 205-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 22,500.00 3 Social security wages $ 22,500.00 5 Medicare wages and tips $ 22,500.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Bob R. Ammons 26 White Cloud Street Rome, GA 30161 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 03-9XXXXXX $ 22,500.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 2,250.00 4 Social security tax withheld $ 1,395.00 6 Medicare tax withheld $ 326.25 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 1,102.36 $ $ Department of the Treasury – Internal Revenue Service Center 4