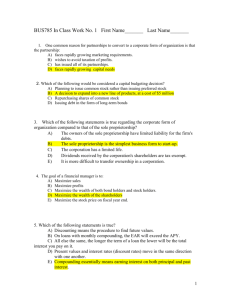

122677234203_bba_time_value_of_money

advertisement