Course Outline - Trinity Western University

advertisement

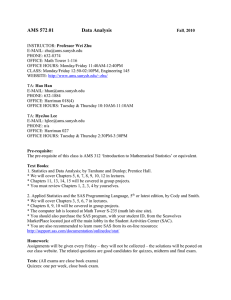

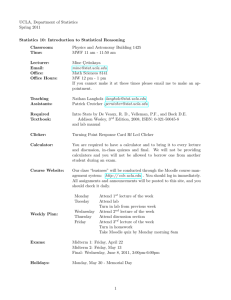

SCHOOL OF BUSINESS Business 221A - Principles of Accounting I Summer 2008 Professor: Brent Groen, MBA, CGA Office: Northwest Building second floor Office Hours: Before and After Class Phone: (604) 888-7511 Local 3305 Email: brentg@twu.ca Credit Hours: 3 Prerequisites: None Website: http://bgroen.pageout.net Class Days: Week One: April 28, 29, May 1, 2; Week Two: May 5, 6, 8, 9; Week Three: May 12, 13, 14, 16. Description: Accounting fundamentals, techniques, principles and concepts are covered in this course. Other topics include the complete accounting cycle, including adjusting and closing entries; the preparation and interpretation of simple financial statements; inventory treatments; capital assets; partnership accounting. Students are also required to complete a computer based accounting lab. Required Materials: Larson, Kermit D., Jensen, Tilly. Fundamental Accounting Principles. Twelfth Canadian Edition, McGraw-Hill Ryerson Limited, Toronto, 2007 Volume 1. Larson, Kermit D., Jensen, Tilly. Fundamental Accounting Principles. Twelfth Canadian Edition, McGraw-Hill Ryerson Limited, Toronto, 2007 Volume 2. Learning Objectives: The Student should acquire the ability to: Describe the principles and assumptions upon which accounting practices are based Follow the flow of information through a conventional accounting system Prepare in good form both the Balance Sheet and Income Statement Understand the relationship between the Income Statement and the Balance Sheet Utilize the various accounting methods relating to Current Assets, Long-Term Assets, Intangibles and Liabilities Understand and use a basic computerized accounting software package Methodology: The class sessions will consist of lecture, problem solving, and review of assigned work. Students will be called on to participate during class, in groups and individually. Evaluation: The grading system as outlined below will be used (modified from catalogue). A+ 95-100 A 88-94 A- 82-87 B+ 77-81 B 73-76 C+ 67-69 C 63-66 C- 60-62 D+ 57-59 D 53-56 The course grade will be calculated based on the following components: Chapter Assignments Lab Assignments Quizzes Midterm Final Exam 10% 10% 10% 30% 40% B- 70-72 D- 50-52 F below 50 Course Requirements: Chapter Assignments A problem or problems will be assigned for each chapter and graded out of 20. Marks can be lost for work that is not properly presented, even if a correct solution is given. Assignments will be due at the beginning of the next class following the completion of the chapter, unless otherwise announced. An assignment handed in late is worth only half marks. The lowest problem grade will be dropped from the calculation of the total marks, to account for illness or absence. Students are encouraged to work together, for learning and study purposes, but what is handed in must be original and prepared by each student individually. Lab Assignments Students will complete computer-based labs individually. The labs deal with the application of Simply accounting software and the instructions will be available on the course web site. Lab 1 due May 5, Lab 2 due May 8, Lab 3 due May 14. Quizzes Multiple-choice quizzes will be given at the beginning of each class that will cover all materials discussed on the previous day. These quizzes cannot be made up, but as above the low grade will be dropped. Exams Exams consist of multiple choice, definition, short answer and problem type questions. At least half of each exam will be made up of problems. The Midterm Exam will cover Chapters 1 - 7 and will be given on Thursday May 8. The Final exam will cover Chapters 1-14 and will be given on Friday May 16. Course Outline The topics will be covered according to the following approximate schedule. Students should read each chapter prior to classes, and do practice exercises after class: Chapter Title Chapter 1: Accounting: The Key to Success Chapter 2: Financial Statements and Accounting Transactions Chapter 3: Analyzing and Recording Transactions Chapter 4: Adjusting Accounts for Financial Statements Chapter 5: Completing the Accounting Cycle and Classifying Accounts Chapter 6: Accounting for Merchandising Activities Chapter 7: Merchandise Inventories and Cost of Sales Chapter 8: Accounting Information Systems Chapter 9: Internal Control and Cash Midterm: Chapters 1-7 Chapter 10: Receivables Chapter 12: Capital Assets and Goodwill Chapter 13: Current and Long-Term Liabilities Chapter 14: Partnerships Day Monday, April 28 Monday, April 28 Tuesday, April 29 Thursday, May 1 Friday, May 2 Friday, May 2 Monday, May 5 Tuesday, May 6 Tuesday, May 6 Thursday, May 8 Friday, May 9 Monday, May 12 Tuesday, May 13 Wednesday, May 14 Final Exam Chapters 1-14 Friday, May 16