Theory of Interest - Formula Sheet III 1. Bonds Notation: P

advertisement

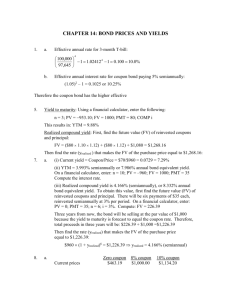

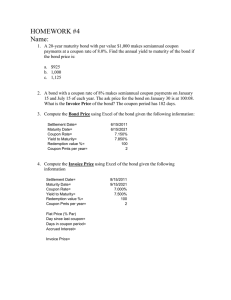

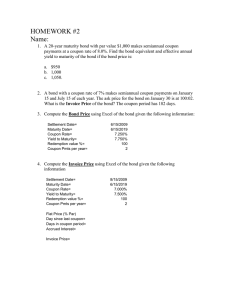

Theory of Interest - Formula Sheet III 1. Bonds Notation: P - price. F - par value or face amount. C - redemption value, that is the amount paid at a redemption date. r - coupon rate (per coupon payment). F r - amount of the coupon. g - modified coupon rate, defined by F r = Cg. i - yield rate (to maturity) of a bond. n - number of coupon payments. K - present value (computed at the yield rate) of the redemption value. G - base amount of a bond, defined by Gi = F r. The formulas: • basic formula: P = F ran| + Cv n . • premium/discount formula: P = C + (F r − Ci)an| . • base formula: P = G + (C − G)v n . • Makeham formula: P = K + gi (C − K). • An approximate yield formula: i∼ g − nk , 1 + n+1 2n k where k = P −C C . A further approximation called the bond salesman’s method is obtained by replacing n+1 2n with 1/2 in the above formula. 2. Approximate Methods Notation: L - amount borrowed. K - finance charge. R - periodic payment = L+K n . n - total number of payments. m - annual payment frequency. i(m) - APR implied by the finance charge. Approximations to i(m) : mK i(m) ∼ Pn−1 , t=0 Bt/m where Bt/m is the unpaid balance at time t/m. The following four methods use different approximations to the denominator in the above formula. • Maximum Yield Method: • Minimum Yield Method: • Constant Ratio Method: Pn−1 n+1 n−1 t=0 Bt/m = 2 L − 2 K. Pn−1 n+1 n−1 t=0 Bt/m = 2 L + 2 K. Pn−1 n+1 t=0 Bt/m = 2 L. • Direct Ratio Method (Rule of 78): Pn−1 t=0 Bt/m = n+1 2 L + n−1 6 K. 3. Depreciation methods Notation: A - asset value at the beginning of n periods. S - salvage value at the end of n periods. Bt - book value at the end of the tth period (B0 = A, Bn = S). Dt - depreciation charge during tth period: Dt = Bt−1 − Bt . Four common depreciation methods: • Sinking Fund Method: Bt = A − • Straight Line Method: Bt = A − A−S sn|j st|j . A−S n t. • Constant Percentage Method (AKA Compound Discount, Declining Balance): Bt = (1 − d)t A, where d = 1 − (S/A)1/n . • Sum of the Digits Method: Bt = A − k(k + 1)/2. A−S Sn (Sn − Sn−t ), where Sk = 1 + · · · + k =