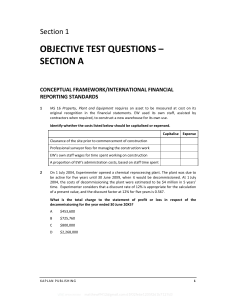

№1 Repro has prepared its draft financial statements for the year ended 30 September 20X4. It has included the following transactions in revenue at the amounts stated below. Which of these has been correctly included in revenue according to IFRS 15 Revenue from Contracts with Customers? A Agency sales of $250,000 on which Repro is entitled to a commission of 10%. B Sale proceeds of $20,000 for motor vehicles which were no longer required by Repro. C Sales of $150,000 on 30 September 20X4. The amount invoiced to and received from the customer was $180,000, which includes $30,000 for ongoing servicing work to be done by Repro over the next two years. D Sales of $200,000 on 1 October 20X3 to an established customer who (with the agreement of Repro) will make full payment on 30 September 20X5. Repro has a cost of capital of 10%. №2 Yling entered into a contract to construct an asset for a customer on 1 January 20X4 which is expected to last 24 months. The agreed price for the contract is $5 million. At 30 September 20X4, the costs incurred on the contract were $1.6 million and the estimated remaining costs to complete were $2.4 million. On 20 September 20X4, Yling received a payment from the customer of $1.8 million which was equal to the full amount billed. Yling calculates contract progress using the output method, on the basis of amount billed compared to the contract price. What amount would be reported as a contract asset in Yling’s statement of financial position as at 30 September 20X4? 5,000-(1,600+2,400)=1,000 1,000*1,800/5,000=0.36 0.36+1,600-1,800=0.16 $_160 000___ №3 CN started a three-year contract to build a new university campus on 1 April 20X4. The contract had a fixed price of $90 million. CN will satisfy the performance obligation over time. CN incurred costs to 31 March 20X5 of $77 million and estimated that a further $33 million would need to be spent to complete the contract. CN measures the progress of contracts using work completed compared to contract price. At 31 March 20X5, a surveyor valued the work completed to date at $63 million. Select the correct amounts to be shown in revenue and cost of sales in the statement of profit or loss for the year ended 31 March 20X5? Revenue Cost of sales Loss = 90 – (77+33) = -20 Progress = 63/90 = 70% Revenue = 70%*90 = 63 CoGS = -20 – 63 = -83 A) $63 million $77 million B) $57 million $83 million №4 Locke sells machines, and also offers installation and technical support services. The individual selling prices of each product are shown below. Sale price of goods $75 Installation $30 One year service $45 Locke sold a machine on 1 May 20X1, charging a reduced price of $100, including installation and one year’s service. Locke only offers discounts when customers purchase a package of products together. According to IFRS 15 Revenue from Contracts with Customers, how much should Locke record in revenue for the year ended 31 December 20X1? Workings should be rounded to the nearest $. Total SP = 75+30+45 = 150 Goods = 75*100/150 = 50 Installation = 30*100/150 = 20 1-year service = 45*100/150 = 30 Service recognized = 30*8/12 = 20 (01.05.20X1-31.12.20X1) Revenue = 50+20+20 = 90 $____90________ №5 Place the following steps for recognising revenue in order in accordance with IFRS 15 Revenue from Contracts with Customers. Identify the separate performance obligations within a contract Identify the contract Determine the transaction price Recognise revenue when (or as) a performance obligation is satisfied Allocate the transaction price to the performance obligations in the contract №6 BL entered into a contract with a customer on 1 November 20X4. The contract was scheduled to run for two years and has a sales value of $40 million. BL will satisfy the performance obligations over time. At 31 October 20X5, the following details were obtained from BL’s records: $m Costs incurred to date 16 Estimated costs to completion 18 Progress at 31 October 20X5 45% Applying IFRS 15 Revenue from Contracts with Customers, how much revenue and cost of sales should BL recognise in its statement of profit or loss for the year ended 31 October 20X5? Profit = 40 – (16+18) = 6 Profit = 6*45% = 2,7 CoGS = (16+18)*45% = 15,3 №7 Malik is a construction business, recognising progress based on work certified as a proportion of total contract value. Malik will satisfy the performance obligation over time. The following information relates to one of its long-term contracts as at 31 May 20X4, Malik’s year-end. $ Contract price 200,000 Costs incurred to date 130,000 Estimated cost to complete 20,000 Invoiced to customer 120,000 Work certified to date 180,000 In the year to 31 May 20X3 Malik had recognised revenue of $60,000 and profit of $15,000 in respect of this contract. What profit should appear in Malik’s statement of profit or loss as at 31 May 20X4 in respect of this contract? P/L = 200 – (130+20) = 50 Progress = 180/200 = 0,9 Profit to be recognized = 50*0,9 = 45 Profit in 20X4 = 45 – 15 = 30 $___________ №8 Which of the following items has correctly been included in Hatton’s revenue for the year to 31 December 20X1? A) $2 million in relation to a fee negotiated for an advertising contract for Rees, one of Hatton’s clients. Hatton acted as an agent during the deal and is entitled to 10% commission. B) $500,000 relating to a sale of specialized equipment on 31 December 20X1. The full sales value was $700,000 but $200,000 relates to servicing that Hatton will provide over the next 2 years, so Hatton has not included that in revenue this year. C) $800,000 relating to a sale of some surplus land owned by Hatton. D) $1 million in relation to a sale to a new customer on 31 December 20X1. Control passed to the customer on 31 December 20X1. The $1 million is payable on 31 December 20X3. Interest rates are 10%. №9 Sugar has entered into a long-term contract to build an asset for a customer, Hewer. Sugar will satisfy the performance obligation over time and has measured the progress towards satisfying the performance obligation at 45% at the year end. The price of the contract is $8 million. Sugar has spent $4.5 million to date, but the estimated costs to complete are $5.5 million. To date, Hewer has paid Sugar $3 million. What is the net liability that should be recorded in Sugar’s statement of financial position? 8 – (4,5+5,5) = -2 8*45% = 3,6 CoGS = (4,5+5,5)*45% = 4,5 Net liability = 4,5-2-3 = 0,5 $_______________ ,000 №10 Hindberg is a car retailer. On 1 April 20X4, Hindberg sold a car to Latterly on the following terms: The selling price of the car was $25,300. Latterly paid $12,650 (half of the cost) on 1 April 20X4 and will pay the remaining $12,650 on 31 March 20X6 (two years after the sale). Latterly can obtain finance at 10% per annum. What is the total amount which Hindberg should credit to profit or loss in respect of this transaction in the year ended 31 March 20X5?