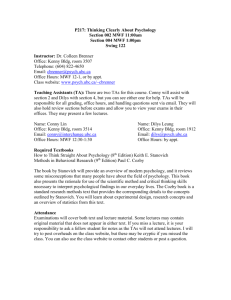

CORPORATE FINANCE

advertisement

Isenberg School of Management University of Massachusetts-Amherst FINANCE 403: Capital Markets and Institutions Fall 2014 Instructor: E-mail: Office: Phone: Fax: Class Time: Office Hours: Prof. Bing Liang bliang@isenberg.umass.edu Room 308B SOM 545-3180 545-3858 2:30-3:45 PM, T, TH 4:00-5:00 PM, T, TH Course Objective The primary objective of FINANCE 403 is to provide students with the basics of the financial institutions, instruments, markets and the public policies. The course materials cover various areas such as interest rates, money markets, fixed income securities markets, stock markets, commercial banks, insurance companies, securities firms, investment banks, pension funds, mutual funds and hedge funds, financial statement analysis and risk management of the financial institutions. FINANCE 403 is the first course in financial markets and institutions and is also a useful preparation for other advanced finance courses in the future. FINOPMGT 301 and 304 are the prerequisite for this course. Students are also expected to have working knowledge of algebra, statistics, and Microsoft Excel. Course Materials 1. 2. 3. Textbook: McGraw Hill Create: Capital Markets and Institutions (based on Financial Markets and Institutions: A Modern Perspective, by Saunders and Cornett, 5th Edition, Irwin/McGraw-Hill, 2012.) Lecture notes and case materials will be posted on Blackboard. The Wall Street Journal. Cases There will be two cases. These cases are real-world related and are useful for students to analyze multiple concepts covered throughout the chapters. Cases should be conducted by groups and will be discussed in class. The case reports must be typed. Homeworks There will be five homework assignments consisting of various questions/problems. These questions/problems are very useful in helping you understand the materials covered and consolidate the knowledge obtained in class. Note the end-of-chapter problems have two parts: conceptual questions (Q) and quantitative problems (P). You are required to turn in these problems individually. Late problem sets will be accepted but with penalties of 50%, 80%, and 90% for being one, two, and three days late, respectively. Exams There will be three exams: one final and two midterm exams. The final exam will be on Dec. 4. The final exam is not comprehensive. No makeup exam is allowed. Please mark your calendar for these exams. Class Participation I encourage you to ask questions and share your insights in class as much as possible. You and your classmates will benefit from your participation. We will frequently discuss the current market events and class materials. Class participation can contribute to your grade marginally. Grade Distribution Problem Sets Projects Exams 30% 20% 50% (final 20% and midterm 15%) The course grade is determined according to the following scale (plus and minus could be given): A: 90 or above B: 80-89 C: 70-79 D: 60-69 F: below 60 2 Course Outline Week Date Topic Chapter Week 1 Sept. 2 Introduction 1 Week 1 Sept. 4 Interest Rates 2 Week 2 Sept. 9 Interest Rates 2 Week 2 Sept. 11 The Federal Reserve System 4 Week 3 Sept. 16 Money Markets HW#1 Due (Ch1: Q1, 2, 10; Ch2: Q1, 5; P2, 5, 9, 18; Ch4: Q2, 8, 13; P2, 4, 7) 5 Week 3 Sept. 18 Bond Markets 6 Week 4 Sept. 23 Bond Markets 6 Week 4 Sept. 25 Midterm Exam I Week 5 Sept. 30 Mortgage Markets 7 Week 5 Oct. 2 Stock Markets 8 Week 6 Oct. 7 Stock Markets HW#2 Due (Ch5: Q1, 4, 5; P5, 9, 11, 12; Ch6: Q1, 3, 7; P3, 5, 7, 10; Ch7: Q3, 5, 7; P2, 5, 10) 8 Week 7 Oct. 9 Commercial Banks 11 Week 7 Oct. 16 Other Lending Institutions Project 1 Due 14 Week 8 Oct. 21 Insurance Companies 15 Week 8 Oct. 23 Securities Firms and Investment Banks HW#3 Due (Ch.8: Q1, 3, 6; P2, 3, 5; Ch11: Q9, 13, 25; Ch14: Q3, 9, 18, 25; 16 3 Ch15: Q2, 3, 16; P1, 3, 6) Week 9 Oct. 28 Securities Firms and Investment Banks Week 9 Oct. 30 Midterm Exam II 16 Week 10 Nov. 4 Mutual Funds 17 Week 10 Nov. 6 Hedge Funds 17 Week 11 Nov. 12 Hedge Funds 17 Week 11 Nov. 13 HW#4 Due (Ch16: Q4, 7, 13; P1, 2, 5; Ch17: Q3, 6, 11; P1, 2, 3) Week 12 Nov. 18 Pension Funds 18 Week 13 Nov. 20 Risk Analysis 19 Week 13 Nov. 25 Project 2 Due Week 14 Dec. 2 Credit Risk HW#5 Due (Ch18: Q3, 10; P4, 5, 6; Ch19: Q4, 7, 9; P2, 3, 5; Ch20: Q1, 5; P2, 3) Week 14 Dec. 4 Final Exam (in class) 4 20