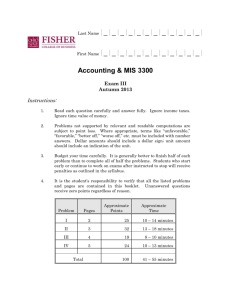

Accounting & MIS 3300

advertisement

Last Name |_|_|_|_|_|_|_|_|_|_|_|_| First Name |_|_|_|_|_|_|_|_|_|_|_|_| Accounting & MIS 3300 Exam III Autumn 2015 Instructions: 1. Read each question carefully and answer fully. Ignore income taxes. Ignore time value of money. 2. Problems not supported by relevant and readable computations are subject to point loss. Where appropriate, terms like “unfavorable,” “favorable,” “better off,” “worse off,” etc. must be included with number answers. Dollar amounts should include a dollar sign; unit amount should include an indication of the unit. 3. Budget your time carefully. It is generally better to finish half of each problem than to complete all of half the problems. Students who start early or continue to work on exams after instructed to stop will receive penalties as outlined in the syllabus. 4. It is the student's responsibility to verify that all the listed problems and pages are contained in this booklet. Unanswered questions receive zero points regardless of reason. Approximate Points Approximate Time Problem Pages I 2 23 9 – 13 minutes II 3 30 12 – 16 minutes III 4 15 6 – 8 minutes IV 5 20 8 – 11 minutes V 6 12 5 – 7 minutes 100 40 – 55 minutes Total Page 2 of 6 PROBLEM I The Austin Company has two support departments (Cleaning and Maintenance) and two production areas (Assembly and Finishing). The following is known: Actual Costs $ Services Furnished by Cleaning (Sq. footage) Maintenance (labor hrs.) Support Departments Cleaning Maintenance 145,530 $ 166,320 8,000 1,000 Operating Departments Assembly Finishing $ - $ 4,000 2,000 30,000 19,000 Total - 16,000 5,000 $ 311,850 58,000 27,000 Part A. Allocate the costs under the step-down method in the order than gives answers closer to the reciprocal method. Part B. Allocate the costs under the reciprocal method. Page 3 of 6 PROBLEM II Bismarck sells one product at the same price per unit. In 20x1 and 20x2, the results were: Sales Units Sales CGS Gross Margin Operating Expenses Operating Income 20x2 45,000 $ 3,262,500 2,529,000 $ 733,500 372,600 $ 360,900 Per Unit $ 72.50 56.20 $ 16.30 8.28 $ 8.02 20x1 40,000 $ 2,900,000 2,290,000 $ 610,000 345,600 $ 264,400 Per Unit $ 72.50 57.25 $ 15.25 8.64 $ 6.61 This year, 20x3, is expected to have the same cost structure as in both 20x1 and 20x2 and the same units sales as in 20x2, absent any special orders. All parts refer to 20x3. For each part, make your answer stand out. Part A. Assume a special order for 8,000 units at $62 each is received. Bismarck has capacity of 55,000 units. This special order will require special packaging that will raise the cost to produce each unit by $1.25. How much better or worse off will they be if they accept this special order? Part B. Assume the same facts in Part A, except the capacity is 50,000 units. How much better or worse off will they be if they accept this offer? Part C. Use the data from Part B. Bismarck does not want to lose any regular customers so they might accept a lower price on the special order. Bismarck would increase production to capacity, sell fewer units to the special order, and lose no regular customers. What price could they offer the special-order customer to entice them to accept the resultant lesser number of units, such that Bismarck is no better/worse off than in Part B? Part D. Bismarck is considering issuing 10,000 coupons that allow the holder to buy one discounted unit at $62. The discounted unit is exactly the same as a regular unit in every way. Bismarck has capacity of 55,000 units. Bismarck is concerned that some of the units sold as part of the promotion may replace units they would have sold at the regular price. What is the maximum percentage of the coupons exercised that can come from those who would have bought at the regular price without making Bismarck worse off? Page 4 of 6 PROBLEM III The Columbus Company purchased a machine to produce its one product on 1/1/20x1 that had a 7-year life. Today, three years later on 1/1/20x4, Columbus has the opportunity to purchase a replacement machine with a 4-year life and lower operating costs. This would permit them to sell the old machine. Columbus depreciates all machines straightline over their useful life with zero salvage, and all machines would be expected to have a zero market value at the end of their useful life. The accountant has prepared expected “year ended 12/31/20x4” income statements under the two alternatives: Keep Revenues Expenses: Other than Machine Machine Operating Costs Depreciation Loss on Sale of Old Machine Total Expenses Operating Income $ 600,000 Replace $ 600,000 $ 124,000 10,000 25,000 32,000 191,000 409,000 124,000 36,000 12,000 $ 172,000 428,000 Part A. Required: What is the current sales value of the old machine? 1/1/20x4 sales value of $ old machine: Part B. Required: Present an analysis of whether or not Columbus should keep or replace the old machine, presenting relevant, professional-quality schedules and a clear conclusion. Page 5 of 6 PROBLEM IV The Denver Company manufactures two products in a joint process that costs $332,640. They began the year with zero finished goods inventory. Additionally, they know: Product Brutus Buckeye Separable Production Costs in kilos $ 30,000 20,000 190,000 50,000 Sales Sales Price in kilos per kilo 20,000 $ 13.80 40,000 7.20 Part A. Required: Assume Denver uses the NRV method, compute the balance in ending finished goods inventory (which consists only of Buckeye): Ending Inventory Balance = $ Part B. Required: Assume Denver uses the constant-gross-margin method, compute the balance in ending finished goods inventory (which consists only of Buckeye): Ending Inventory Balance = $ Page 6 of 6 PROBLEM V The Frankfort Corporation manufactures two products in a joint process that costs $54,000. They began the year with no balances in any inventory account. During the year, they produced and sold 5,000 pounds of their main product, XG1, with a selling price of $16 per pound. They also produced 1,000 pounds of the byproduct, Z99, and sold 800 pounds of it at $3 per pound. Required: Fill in the requested information: PRODUCTION METHOD: Total Revenue: $ Cost of Goods Sold: $ Total Revenue: $ Cost of Goods Sold: $ SALES METHOD: