Slides - On Contracts

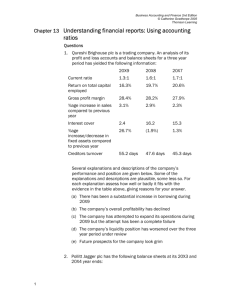

advertisement

Contract Drafting Class 11 Tues. Feb 21 University of Houston Law Center D. C. Toedt III Common contract screw-ups Common contract screw-ups “6. The contract with a date line left blank.” QUESTION: What do you do about it? [From “Top 10 howlers when preparing contracts for signature,” by the IP Draughts blog at http://goo.gl/Km6Dw.] Couplets & triplets Some awkward expressions How could these be improved? that property known and described as … of every kind and character … ABC will not suffer or permit … of every type and kind … it is understood and agreed … Representations and Warranties, cont’d 211 – No reliance Representations outside this Agreement: None – the parties have specifically negotiated this section. Each party represents and warrants that, in entering into this Agreement, it is not relying on any representation by the other party, other than those set forth herein or incorporated by reference. Why include no-reliance clause? Vendor: Avoid fraudulent-misrep. claims Customer (silver lining if forced to agree): Identify problems BEFORE they arise Discovery issues for either warranty or misrep. claim True value of asset sold Inspections Comparables Expert testimony Alt: Repair costs Estimates Expert testimony Extra discovery issues for misrepresentations Standard of care (negligence claims): deals, practices, problems – interrog., document production, depositions Expert witnesses – fees, report review, depositions, trial props, trial prep Past Intent (fraud claims): Email trails, interrog., depositions Net worth – for punitive damages Negotiating risk allocation (Stark pp. 17-19) See Stark’s examples Flat representation Unequivocal Without wiggle room Qualified representation Hedged Interplay of Contract Concepts Rep and Warranty The car is red. Covenant Seller shall not paint the car. Condition Seller must have complied with all covenants. Stark Exercises 7-1 through 7-3 Exercise 7-1: In-line definition 2.1 Grant of License. By signing this Agreement, Ralph LP grants Merchandisers an exclusive license to manufacture and sell Licensed Products bearing the Trademark, during the Term, in Maine, New Hampshire, and Vermont (those three states, the “Territory”). The Territory is extended to include Delaware and Rhode Island for the second and third years of the Term, but only if Merchandisers’ sales for the first year of the Term exceed $7 million. Exercise 7-1: Separate definition “Territory” means Maine, New Hampshire, and Vermont “Extended Territory” means the Original Territory plus Delaware, Maine, New Hampshire, Rhode Island, and Vermont. *** Ralph LP grants Merchandisers an exclusive license to manufacture and sell Licensed Products bearing the Trademark, during the Term, in the Territory. If Merchandisers’ sales for the first year of the Term exceed $7 million, this license will apply in the Extended Territory for the second and third years of the Term. Exercise 7-2: Separate definition “Financial Statements” means (i) the balance sheet of the Company as of December 31, 20X4 and December 31, 20X3 and (ii) the related statements of income, cash flows, and shareholders' equity for each of the two years in the period ended December 31, 20X4, including the related notes. *** 3.4 Financial Statements. The Financial Statements present fairly, in all material respects, the financial position of the Company as of December 31, 20X4 and December 31, 20X3, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 20X4, in conformity with generally-accepted accounting principles as established and interpreted in the United States of America, consistently applied. Exercise 7-2: In-line definition 3.4 Financial Statements. The balance sheet of the Company as of December 31, 20X4 and December 31, 20X3 and the related statements of income, cash flows, and shareholders' equity for each of the two years in the period ended December 31, 20X4, including the related notes (the “Financial Statements”) present fairly, in all material respects, the financial position of the Company as of December 31, 20X4 and December 31, 20X3, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 20X4, in conformity with generallyaccepted accounting principles as established and interpreted in the United States of America, consistently applied. Exercise 7-3 The purchase price for the House (the “Purchase Price”) is $250,000. The purchase price for the House is $250,000 (the “Purchase Price”). Stark Exercise 5-1 End of class