ACCTG833_f2007_CHPT05D1

advertisement

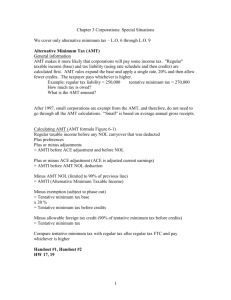

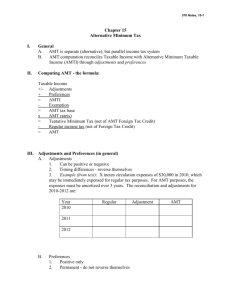

Chapter 5 Other Corporate Tax Levies Alternative Minimum Tax Overview What is the AMT? Slide 6-3 Alternative income tax system running parallel to the regular income tax system Generally has a broader base, lower tax rates Objective of the AMT: To ensure taxpayers with substantial economic incomes pay some minimum amount of income tax (despite the lawful use of tax incentives) Small Corporations Slide 6-4 Small corporation exemption [IRC §55(e)] - Average annual gross receipts for prior 3 years less than $7.5 million - Controlled groups are aggregated - Special rules for initial years AMT Overview Slide 6-5 Regular taxable income + NOL carryforward deducted (if any) + Tax preferences (if any) +/- AMT adjustments other than ACE (if any) AMTI before ACE adjustment +/- ACE adjustment (if any) AMTI before AMT NOL deduction - AMT NOL deduction (if any) = Alternative Minimum Taxable Income (AMTI) AMT Overview Slide 6-6 Alternative Minimum Taxable Income (AMTI) - AMT exemption = Taxable excess X 20% Tentative Minimum Tax Slide 6-7 AMT Overview [IRC §55(a)] If Tentative Minimum Tax > Regular tax before credits (except FTC), then AMT payable equals the excess Regular tax is before credits except foreign tax credits [IRC §55(c) and §26(b)] AMT Credit Slide 6-8 [IRC §53] When Tentative Minimum Tax < regular tax, an AMT credit is allowed as a reduction of regular taxes payable The AMT credit is limited to the lesser of: Regular tax less the tentative minimum tax or The sum of AMT paid in all prior years less the sum of AMT credits claimed in prior years Examples 1, 2, and 3 Alternative Minimum Tax Tax Preferences and AMT Adjustments (other than the ACE adjustment) AMT Tax Preferences Slide 6-10 Tax preferences are always positive Interest income from private activity bonds issued after August 8, 1986 [IRC §57(a)(5)] Excess percentage depletion from oil and gas wells [IRC §57(a)(1)] Excess intangible drilling costs from oil, gas, etc. properties [IRC §57(a)(2)] Slide 6-11 AMT Adjustments Depreciation: Real property placed in service after 1986 and before 1999 [IRC §56(a)(1)] Tangible personal property placed in service after 1986 and before 2005 [IRC §56(a)(1)] AMT basis in excess of regular tax basis for property dispositions [IRC §56(a)(6)] Slide 6-12 AMT Adjustments Long-term contracts must use percentage of completion for AMT [IRC §56(a)(3)] Loss limitations must be recalculated U.S. production activities deduction must be recalculated [IRC §199(d)(6)] Alternative Minimum Tax The ACE Adjustment Slide 6-14 Adjusted Current Earnings Adjusted current earnings [IRC §56(g)] AMTI before ACE adjustment +/- Adjustments for computing ACE = Adjusted current earnings (ACE) Slide 6-15 Adjusted Current Earnings Adjustments for ACE [IRC §56(g)(4)]: (+) Tax-exempt interest income (excluding PAB interest income that is a tax preference) (-) Disallowed expenses and interest allocable to tax-exempt income (+) Proceeds from key-man life insurance (-) Premiums paid on key-man life insurance (+) 70% DRD actually deducted (+/-) LIFO inventory method not allowed Slide 6-16 Adjusted Current Earnings Adjustments for ACE [IRC §56(g)(4)]: (+/-) Depreciation on assets placed in service 1/1/90 through 12/31/93 (-) Ace basis in excess of AMT basis for property dispositions of assets above (+) Amortization of organizational costs incurred after 1989 (+/-) Installment method not allowed Slide 6-17 ACE Adjustment [IRC §56(g)(1)] If the Adjusted Current Earnings (ACE) exceed the pre-ACE adjustment AMTI, then the positive ACE adjustment equals: 75% * (ACE less pre-ACE adj. AMTI) Slide 6-18 ACE Adjustment – Example 1 Assume: AMTI before the ACE adjustment = $100,000 Adjusted current earnings (ACE) = $130,000 No AMT NOL carryforward Then the ACE adjustment = 75% x (130,000 – 100,000) = $22,500 So, AMTI = 100,000 + 22,500 = $122,500 Slide 6-19 ACE Adjustment [IRC §56(g)(2)] If the Adjusted Current Earnings (ACE) are less than the pre-ACE adjustment AMTI, then the negative ACE adjustment equals the lesser of: 75% * (Pre-ACE adj. AMTI less ACE) or The sum of positive ACE adjustments in all prior years over the sum of negative ACE adjustments in all prior years Slide 6-20 ACE Adjustment – Example 2 Assume: AMTI before the ACE adjustment = $100,000 Adjusted current earnings (ACE) = $80,000 Sum of all prior year ACE adj.s = $25,000 No AMT NOL carryforward Then the ACE adjustment = 75% x (80,000 – 100,000) = ($15,000) So, AMTI = 100,000 + (15,000) = $85,000 Slide 6-21 ACE Adjustment – Example 3 Assume: AMTI before the ACE adjustment = $100,000 Adjusted current earnings (ACE) = $80,000 Sum of all prior year ACE adj.s = $12,000 No AMT NOL carryforward Then the ACE adjustment = 75% x (80,000 – 100,000) = ($15,000) Limited to ($12,000) So, AMTI = 100,000 + (12,000) = $88,000 Alternative Minimum Tax AMT NOL Deduction and AMT Exemption AMT NOL Deduction [IRC §56(a)(4) and (d)(2)] NOL carryover is determined after all AMT adjustments in the year originated [IRC §56(d)(1)] Limited to 90% of AMTI before the NOL deduction Slide 6-23 AMT Exemption Exemption [IRC §55(d)] Exemption amount is $40,000 Phase-out of exemption amount: 25% * (AMTI - 150,000) Exemption cannot go below zero! (Fully phased-out at AMTI of $310,000 or more) Slide 6-24 AMT Exemption – Examples Slide 6-25 What is the exemption for a corporation with AMTI of $101,500? $40,000, AMTI < $150,000 (no phase-out) AMT Exemption – Examples Slide 6-26 What is the exemption for a corporation with AMTI of $193,000? 40,000–25%(193,000–150,000)= $29,250 AMT Exemption – Examples Slide 6-27 What is the exemption for a corporation with AMTI of $350,000? $0, AMTI > $310,000 (fully phased-out) Slide 6-28 AMT Examples Examples 4, 5, and 6 Problems: C5-36, C5-40, C5-48