FI3300 Corporation Finance

advertisement

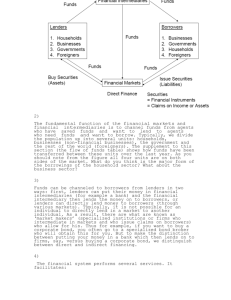

FINC3131 Business Finance Chapter 2,6,8 Financial Markets, Interest, Return and Risk 1 The Capital Allocation Process In a well-functioning economy, capital flows efficiently from those who supply capital to those who demand it. Suppliers of capital – individuals, firms, institutions, and government agency with “excess funds”. These groups are saving money and looking for a rate of return on their investment. Demanders or users of capital – individuals, firms, institutions, and government who need to raise funds to finance their investment opportunities. These groups are willing to pay a rate of return on the capital they borrow. 2 The Capital Allocation Process 3 Overview of Financial Markets Types of Financial Markets a. Money versus Capital Markets b. Primary versus Secondary Markets c. Organized versus Over-the-Counter Markets d. Spot versus Future Markets 4 Financial Markets 1 Financial markets: markets for trading financial securities. Primary market: Markets in which companies raise money by selling securities to investors. Every security sells only once in the primary market. Initial public offering market: firms become publicly owned by issuing (selling) shares to investors for the first time. Secondary market: Markets in which already issued securities trade. Trading is primarily among investors. Issuers are usually not involved. 5 Financial Markets 2 Money market: markets for trading of debt securities with less than one-year maturity. Capital markets: market for trading of intermediate-term and long-term debt and common stock. Spot markets: securities are bought and sold for ‘on-the-spot’ delivery. Futures markets: trading takes place now, but full payment and delivery of the asset takes place in the future, e.g., 6 months or 1-year. 6 Types of Financial Institutions Commercial banks Investment banks Mutual savings banks Credit unions Pension funds Life insurance companies Mutual funds Hedge funds 7 Asset Sizes of Financial Institutions (in Billions of Dollars) 8 Source: Board of Governors, Federal Reserve System, 2007. What is a financial security? It’s a contract between the provider of funds and the user of funds. The contract specifies the: amount of money that has been provided terms & conditions of how the user is going to repay the provider Provider: you (ordinary investor), the bank, venture capitalist, etc. User: entrepreneur or firm with good business idea/product but with no (or insufficient) funds to execute the idea. 9 Simple example You start your firm by borrowing 7.5 million dollars from a bank at 8 percent interest p.a. In return, your contract with the bank stipulates that you will repay the bank in 10 equal yearly installments. Each installment is approximately 1.118 million dollars every year. The loan that the bank has given you is a financial security! 10 TVM and valuing financial securities To an investor who owns a financial security (e.g., the bank in the previous example), the security is a stream of future expected cash flows. A financial security’s value or price is simply the Present Value of all future expected cash flows generated by the security. 11 Securities a. Money Market Securities Treasury Bill (T-bill); Commercial paper; negotiable CD by banks b. Capital Market Securities Bonds and Mortgages, Stocks c. Derivative Securities Futures, Options, Swaps 12 Common financial securities Debt security Equity security 1) Holder is a creditor of the firm. No say in running of the firm. 1) Holder is an owner of the firm. Have a say in running of the firm (by voting). 2) Fixed payment. 2) Payment is not fixed. No guaranteed cash flow from firm. 3) Receives payment before anything is paid to equity holders. 3) Receives what’s left over after all debt holders/creditors are paid. 4) If firm cannot pay, debt holders will take over ownership of firm assets. 4) If firm cannot pay debt holders, loses control of firm to debt holders. 5) Limited liability. 5) Limited liability. 13 Equity securities (common stock) Equity security means common stock. Common stock holders have control privileges, i.e., have a say in firm’s operating decisions. • Exercise control privileges by voting on matters of importance facing the firm. Voting takes place during shareholder meetings. Board of directors: Elected by shareholders to make sure management acts in the best interests of shareholders. Common stock holders can expect two types of cash flows: Dividends Money received from selling shares 14 Physical location stock exchanges vs. Electronic dealer-based markets Auction market vs. Dealer market NYSE vs. Nasdaq 15 What is an IPO? An initial public offering (IPO) is where a company issues stock in the public market for the first time. “Going public” enables a company’s owners to raise capital from a wide variety of outside investors. Once issued, the stock trades in the secondary market. Public companies are subject to additional regulations and reporting requirements. 16 Stock Market Transactions Apple Computer decides to issue additional stock with the assistance of its investment banker. An investor purchases some of the newly issued shares. Is this a primary market transaction or a secondary market transaction? • Since new shares of stock are being issued, this is a primary market transaction. What if instead an investor buys existing shares of Apple stock in the open market – is this a primary or secondary market transaction? • Since no new shares are created, this is a secondary market transaction. 17 Where can you find a stock quote, and what does one look like? Stock quotes can be found in a variety of print sources (Wall Street Journal or the local newspaper) and online sources (Yahoo!Finance, CNNMoney, or MSN MoneyCentral). 18 Characteristics of Debt Securities that Cause Their Yields to Vary Default Risk a. Rating Agencies 1.) Moody’s Investor Service 2.) Standard and Poor’s Corporation b. Accuracy of Credit Ratings 19 Exhibit 3.1 Rating Classification by Ratings Agencies 20 Characteristics of Debt Securities that Cause Their Yields to Vary Term to Maturity • • maturity dates will differ between debt securities The term structure of interest rates defines the relationship between term to maturity and the annualized yield (Yield Curve) 21 Illustrating the relationship between corporate and Treasury yield curves Interest Rate (%) 15 BB-Rated 10 AAA-Rated 5 Treasury 6.0% Yield Curve 5.9% 5.2% Years to 0 Maturity 0 1 5 10 15 20 22 Other factors that influence interest rate levels Federal reserve policy Federal budget surplus or deficit Level of business activity International factors 23 Risk and Return 1 There is a positive relationship between risk and return. To take on more risk, you demand a higher rate of return. 24 Risk and Return 2 Financial securities are risky. When you buy a financial security, there is a chance that you don’t receive the expected cash flows. E.g., if you buy Delta’s bond, there is a chance that Delta may not be able to pay the periodic coupon or face value. How do you figure out the rate of return that you would demand from buying a risky financial security? (Incidentally, this rate of return you demand is called the ‘required rate of return’. ) 25 Risk and Return 3 In general, the required rate of return for a financial security is given by: Required rate of return = risk-free rate + Risk Premium 26 Risk and Return 4 Risk premium: the additional rate of return, above the risk-free rate, which you demand because of the riskiness of the financial security. The risk premium for a debt security is different from the risk premium for an equity security. 27 Same thing, different names In fact, the required rate of return on debt security is also known as: • • • Cost of debt Yield-to-maturity Discount rate 28 Risk & return relationship for equity security 1 To find the risk premium for an equity security, we make use of a theoretical model in finance, called the Capital Asset Pricing Model (CAPM, pronounced as “cap M”). 29 Risk & return relationship for equity security 2 The CAPM says that the risk premium on equity is defined as: b(rm – rf ) tells you how sensitive a stock is to movements in a large, diversified portfolio expected return on the diversified portfolio 30 Risk & return relationship for equity security 3 Required rate of return for an equity security = risk-free rate + b(rm – rf ) Required rate of return on equity is also known as: • • Cost of equity Discount rate 31 Beta Measures a stock’s market risk, and shows a stock’s volatility relative to the market. 32 Comments on beta If beta = 1.0, the security is just as risky as the average stock (the market). If beta > 1.0, the security is riskier than average. If beta < 1.0, the security is less risky than average. Most stocks have betas in the range of 0.5 to 1.5. 33 Calculating betas Well-diversified investors are primarily concerned with how a stock is expected to move relative to the market in the future. Without a crystal ball to predict the future, analysts are forced to rely on historical data. A typical approach to estimate beta is to run a regression of the security’s past returns against the past returns of the market. The slope of the regression line is defined as the beta coefficient for the security. 34 Illustrating the calculation of beta _ ri 20 . 15 . 10 Year 1 2 3 rM 15% -5 12 ri 18% -10 16 5 -5 . 0 -5 -10 5 10 15 20 _ rM Regression line: ^ ^ ri = -2.59 + 1.44 rM 35 Summary Different types of Financial Markets Financial institutions Stock vs. Bonds Risk vs. return Practice assignment questions 2-4; 6-8 Problems: 8-3 8-4 8-5 8-8 8-9 8-10 36