Review for Exam 2

advertisement

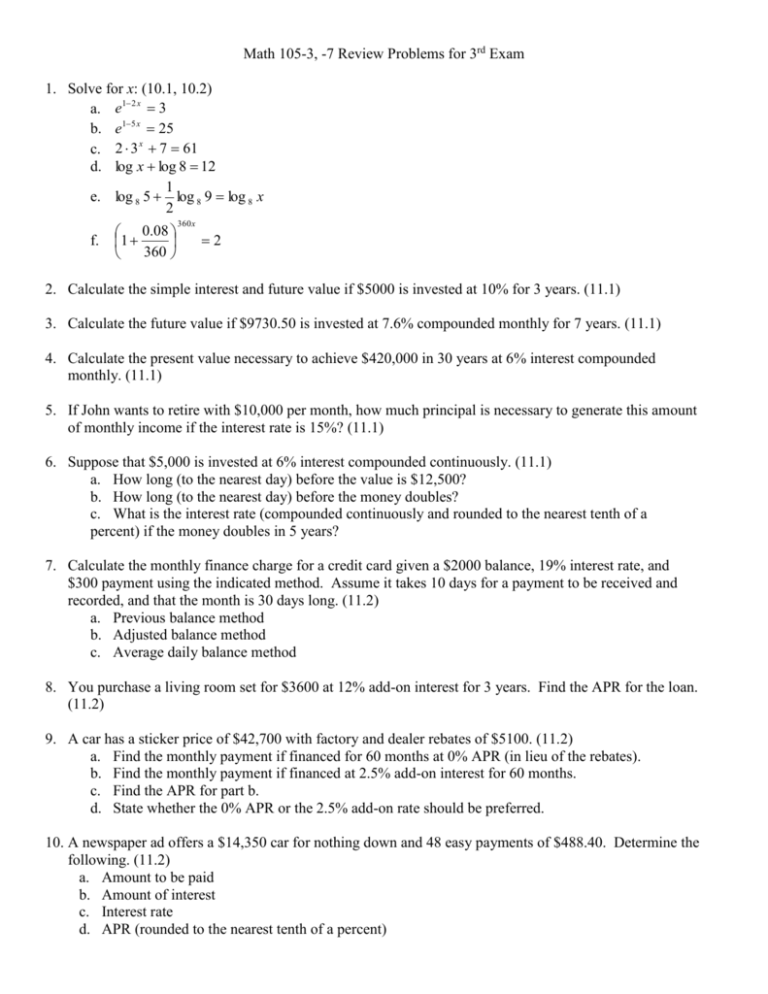

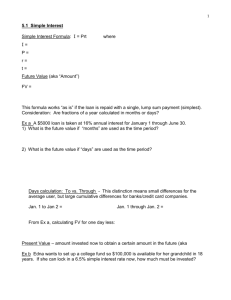

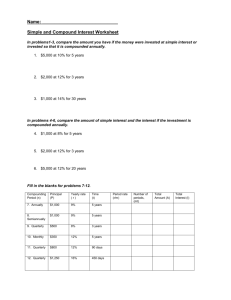

Math 105-3, -7 Review Problems for 3rd Exam 1. Solve for x: (10.1, 10.2) a. e1 2 x 3 b. e15 x 25 c. 2 3 x 7 61 d. log x log 8 12 1 e. log 8 5 log 8 9 log 8 x 2 f. 0.08 1 360 360 x 2 2. Calculate the simple interest and future value if $5000 is invested at 10% for 3 years. (11.1) 3. Calculate the future value if $9730.50 is invested at 7.6% compounded monthly for 7 years. (11.1) 4. Calculate the present value necessary to achieve $420,000 in 30 years at 6% interest compounded monthly. (11.1) 5. If John wants to retire with $10,000 per month, how much principal is necessary to generate this amount of monthly income if the interest rate is 15%? (11.1) 6. Suppose that $5,000 is invested at 6% interest compounded continuously. (11.1) a. How long (to the nearest day) before the value is $12,500? b. How long (to the nearest day) before the money doubles? c. What is the interest rate (compounded continuously and rounded to the nearest tenth of a percent) if the money doubles in 5 years? 7. Calculate the monthly finance charge for a credit card given a $2000 balance, 19% interest rate, and $300 payment using the indicated method. Assume it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (11.2) a. Previous balance method b. Adjusted balance method c. Average daily balance method 8. You purchase a living room set for $3600 at 12% add-on interest for 3 years. Find the APR for the loan. (11.2) 9. A car has a sticker price of $42,700 with factory and dealer rebates of $5100. (11.2) a. Find the monthly payment if financed for 60 months at 0% APR (in lieu of the rebates). b. Find the monthly payment if financed at 2.5% add-on interest for 60 months. c. Find the APR for part b. d. State whether the 0% APR or the 2.5% add-on rate should be preferred. 10. A newspaper ad offers a $14,350 car for nothing down and 48 easy payments of $488.40. Determine the following. (11.2) a. Amount to be paid b. Amount of interest c. Interest rate d. APR (rounded to the nearest tenth of a percent) 11. Determine the next three terms in each sequence. (11.3) a. 5, 10, 15, 20, ____, ____, ____, … b. 5, 10, 20, 40, ____, ____, ____, … c. 5, 10, 20, 35, ____, ____, ____, … d. 5, 50, 500, 5000, ____, ____, ____, … 12. Evaluate. (11.4) k 3 a. 2 2k 1 k 1 4 b. k 1 k 1 k 1 13. You deposit $50 at the end of each month into a retirement account paying 6% compounded monthly. What is the value of the account at the end of 25 years? (11.5) 14. Find the value of each annuity at the end of 30 years. (11.5) a. Deposits of $500, annually, at a rate of 8% b. Deposits of $300, quarterly, at a rate of 6% c. Deposits of $30, monthly, at a rate of 8% 15. Find the amount of periodic payment necessary for each deposit to a sinking fund. (11.5) a. $3,000,000 in 20 years, semiannually, at a rate of 3% b. $500,000 in 10 years, quarterly, at a rate of 8% c. $45,000 in 30 years, monthly, at a rate of 7% 16. A business must raise $100,000 in 8 years. What should be the size of the owner’s quarterly payment to a sinking fund paying 7% compounded quarterly? (11.5) 17. Find the present value of the annuities. (11.6) a. m = $200, quarterly, at 8% for 20 years b. m = $100, monthly, at 4% for 5 years 18. Find the monthly payment for the loans. (11.6) a. $500 loan for 12 months at 12% b. New-car financing of 2.9% on a 30-month $12,450 loan c. A $108,000 condominium bought with a 30% down payment and the balance financed for 30 years at 12.05% 19. How much interest would be saved in part c above if the condominium were financed for 15 years instead of 30? (11.6) 20. You decide you can afford $275 per month for a car. What is the maximum loan you can afford if the interest rate is 12% and you want to repay the loan in 4 years? (11.6) You should use all of your homework problems (including the ones we worked on in class for homework #9 and homework #10) to study for the exam. They are all fair game!

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)