Overview of the Financial System

advertisement

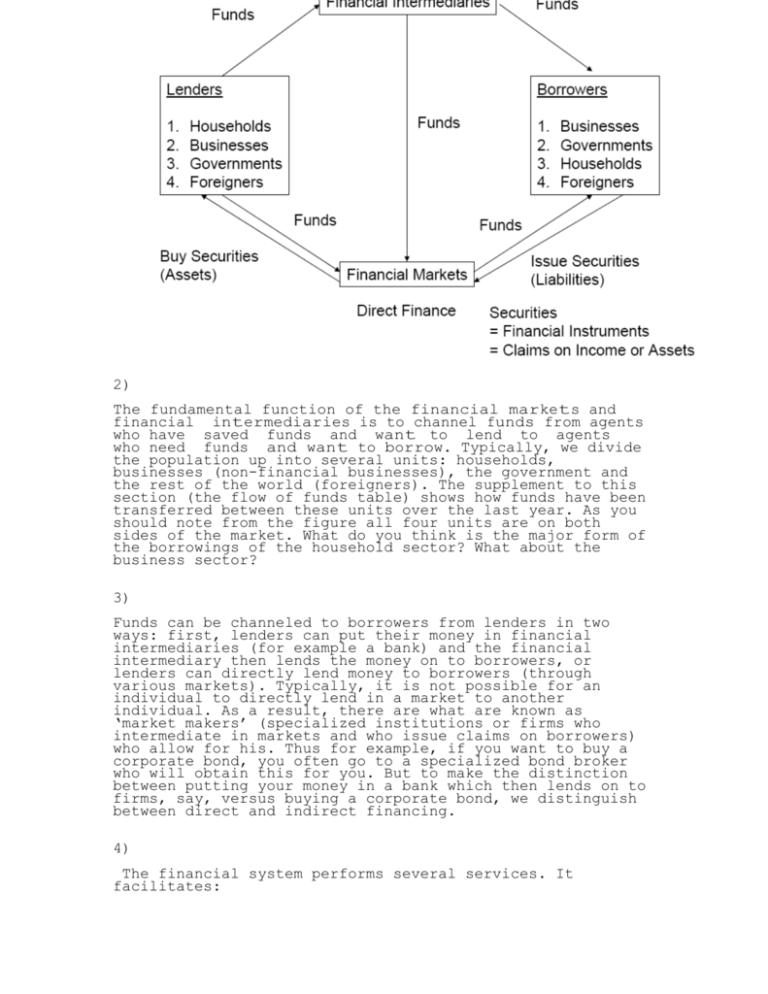

OVERVIEW OF THE FINANCIAL SYSTEM 1) The modern financial system as it has developed is huge and complex. In this note, we perform a very basic ‘naming of parts’ exercise. That is, we will seek to get a broad picture of the major components which constitute the financial system and their roles, defining some of the actors and their purpose. Repeatedly throughout this course, we’ll be coming across references to the numerous types of financial markets, financial instruments, and financial institutions outlined here. As we go along, we can refer back to this overview to recall how a particular type of financial instrument works or what a particular type of financial intermediary does. It is useful to therefore begin with an overall picture. The one at the end of this overview is taken from Mishkin, page 24. 2) The fundamental function of the financial markets and financial intermediaries is to channel funds from agents who have saved funds and want to lend to agents who need funds and want to borrow. Typically, we divide the population up into several units: households, businesses (non-financial businesses), the government and the rest of the world (foreigners). The supplement to this section (the flow of funds table) shows how funds have been transferred between these units over the last year. As you should note from the figure all four units are on both sides of the market. What do you think is the major form of the borrowings of the household sector? What about the business sector? 3) Funds can be channeled to borrowers from lenders in two ways: first, lenders can put their money in financial intermediaries (for example a bank) and the financial intermediary then lends the money on to borrowers, or lenders can directly lend money to borrowers (through various markets). Typically, it is not possible for an individual to directly lend in a market to another individual. As a result, there are what are known as ‘market makers’ (specialized institutions or firms who intermediate in markets and who issue claims on borrowers) who allow for his. Thus for example, if you want to buy a corporate bond, you often go to a specialized bond broker who will obtain this for you. But to make the distinction between putting your money in a bank which then lends on to firms, say, versus buying a corporate bond, we distinguish between direct and indirect financing. 4) The financial system performs several services. It facilitates: Risk sharing by allowing savers to hold many assets(through diversification). Providing liquidity, which is the ease with which an asset can be exchanged for money. Providing information about borrowers and returns on financial assets Delegating monitoring activity Pooling Funds for Investment 5) There are two broad types of markets that we are interested in: Debt and Equity Markets A debt instrument is a contractual agreement by the issuer of the instrument (the borrower) to pay the holder of the instrument (the lender) fixed dollar amounts (interest and principal payments) at regular intervals until a specified date (maturity date) when a final payment is made. Examples include Government and corporate bonds. Debt usually has a maturity associated with it (Short-term = maturity of less than one year. Long-term = maturity of more than ten years. Intermediate-term = maturity between one and ten years) Equity refers to a contractual agreement representing claims to a share in the income and assets of a business. Examples would include corporate stock. These have no maturity date and are hence are considered long-term securities. Since equity holders own the firm, they are entitled to elect members of the firm’s board of directors and vote on major issues concerning how the firm is managed. A key feature distinguishing equity from debt is that the equity holders are the residual claimants: the firm must make payments to its debt holders before making payments to its equity holders. We can refer to this feature in identifying the major advantages and disadvantages of holding debt versus equity: Advantage to holders of debt instruments: Receive fixed payments, regardless of whether the borrower’s income and assets become more or less valuable over time. Disadvantage to holders of debt instruments: Do not benefit from an increase in the value of the borrower’s income or assets. Advantage to holders of equities: Receive larger payments when the business becomes more profitable or the value of its assets rises. Disadvantage to holders of equities: Receive smaller payments when the business becomes less profitable or the value of its assets falls. 7) Primary and Secondary Markets It is important to distinguish between two sorts of markets within financial markets: Primary markets and secondary markets. Primary markets are those in which newly issued claims are sold to initial buyers. Secondary markets are those in which previously issued claims are resold. A primary market refers to markets in which newly-issued securities are sold to initial buyers by the corporation or government borrowing the funds. For example: US Treasury issues a new US Government bond, and sells it to Morgan Stanley. In order to do this, Investment banks play an important role in many primary market transactions by underwriting securities: they guarantee a price for a corporation’s securities and then sell those securities to the public. A secondary market refers to a market in which previouslyissued securities are traded. For example Morgan Stanley sells the existing US government bond to Citigroup or to an individual. Brokers and dealers play an important role in secondary markets: Brokers = facilitate secondary-market transactions by matching buyers with sellers. Dealers = facilitate secondary-market transactions by standing ready to buy and sell securities. Now it is critical to note that the original issuer or borrower receives funds only when its securities are first sold in the primary market; the issuer does not receive funds when its securities are traded in the secondary market. Why have the secondary market then? Well, secondary markets perform three essential functions: They allow the original buyers of securities to sell them before the maturity date, if necessary. That is, they make the securities more liquid. So if you wanted to exchange your bond for cash, you could do so. This makes it easier for the bond issuer to sell the bond in the first place. Second, they allow participants in the primary markets to make judgments about the value of newly-issued securities by looking at the prices of similar, existing securities that are traded in the secondary markets. Third, they provide information on the expected future profitability of a company. 7) Another distinction to make is between Money and Capital Markets. Money markets are markets in which only short-term debt instruments are traded (< 1 year). In the capital market intermediate-term debt, long-term debt, and equities are traded. We will learn more about the money market in section (IV). You are, however more familiar already with the instruments in the capital market. These include Corporate Stocks (Equity in companies) Residential, Commercial, and Farm Mortgages (Debt Instruments of the household sector or businesses) Corporate Bonds (debt instruments of businesses) US Government Securities (Intermediate and Long-Term) (Debt Instruments of the USG) State and Local Government (Municipal) Bonds (Debt Instruments of the State and Local Governments) Bank Commercial and Consumer Loans (Shorter term instruments for businesses and households).