Chabot College Fall, 2006 Course Outline for Business 2

advertisement

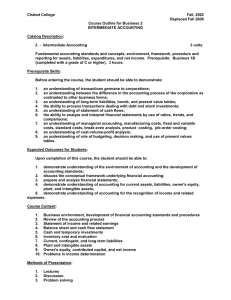

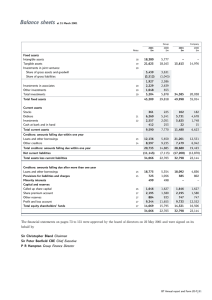

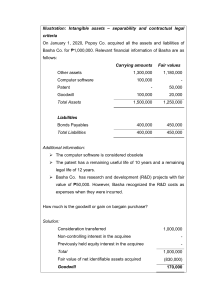

Chabot College Fall, 2006 Course Outline for Business 2 INTERMEDIATE ACCOUNTING Catalog Description: 2 - Intermediate Accounting 3 units Fundamental accounting standards and concepts, environment, framework, procedure and reporting for assets, liabilities, expenditures, and net income. Prerequisite: Business 1B (completed with a grade of C or higher). 3 hours. [Typical contact hours: 52.5] Prerequisite Skills: Before entering the course, the student should be able to: 1. 2. 3. 4. 5. 6. 7. 8. 9. process transactions germane to corporations. identify the differences in the accounting process of a corporation as contrasted to other business forms; analyze long-term liabilities and bonds by using the present value tables; process transactions dealing with debt and stock investments; prepare a statement of cash flows; analyze and interpret financial statements by use of ratios, trends, and comparisons; analyze and process managerial accounting, manufacturing costs, fixed and variable costs, standard costs, break-even analysis, product costing, job-order costing; perform cost-volume-profit analysis; identify the role of budgeting, decision making, and use of present value tables. Expected Outcomes for Students: Upon completion of this course, the student should be able to: 1. 2. 3. 4. 5. demonstrate an understanding of the environment of accounting and the development of accounting standards; analyze and identify the conceptual framework underlying financial accounting; prepare and analyze financial statements; demonstrate an understanding of accounting for current assets, liabilities, owner's equity, plant, and intangible assets; demonstrate an understanding of accounting for the recognition of income and related expenses. Course Content: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Business environment, development of financial accounting standards and procedures Review of the accounting process Statement of income and related earnings Balance sheet and cash flow statement Cash and temporary investments Inventory cost and evaluation Current, contingent, and long term liabilities Plant and intangible assets Owner's equity, contributed capital, and net income Problems in income determination Methods of Presentation: 1. 2. 3. Lectures Discussion Problem solving Chabot College Course Outline for Business 2, Page 2 Fall 2006 Assignments and Methods of Evaluating Student Progress: 1. Typical Assignments: a. Prepare and analyze an Income Statement and Retained Earnings b. Prepare and analyze a Balance Sheet and Statement of Cash Flow c. Evaluate Investments, Inventory costs, and Tangible & Intangible Assets 2. Methods of Evaluating Student Progress: a. Examinations b. Graded problems c. Final examination Textbook(s) (Typical): Intermediate Accounting, Kieso. Wiley and Sons, March 2005 Cases in Financial Reporting, 5th Edition, Hirst and McAnally. Prentice Hall, Spring 2006 Financial Reporting and Analysis, 3rd Edition. Revsine, Collins & Johnson. Prentice Hall, 2005 Special Student Materials: Working papers, inexpensive calculator. ww 11/01/05 Bus 02 course outline.doc