1285439740_427252

Chapter 17

Digging Deeper

Contents:

| WORK OPPORTUNITY TAX CREDIT | BUSINESS ENERGY TAX CREDITS | LOW-INCOME

HOUSING CREDIT | AMT AND TAX PREFERENCES | AMT ADJUSTMENTS | AMT AND

ADJUSTED CURRENT EARNINGS (ACE) |

WORK OPPORTUNITY TAX CREDIT

1. Computation of the Work Opportunity Tax Credit: Qualified Summer Youth Employees.

The credit for qualified summer youth employees is allowed on wages for services during any 90day period between May 1 and September 15. The maximum wages eligible for the credit are

$3,000 per summer youth employee. The credit rate is the same as that under the general provision for the work opportunity tax credit. If the employee continues employment after the 90day period as a member of another targeted group, the amount of the wages eligible for the general work opportunity tax credit as a member of the new target group is reduced by the wages paid to the employee as a qualified summer youth employee.

A qualified summer youth employee must be age 16 or 17 on the hiring date. An additional requirement for qualifying is that the individual’s principal place of abode must be within an economically disadvantaged area (specifically, an empowerment zone, a renewal community, or an enterprise community).

BUSINESS ENERGY TAX CREDITS

2.

Businesses are eligible for additional general business tax credits for producing alternative fuels, building energy-efficient buildings, producing energy-efficient products, and producing energy using alternative means.

Biodiesel/Alternative Fuels — Small Producer Biodiesel, Renewable Diesel, and Ethanol

Credit. Small agri-biodiesel producers are provided a tax credit measured in varying cents per gallon for producing these fuels (with varying maximums per year). The credit is available for sales through 2013 (§§ 40 and 40A).

Credit for Business Installation of Qualified Fuel Cells, Stationary Microturbine Power

Plants, Solar, and Small Wind Energy Equipment.

A tax credit —based on the purchase price —is provided for installing qualified fuel cell power plants (a 30% credit), qualifying stationary microturbine power plants (a 10% credit), qualifying solar energy equipment (a

30% credit), and small wind energy equipment (a 30% credit). The credit applies to property placed in service before January 1, 2017 (§ 48).

Credit for Building Energy-Efficient New Homes.

A $2,000 tax credit is provided to eligible contractors for each qualified new energy-efficient home constructed through 2013. The credit applies to manufactured homes meeting ENERGY STAR

®

criteria and other homes

(§ 45L).

Manufacturing Energy-Efficient Appliances.

A tax credit is provided to the manufacturer of energy-efficient dishwashers, clothes washers, and refrigerators. Credits vary depending on the efficiency of the unit and relate, generally, to production through 2013 (§ 45M).

Energy Credit for Producing Electricity via Wind, Solar, Geothermal, and Other Property.

A tax credit is provided for producing energy via qualified wind, solar, geothermal, and other property. The tax credit —based on the number of kilowatt-hours of electricity produced —applies to production through the end of 2013 (§ 45).

LOW-INCOME HOUSING CREDIT

3.

To encourage building owners and real estate developers to make affordable housing available for low-income individuals, Congress has made a general business credit available to owners of qualified low-income housing projects.

1

More than any other, the low-income housing credit is influenced by nontax factors. For example, certification of the property by the appropriate state or local agency authorized to provide lowincome housing credits is required. These credits are issued based on a nationwide allocation, dictated chiefly by nontax budgetary and housing policy concerns.

The amount of the credit is based on the qualified basis of the property. The qualified basis depends on the number of units rented to low-income tenants. Tenants are low-income tenants if their income does not exceed a specified percentage of the area median gross income. The amount of the credit is determined by multiplying the qualified basis by the credit rate. The credit is allowed over a 10-year period if the property continues to meet the required conditions.

Generally, first-year credits are prorated based on the date the project is placed in service.

Example: A partnership spends $1,000,000 to build a qualified low-income housing project. The complex is completed January 1 of the current year. The entire project is rented to low-income families. Assume the credit rate for property placed in service during January of the current year is 7.36%.

2 The partners are allocated a credit of $73,600 ($1,000,000 year and in each of the following nine years.

7.36%) in the current

Recapture of a portion of the credit may be required if the number of units set aside for lowincome tenants falls below a minimum threshold, if the taxpayer disposes of the property or the interest in it, or if the taxpayer’s at-risk amount decreases. See Chapters 6 and 14 to review the at-risk rules.

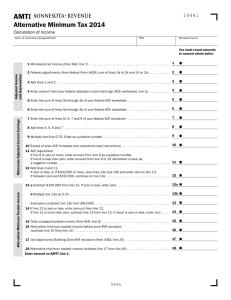

AMT AND TAX PREFERENCES

4. Intangible Drilling Costs.

In computing the regular income tax, taxpayers are allowed to deduct certain intangible drilling and development costs in the year incurred, although such costs are normally capital in nature. The deduction is allowed for costs incurred in connection with oil and gas wells and geothermal wells.

For AMT purposes, excess intangible drilling costs (IDC) for the year are treated as a preference.

3 The preference for excess IDC is computed as follows.

IDC expensed in the year incurred

Minus: Deduction if IDC were capitalized and amortized over 10 years

Equals: Excess of IDC expense over amortization

Minus: 65% of net oil and gas and geothermal income

Equals: Tax preference item

Example: Nuthatch, Inc., incurred IDC of $50,000 during the year and elected to expense that amount. Net oil and gas income for the year was $60,000. Nuthatch’s tax preference for IDC is

$6,000 [($50,000 IDC

$5,000 10-year amortization)

(65%

$60,000 income)].

A taxpayer can avoid the preference for IDC by electing to amortize the expenditures over a 10year period for regular income tax purposes.

AMT ADJUSTMENTS

5. Mining Exploration and Development Expenditures.

A regular income tax deduction is allowed for expenditures paid or incurred during the taxable year for exploration (ascertaining the existence, location, extent, or quality of a deposit or mineral) and for development of a mine or other natural deposit, other than an oil or gas well.

4 Mining development expenditures are expenses paid or incurred after the existence of ores and minerals in commercially marketable quantities has been determined.

For AMT purposes, however, mining exploration and development costs are capitalized and amortized ratably over a 10-year period.

5 The AMT adjustment for mining exploration and development costs is equal to the amount expensed minus the allowable expense if the costs had been capitalized and amortized ratably over a 10-year period. This provision does not apply to costs relating to an oil or gas well.

Example: Eagle Mining Company incurs $150,000 of mining exploration expenditures and deducts this amount for regular income tax purposes. For AMT purposes, these mining exploration expenditures must be amortized over a 10-year period. Eagle must make a positive adjustment for AMTI of $135,000 ($150,000 allowed for regular income tax

$15,000 for AMT) for the first year. In each of the next nine years for AMT purposes, Eagle is required to make a negative adjustment of $15,000 ($0 allowed for regular income tax

$15,000 for AMT).

To avoid the AMT adjustments for mining exploration and development costs, a taxpayer may elect to amortize the expenditures over a 10-year period for regular income tax purposes.

6

AMT AND ADJUSTED CURRENT EARNINGS (ACE)

6.

The adjustments to convert pre-NOL AMTI to ACE include the following items.

Exclusion items . These are income items (net of related expenses) that are included in

E & P, but never will be included in regular taxable income or AMTI (except on liquidation or disposal of a business). In essence, items that are permanently excluded from unadjusted AMTI but are included in E & P are included in ACE (e.g., life insurance proceeds, interest on tax-exempt bonds, and tax-benefit-rule exclusions).

Depreciation . For property placed in service before 1994, depreciation is calculated using the straight-line method over ADS useful lives. For property placed in service after 1993, there is no ACE depreciation adjustment.

Disallowed items . A deduction is not allowed in computing ACE if it is never deductible in computing E & P. A deduction is not allowed for the dividends received deduction of 70 percent (less than 20 percent ownership). A deduction is allowed for the dividends received deduction of 80 percent (20 percent but less than 80 percent ownership) and

100 percent (80 percent or more ownership).

7

Other adjustments . Additional adjustments which are required for regular E & P purposes are applied to arrive at ACE. These rules eliminate the tax benefits of using intangible

drilling costs, circulation expenditures, organization expense amortization, and installment sales.

8

Both AMTI and ACE . Items must be deductible for both AMTI and E & P purposes to be deductible for ACE. Thus, certain deductible items do not reduce ACE: excess charitable contributions, excess capital losses, disallowed travel and entertainment expenses, penalties, fines, bribes, and golden parachute payments.

Lessee improvements . The value of improvements made by a lessee to a lessor’s property that is excluded from the lessor’s income is excluded from both unadjusted

AMTI and ACE.

LIFO recapture adjustments . An increase or decrease in the LIFO recapture amount results in a corresponding increase or decrease in ACE.

Notes:

1 § 42.

2 The rate is subject to a monthly adjustment.

3 § 57(a)(2).

4 §§ 617(a) and 616(a).

5 § 56(a)(2).

6 §§ 59(e)(2)(D) and (E).

7 §§ 56(g)(4)(C)(i) and (ii).

8 Reg. § 1.65(g)–1(f).

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.