chapter 17

advertisement

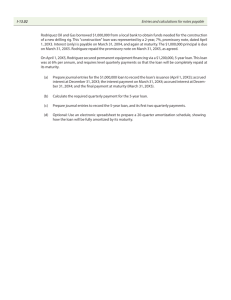

WEEK TEN REVIEW QUESTIONS AND PROBLEMS Company Analysis Do the following textbook questions and problems to review your readings. Then check your answers below. Chapter 17, pages 541 to542: Questions 2, 10, 13, 15 and 18. Chapter 17, pages 543 to 544: Problem 1. ANSWERS TO REVIEW QUESTIONS CHAPTER 17 2. A stock's intrinsic value can be estimated by using the dividend discount model or the earnings multiplier model. 10. Although higher ROE leads to higher EPS, two factors determine stock price, the ultimate variable of interest to investors. The increasing use of debt financing increases the risk to stockholders, raising their required rate of return. The increase in the required rate of return will, at some point, offset the higher EPS and lower the stock price. 13. Malkiel and Cragg, among others, have shown how important it is to know what the market thinks the earnings growth rate will be. Investors form expectations about EPS, and these expectations play a key role in affecting stock prices. In short, earnings expectations are a key variable in selecting stocks. 15. Beta reflects the relative systematic risk for a stock. Other things being equal, the higher the beta, the higher the risk and the higher the required rate of return. Investors will want to know about a stock's beta in order to estimate the volatility of the stock's returns. If a rise in the market is expected, investors would prefer, other things being equal, stocks with higher betas. Likewise, with an expected market decline, lower betas would be preferred if stocks are to be held. 18. As Equation 17-8 shows, the three variables that affect the P/E ratio are: (1) The dividend payout ratio (direct relation). (2) The required rate of return (inverse relation). 1 (3) The expected growth rate in dividends (direct relation). ANSWERS TO PROBLEM CHAPTER 17 1. For 20X5, the calculations for parts (a), (b) and (c) are: (a) (b) (c) 100(721/8256) = 8.73% 100(289/8256) = 3.50% 289/51.92 = $5.57 The same values for 20X1-20X4 are: Year (a) (b) (c) 20X1 20X2 20X3 20X4 9.6% 9.0 8.6 8.3 4.2% $4.65 4.3 5.12 3.9 5.16 2.6 4.47 (d), (e), (f), (g), and (h) are calculated for 20X5 and are summarized for 20X1-20X5 below. (d) (e) (f) (g) (h) 2315/1342 = 1.72 (736/1872)(100) = 39.3%, as a percentage 1872/51.92 = $36.06 100 (Net Income after tax/Common Equity) = 100(289/1872) =15.4% (289/4310)100 = 6.7% Year (d) (e) (f) (g) (h) 20X1 20X2 20X3 20X4 2.05 1.86 2.17 1.86 19 % 17.2% 24.3% 45% $26.46 29.62 32.57 32.88 17.6% 17.3 15.8 13.6 9.0% 8.6 8.2 5.7 Again the 20X5 calculations will be shown for (i) through (n), and summarized for the other years. (i) (j) (k) (l) (m) 4310/1872 = 2.30 **NOTE: 2.30 X 6.7% = 15.4%, the ROE (289/8256)100 = 3.5%, as a percentage 8256/4310 = 1.92 535 + 139 = $674 mn. (289/674)100 = 42.9% 2 (n) (674/8256)100 = 8.2% Year 20X1 20X2 20X3 20X4 (o) 1.94 2.01 1.93 2.37 (i) (j) (k) (l) 4.2% 4.3 3.9 2.6 2.13 2.00 2.13 2.16 $483mn 509 523 570 (m) 48.0% 50.3 48.8 38.8 (n) 8.8% 8.5 7.9 6.8 Examining the figures for the years 20X1-20X5 from parts (a) through (n), we see that ROE declined through 20X4, although it recovered somewhat in 20X5. The same is true of ROA. Leverage has increased. Operating efficiency declined through 20X4 before turning up in 20X5. Reviewing more basic components, we see that operating income/net revenue has been deteriorating, as has net profits/revenue. The current ratio has deteriorated. In summary, it would appear that GF underwent some deterioration between 20X1 and 20X5 with some (but not complete), improvement in 20X5. Examining the ROE and ROA in 20X5, we can see that GF had recovered some ground, but still compared unfavourably to 20X1 and 20X2. 3