Tax preparation fees $150

advertisement

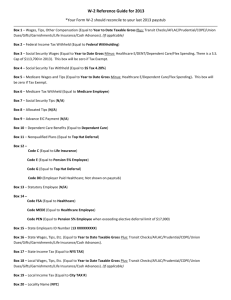

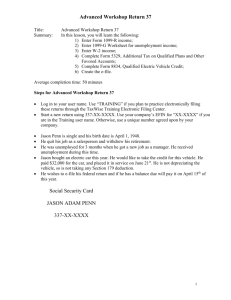

Advanced Workshop Return 7 Title: Summary: Advanced Workshop Return 7 In this lesson, you will learn the following: 1) Create multiple W-2s; 2) Complete K-1 Worksheet from a fiduciary; 3) Complete Schedule B, Interest and Ordinary Dividends; 4) Complete Schedule D, Capital Gains and Losses; 5) Complete Schedule E, Supplemental Income and Loss; 6) Compare itemized and standard deductions; 7) Create the e-file. Average completion time: 1 hour, 10 minutes Steps for Advanced Workshop Return 7 Log in to your user name. Use “TRAINING” if you plan to practice electronically filing these returns through the TaxWise Training Electronic Filing Center. Start a new return using 307-XX-XXXX. Use your company’s EFIN for “XXXXXX” if you are in the Training user name. Otherwise, use a unique number agreed upon by your company. Ann Sanderson and John Hanson are married and wish to file a joint return. They reside at 14 Ridge Ferry Way, Cedartown, GA 30125. Ann’s date of birth is April 23, 1971. John’s date of birth is January 15, 1969. Ann worked at Impeccable Pets as a sales clerk. John worked at American General Finance as a manager trainee. Ann’s father, Richard R. Sanderson, passed away last year and left part of his estate to Ann. She received a Schedule K-1 from the estate. None of the interest income on the Schedule K-1 is from a foreign account. Ann and John wish to itemize. On June 1, they donated clothing to the Hospitality House located at 7 Main Street, Cedartown, GA 30125. The cost of the items was $725 when purchased in May of 2000. The thrift store value at the time of the donation was $350. These are the other expenses they wish to claim: Doctor Bills .................$2,698 Eyeglasses ......................$465 Prescriptions ...................$823 Surgery ........................$1,709 Personal Property Taxes $536 Hospitality House...........$100 Heart Association ...........$125 Red Cross .......................$125 Tax preparation fees .......$150 They wish to electronically file their return. They will do this on April 1. If they will receive a refund, they would like it mailed, and if they owe, they will mail a check on the same day they file the return. Their last year’s tax was $4,255. 1 Advanced Workshop Return 7 Social Security Card Social Security Card ANN MARIE SANDERSON JOHN PAUL HANSON 307-XX-XXXX 490-XX-XXXX RECIPIENT’S name, address, and telephone number Cedartown First Bank 8662 Rome Highway Cedartown, GA 30125 OMB No. 1545-0901 20XX Form 1098 RECIPIENT’S Federal PAYER’S social security no. 14-6XXXXXX 307-XX-XXXX PAYER’S/BORROWER’S name Ann Sanderson and John Hanson Street address (including apt no.) 14 Ridge Ferry Way City, State, and ZIP code 1 Mortgage interest received from payer(s)/borrower(s) $ 2 Points paid on purchase of principal residence $ 2,645.00 3 Refund of overpaid interest $ 4 Real Estate Taxes: $ 3,000.00 Mortgage Interest Statement Copy C For Recipient For Privacy Act And Paperwork Reduction Act Notice, see the 20XX General Instructions for Forms 1099, 1098, 5498, and W-2G. Cedartown, GA 30125 Account number (optional) Form 1098 Department of the Treasury – Internal Revenue Service 2 Advanced Workshop Return 7 A Control number OMB No. 1545-0008 B Employer Identification Number 14-7XXXXXX C Employer’s name, address, and ZIP code Impeccable Pets 19 Hicks Drive Rome, GA 30161 D Employee’s social security number 307-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 13,625.00 3 Social security wages $ 13,625.00 5 Medicare wages and tips $ 13,625.00 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ Ann Sanderson 14 Ridge Ferry Way Cedartown, GA 30125 13 15 State Employers State ID no. 16 State wages, tips, etc. GA 254569999 $ 13,625.00 Form W-2 Wage and Tax Statement Statutory Employee 17 State income tax Pension Plan 2 Federal income tax withheld $ 1,000.00 4 Social security tax withheld $ 844.75 6 Medicare tax withheld $ 197.56 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code $ 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 18 Locality name 19 Local 20 Local Income wages, tips, tax etc. $ 139.68 $ $ Department of the Treasury – Internal Revenue Service Center 3 Advanced Workshop Return 7 A Control number OMB No. 1545-0008 B Employer Identification Number 14-8XXXXXX C Employer’s name, address, and ZIP code American General Finance 1365 Shorter Avenue Rome, GA 30165 D Employee’s social security number 490-XX-XXXX E Employee’s name, address, and ZIP code 1 Wages, tips, other compensation $ 32,415.00 3 Social security wages $ 33,102.96 5 Medicare wages and tips $ 33,102.96 7 Social security tips $ 9 Advance EIC payment $ 11 Nonqualified plans $ John Hanson 14 Ridge Ferry Way Cedartown, GA 30125 13 15 State Employers State ID no. Statutory Employee Pension Plan X 2 Federal income tax withheld $ 3,000.00 4 Social security tax withheld $ 2,052.38 6 Medicare tax withheld $ 479.99 8 Allocated tips $ 10 Dependent care benefits $ 12a See instructions for box 12 Code D $ 687.96 12b Code $ 12c Code $ 12d Code $ Third-party 14 Other Sick pay 16 State 17 State income tax 18 Locality 19 Local wages, tips, name wages, tips, etc. etc. GA 14-8XXXXXX $ 32,415.00 $ 1,531.33 $ Form W-2 Wage and Tax Statement Department of the Treasury – Internal Revenue Service Center 20 Local Income tax $ 4 Advanced Workshop Return 7 Schedule K-1 (1041) Department of the Treasury Internal Revenue Service 20XX Tax year beginning _____________, 20XX and ending ____________, 20_____ Beneficiary’s Share of Income, Deductions, Credits, etc. See back of form and instructions Part I Information About the Estate or Trust A Estate’s or Trust’s employer identification number 14-9XXXXXX B Estate’s or Trust’s name Final K-1 Amended K-1 Part III Beneficiary’s Share of Current Year Income, Deductions, Credits, and Other Items 1 Interest Income 11 Final year deductions $5,329.00 B $3,000.00 2a Ordinary dividends $2,345.00 2b Qualified dividends 3 Net short-term capital gain $6,845.00 4a Net long-term capital gain 4b 28% rate gain Richard R. Sanderson 4c Unrecaptured section 1250 gain C Fiduciary’s name, address, city, state, and ZIP code 5 Other portfolio and nonbusiness income $ 425.00 6 Ordinary business income Robert Heckle, Attorney at Law 18 Bridgepoint Plaza Rome, GA 30161 D Check if Form 1041-T was filed and enter the date filed E Check if this is the final Form 1041 for the estate or trust F Tax shelter registration number, if any__________________ G Check if Form 8271 is attached Part II Information About the Beneficiary H Beneficiary’s identifying number: 307-XX-XXXX I Beneficiary’s name, address, city, state and ZIP code: Ann Marie Sanderson 14 Ridge Ferry Way Cedartown, GA 30125 7 Net rental real estate income $ 1,566.00 12 Alternative minimum tax adjustment 13 Credits and credit recapture 14 Other Information A $1,644.00 8 Other rental income 9 Directly apportioned deductions A $ 230.00 10 Estate tax deduction $ 455.00 *See attached statement for additional information For IRS Use Only J Domestic beneficiary X or Foreign beneficiary 5