LOGIC AND TRUTH TABLES

advertisement

1 5.1 Simple Interest Simple Interest Formula: I = Prt where I= P= r= t= Future Value (aka “Amount”) FV = This formula works “as is” if the loan is repaid with a single, lump sum payment (simplest). Consideration: Are fractions of a year calculated in months or days? Ex a A $5000 loan is taken at 16% annual interest for January 1 through June 30. 1) What is the future value if “months” are used as the time period? 2) What is the future value if “days” are used as the time period? Days calculation: To vs. Through - This distinction means small differences for the average user, but large cumulative differences for banks/credit card companies. Jan. 1 to Jan 2 = Jan. 1 through Jan. 2 = From Ex a, calculating FV for one day less: Present Value – amount invested now to obtain a certain amount in the future (aka Ex b Edna wants to set up a college fund so $100,000 is available for her grandchild in 18 years. If she can lock in a 6.5% simple interest rate now, how much must be invested? 2 Add-on Interest – the precursor to today’s monthly payments (amortization) Current application: Relatively large sum loans for people with poor credit history. Ex c A $4500 car is purchased with a 2-year, 13% add-on interest loan. 1) Calculate the interested added and the future value 2) How many payments are there? 3) Calculate the interest added each month and the monthly payment. Credit Card Finance Charges – based on average daily balance Ex d The activity on an account is shown below. The billing period is Sept. 11 – Oct 10. The account begins with a balance of $321.19. The annual interest rate is 20%. Sept. 15 Sept. 28 Oct. 1 payment purchase purchase $ 75. $ 23.82 $156.29 Find the average daily balance, the finance charge, and the ending balance. Dates # of days Daily Balance Fraction of monthly charge Product 3 Credit Card Supplemental Information (not in textbook) Grace Period: Effective February 22, 2010, under the Federal Credit Card Accountability, Responsibility and Disclosure Act of 2009 (aka the CARD Act of 2009), you have at least 21 days to pay any new charges. This grace generally applies only IF YOU PAY YOUR BILL IN FULL. Carrying even a small balance makes you liable for the entire amount. Ex e A $500 washing machine using a credit card is bought on April 1st. The billing period is March 16 through April 15th. The payment due date is May 7th. 1) Suppose you have a 0 balance carried from the previous month. What is the balance on your account on May 8 if you make a payment of $500 on May 7? 2) Supposed you have a -$100 balance carried from the previous month (March 16). What is the balance on your account on May 8 if you make a payment of $500 on May 7? Credit Card Caveats (portions of statement) 4 Pay Day Loans (and other misery to avoid) 5 5.2 Compound Interest – simple interest reinvested regularly Ex a How much interest is paid on a $1000 investment for 1 year 1) 12% (annual) simple interest? 2) 12% (annual) interest compounded quarterly? Quarter Interest earned that quarter 1 2 3 4 Balance at quarter’s end Compound Interest formulas: 1. Compounded Annually FV = P(1 + r)t 2. Compounded More Than Annually Nt r FV P1 , where N = number of compoundings per year N 3. Compounded Continuously (not in textbook Chapter 5 – it’s in Chapter 10) FV = Pert, where e is the natural number 2.718 Ex How much is repaid on a loan of $20,000 at 20% interest over 5 years, compounded annually? Monthly? Daily? One million times/year? N 1 12 365 106 Notice what happens to (1 + 1/N)N as N becomes very large. This number “naturally” appears, and is called the natural number, e. 6 Homework #8 - Due Oct. 27, 2015 From the textbook: 5.1 # 6, 7, 11, 16, 18, 19, 21, 22, 25, 39, 45ad, 52, 54, 55 5.1 Supplemental problem # 1 From your own credit card statement or from a credit card offer: - Write the name of the credit card and company or bank which offers it - Find and list at least 5 of the following: a. The introductory APR (if applicable) and duration of introductory offer b. The APR for purchases after the intro period c. The APR for transferred balances d. The APR for cash advances e. The transaction fee for cash advances f. The late payment penalty APR g. The late payment fee h. Any additional fees listed From the textbook: 5.2 # 1abc, 4abc, 9, 12, 13, 17, 23, 26, 28, 37, 53, 54 5.2 Supplemental Problems # 1 If $12,000 is invested at 4% interest, compounded continuously, find the future value. # 2 If $1000 is borrowed at an annual rate of 19%, find the amount due at the end of 1 year if the interest is compounded: a. monthly d. Find the annual yield if compounded monthly b. daily e. Find the annual yield if compounded daily c. continuously f. Find the annual yield if compounded continuously

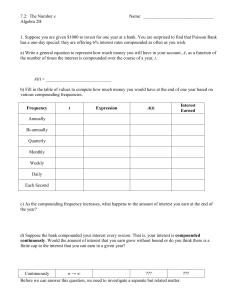

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)