FEDERAL understanding rev 1

advertisement

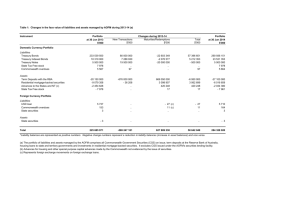

FEDERAL Fed-e-ral = Feed - out of - that which is Real. “in other words - We have to feed them if they are to survive” We STOP feeding them, they now get pissed off because they think we owe it them to keep feeding them and they want to continue to survive; so they will destroy that which originally feed them and then go after any other food source, destroying its originator; until they finally die or are destroyed, because they do not know how to produce their own life substance. Case in point - Try it out on Raccoons and see what happens. Or better yet just watch a documentary film on Vampires. The Constitution of the United States: Article III § 3. Treason against the United States, shall consist only in levying war against them, or in adhering to their enemies, giving them aid and comfort. No person shall be convicted of treason unless on the testimony of two witnesses to the same overt act, or on confession in open court. The Congress shall have power to declare the punishment of treason, but no attainder of treason shall work corruption of blood, or forfeiture, except during the life of the person attainted. I really wonder just how many of the Courts in this country really understand just what the above statement is saying. SECURITIES SECUR-IT-I-ES = to protect – an item - if I am – out of funds. A License is a security to protect you if you happen to get caught breaking or violating a statutory law. RED NUMBER – a superior in color as item backed by Gold in value. Now how many Red numbered Securities do you have, you process them through a series 7 government authorized broker that has a SEC medallion stamp in the private and you will be parting the Red Sea of debt owed to you as a secured creditor. You either REASSIGN the certificate in question back to the Issuer (ie; the Government or voluntary assignment to the Court) to settle a debt or charge. OR you cash it out and then settle any debt or charge owed, as they are government securities/Insurance policies that you can cash in when needed. Just a few items to get you started: Assignment: You are going to have to look this one up to get the understanding that you need. Bootstrap: Term used to describe the start-up of a company with very little capital. Committee on Uniform Securities Identification Procedures (CUSIP): Committee that assigns identifying numbers and codes for all securities. These "CUSIP" numbers and symbols are used when recording all buy or sell orders. Commodities Exchange Center (CEC): The location of five New York futures exchanges: Commodity Exchange, Inc. (COMEX); the New York Mercantile Exchange (NYMEX); New York Cotton Exchange, Coffee, Sugar & Cocoa Exchange (CS&CE), and New York Futures Exchange (NYFE). Commodity: A commodity is food, metal, or another fixed physical substance that investors buy or sell, usually via futures contracts. Commodity-backed bond: A bond with interest payments tied to the price of an underlying commodity. Commodity Bundle: One unit of the collection of the complete set of goods produced and sold in the world market. CUSIP number: Unique number given to a security to distinguish it from other stocks and registered bonds. See: Committee on Uniform Securities Identification Procedures. Government obligations: U.S. government-backed debt instruments, which are considered among the safest investments possible, including Treasury bonds, bills, and notes, and savings bonds. Government securities: Negotiable, U.S. Treasury, securities. Governments: U.S. government-issued securities, such as Treasury bills, bonds, and notes, and savings bonds. Governments are considered among the safest investments available as they are backed by the U.S. government. Also used to refer to debt issues of federal agencies, which are not directly backed by the U.S. government. Land contract: A method of real estate financing; a mortgage-holding seller finances a buyer by taking a down payment and subsequent payments in installments, but holds the title until the mortgage is fully repaid. Landlord: A property owner who rents property to a tenant. Trade: An oral (or electronic) transaction involving one party buying a security from another party. Once a trade is consummated, it is considered "done" or final. Settlement occurs 1-5 business days later. Trade acceptance: Written demand that has been accepted by an industrial company to pay a given sum at a future date. Related: Banker's acceptance. Trade away: Trade execution by another broker/dealer.