Credit Review Sheet

advertisement

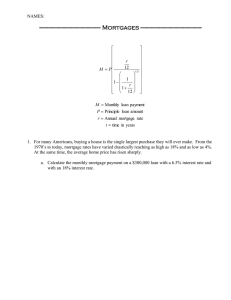

Credit Review Sheet 1. Define credit 2. Who uses credit? 3. Describe each of the following types of sales credit: a. 30 day charge b. Regular charge c. Installment account d. Revolving charge account 4. What is collateral? 5. What is a cosigner? 6. Describe each of the following types of cash credit: a. Installment loan b. Single payment loan c. Credit card loan d. Unsecured loan e. Secured loan 7. What is a loan consolidation? 8. Explain what each of the 3 C’s of credit means: a. Character b. Capacity c. Capital 9. How does a person establish a credit rating? 10. How does a person get a poor credit rating? 11. Define bankruptcy. 12. Explain the difference between Ch. 7 and Ch. 13 bankruptcy. 13. What are the advantages and disadvantages of using credit? 14. How does the Truth in Lending Law help consumers? 15. How does the Equal Opportunity Act help consumers? 16. How does the Fair Credit and Billing Act help consumers? 17. What does APR stand for? Know how to calculate APR. 18. Define finance charge and be able to calculate it. 19. What is principal? 20. Give the definition of a grace period. 21. Define credit limit. 22. No more than _________% of your net income should be spend on installment payments. 23. Salvador and Aurelia are borrowing $150,000 to buy a new house. They must decide whether to borrow the money for 15 years at 8% interest or 30 years at 8 ½ % interest. If they choose the 15-year mortgage, their month payments would be $9.56 per $1,000 borrowed, or $1,434. If they choose the 30-year mortgage, their monthly payment would be $7.69 per $1,000 borrowed, or $1,153. a. How much more money would they have to spend each month if they choose the 30-year mortgage? b. How much more would they be paying for the house if they take out a 15-year mortgage? A 30-year mortgage? What is the total difference? (turn over)