4th,5th&6thsession

advertisement

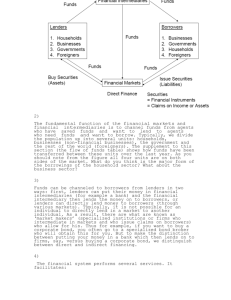

4th, 5TH and 6th SESSION 1 Financial Markets 2 Few Key Terms • • • • Assets Types of Assets: Tangible and Intangible Lender/Saver/Investor Borrower/Seller of financial assets 3 Markets • Definition • Function of Markets: ‘move money’ • People are not satisfied with their existing cash flow stream, financial markets serve to reengineer their existing cash flow streams 4 Financial Markets and their Functions • Financial Markets – Markets (bond and stock market for instance) where financial securities are bought and sold. • Two main functions 1. Moving funds from people having surplus funds to those in need of funds. 2. Financial markets promote greater economic efficiency. 5 Structure of Financial Markets – Several ways for classifying the financial markets – Key terms to describe financial markets: • • • • Public offering vs. Private placement Primary vs. Secondary market Debt vs. Equity market Money vs. Capital market 6 A. Classification of financial market on the basis Public or private placement of securities 7 1. Public Placement of Securities • In a public offering equity shares or other financial instruments are offered for sale to the public. • Investment banking firm – Underwriting – Underwriter 8 1. Private Placement of Securities • Also called ‘Direct Placement’ • Securities are offered and sold directly to a limited number of investors 9 B. Classification of financial market on the basis of the security issue – Primary market (new issues of security) – Secondary market (previously issued) 10 1. Primary Market • New issues of a security as opposed to previously issued securities are traded. • If Google issues a new batch of securities it would be called a primary market transaction. • Works like a new car market. • IPO – The first time a company issues stock to the public. • SEO – Sale of additional shares by a company whose shares are already publicly traded. 11 2. Secondary Market • Previously issued securities are bought and sold. • Used car market. • New York Stock Exchange (NYSE), Karachi Stock Exchange (KSE) and NASDAQ etc. • Important to remember: – When an individual buys securities in the secondary market, the person selling the security gets the money and the issuing corporation gets no new funds. 12 Secondary Market Broker Market Dealer Market Stock Exchange OTC • Broker Market – Broker • Broker matches ‘buy order’ of person A with ‘sell order’ of person B and charges a commission for that. • Broker acts as an ‘agent’ of the buyer and seller of the security. – Stock Exchanges • Dealer Market – Dealer • Dealer trades for himself acting as a principal not an agent. • 2 separate trades are made. • Dealer buys securities from person A (at ‘bid price’ - low) and sells to person B (at ‘ask price’ - high). • Bid Ask Spread – Difference between ask price and bid price (dealer’s profit). • Example: Dealer will offer $599 bid price for 100 shares of Google’s stock and will sell them at an ask price of $600 keeping the $1. – OTC C. Classification of financial market on basis of the nature of claim – Debt market – Equity market Claim is to ‘demand anything as a right’. If I hold a debt instrument it means I hold the right to demand periodic interest payments and principal upon maturity, similarly if I hold a stock I can demand dividend as my right. 16 1. Debt Market • Most common method used to raise funds. • The debt market is the market where debt instruments (govt. bonds, corporate bonds) are traded. • Debt instruments are assets that require a fixed payment to the holder, usually in the form of interest payments and a final payment at maturity. • Examples of debt instruments include government bonds and corporate bonds. 17 • The maturity of a debt instrument is the number of years (term) until that instrument’s expiration date. – A debt instrument is short-term if its maturity is less than a year (T-bills). – Debt instruments are called long-term if their maturity is ten years or longer (T-bonds). – Debt instruments with a maturity between one and ten years are said to be intermediate-term (TNotes). 18 2. Equity Market • The equity market (often referred to as the stock market) is the market for trading equity instruments. • The second method of raising funds is by issuing equities, such as common stock. • A common stock is a document which serves as legal evidence of ownership in a company. 19 Characteristics of Equity Securities • Variable return (dividend, decided by company’s board of directors) • Unlimited life of the security • Voting rights 20 Advantages versus disadvantage of owning a corporation’s equities rather than its debt ADVANTAGES DEBT DISADVANTAGES 1. A corporation has to pay 1. Debt holders interest all its debt holders payments are fixed, they do before it pays its equity not benefit directly from holders. any increases in the - Less risky (paid first) corporation’s profitability. EQUITI 1. Equity holders benefit ES directly from any increase in the corporation’s profitability as they are owners of the 1. An equity holder is a residual claimant. - More risky. 21 D. Classification of financial market on the basis of maturities of securities traded – Money market – Capital market 22 1. Money Market • Short term (maturity of less than one year) • Debt instruments • Money market isn’t a physical place rather a telephone and computer based market. • Characteristics – Highly liquid. – Active secondary market. – Wholesale market (usually in excess of $1 million). 2. Capital Market • Long term (maturity of greater than one year) • Debt and Equity instruments Money Market Instruments 1. T-bills: – Short term debt instruments – Issued by government at a ‘discount’ – Discount from principal represents interest to investors • – – – – For example, a 52-week T-Bill with a $1,000 face value might be sold initially for $990. When it matures, the investor will receive the full $1,000. The extra $10 the investor receives is their investment return for purchasing the T-Bill. Default free Maturity (3, 6 or 12 months) Liquid Instrument Balance Sheet (Cash and Cash Equivalent) 2. Certificate of Deposit • Issued by a bank to certify that the depositor has deposited a certain sum of money at the bank. • Characteristics – – – – – – – – Typical Issuer: Commercial bank Typical Investor: Institutional Investors Large denominations ($100,000, $1M, $10 M) Interest payment Maturity (up to 1 year) Term security Bearer Instrument (holder of instrument is owner and entitled to coupon and principal payment) Negotiable (can be bought and sold in secondary market) 3. Commercial Paper • Issued by well-known corporations for short term financing obligations. • Characteristics – – – – – – Typical issuer: Large well-known corporations Typical Investor: Institutional investors Discount Investment Maturity: Less than 270 days Unsecured loan Riskiness (investor can gauge possible riskiness by looking at the credit rating of the issuing corporation) 4. Fed Funds – Reserve requirement – Loans that bank make to each other in order to meet the reserve requirement set by the Central Bank. – Fed. Fund Rate: Rate at which the loans are lent. 5. Banker’s Acceptance • Short term debt instrument guaranteed for payment by a commercial bank. • Bank ‘accepts’ the responsibility to pay. • Characteristic – Typically arises in International trade where the two companies do not know about each other (located at different geographical areas). 6. Eurodollar • Euro means a ‘foreign country’. • Refers to US dollar deposit in a foreign country. 7. Repo (Repurchase Agreement) • Sale of government securities with an immediate agreement to buy them back on a future date at a specified price. • Characteristics – Secured loan – Time (Overnight – some are long term) Capital Market Instruments 1. T-Bonds and T-Notes – Long term debt security – Issued by government • PIB: Pakistan Investment Bond – Maturity: T-Notes (2-10 years) T-Notes (10-30 years) – – – – Fixed Interest payment Principal payment upon maturity Government is the borrower Risk (Riskier than T-bills) 2. Corporate Bonds – – – – – Long term debt security Issued by well-reputed corporations Maturity (2-30 years) Fixed interest payment Risk (credibility) • • AAA rated bond: risk (low) return (low) B rated bond: risk (high) return (high) 3. Mortgages – Loan made to purchase real estate with the real estate serving as collateral for the loan. 4. Common Stock – Share of ownership – Dividends • Variable 5. Preferred Stock – Hybrid security (characteristics of both bond and stock instruments) – Characteristics similar to bond: • • Fixed dividend payment Paid before common stockholders – Characteristics similar to stock: • • Generally listed on a stock exchange No fixed maturity date