Social Security Card

advertisement

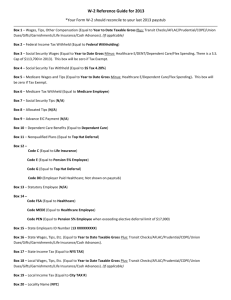

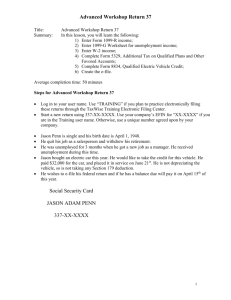

Advanced Workshop Return 28 Title: Summary: Advanced Workshop Return 28 In this lesson, you will learn the following: 1) Complete multiple W-2s; 2) Report Alaska Permanent Fund dividend income; 3) Complete multiple Forms 8814, Parent’s Election to Report Child’s Interest; 4) Create the e-file. Average completion time: 1 hour Steps for Advanced Workshop Return 28 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 328-XX-XXXX. Use your company’s EFIN for “XX-XXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Charles Snead is a doctor. His wife, Anya, is a nurse in the same hospital. Anya’s mother, Mary, lives with them and they totally support her. They also have two children, Maria and Eliza. Maria’s birth date is May 18, 1998, and Eliza’s is January 17, 2000. They live in Alaska, so they all receive Alaska Permanent Fund Dividends, and Charles and Anya would like to report the children’s income on their return. Each one of them received Permanent Fund Dividends of $1,645 this year. Charles was born on April 30, 1968, and Anya was born on May 2, 1969. Mary’s birth date is September 26, 1936. Please complete their return and electronically file it so that they will receive a paper check. Social Security Card TERESA ANYA SNEAD CHARLES LOWELL SNEAD 513-XX-XXXX 328-XX-XXXX Social Security Card Social Security Card MARY LOIS WALKER 1 Advanced Workshop Return 28 514-XX-XXXX Social Security Card MARIA RANA SNEAD 515-XX-XXXX Social Security Card ELIZA JANE SNEAD 516-XX-XXXX A Control number OMB No. 1545-0008 B Employer Identification Number 22-8XXXXXX C Employer’s name, address, and ZIP code Juneau Memorial Hospital 86 Bering Avenue Juneau, AK 99824 D Employee’s social security number 328-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 34,629.16 3 Social security wages $ 34,629.16 5 Medicare wages and tips $ 34,629.16 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Charles L. Snead 2930 Tundra Road Juneau, AK 99811 13 15 State Employers State ID no. 16 State wages, tips, etc. AK 22-8XXXXXX $ 34,629.16 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 3,464.99 4 Social security tax withheld $ 2,147.01 6 Medicare tax withheld $ 502.12 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ $ $ Department of the Treasury – Internal Revenue Service Center 2 Advanced Workshop Return 28 A Control number OMB No. 1545-0008 B Employer Identification Number 22-8XXXXXX C Employer’s name, address, and ZIP code Juneau Memorial Hospital 86 Bering Avenue Juneau, AK 99824 D Employee’s social security number 513-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 23,614.86 3 Social security wages $ 23,614.86 5 Medicare wages and tips $ 23,614.86 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Teresa A. Snead 2930 Tundra Road Juneau, AK 99811 13 15 State Employers State ID no. 16 State wages, tips, etc. AK 22-8XXXXXX $ 23,614.86 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 2,251.34 4 Social security tax withheld $ 1,464.12 6 Medicare tax withheld $ 342.42 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ $ $ Department of the Treasury – Internal Revenue Service Center 3