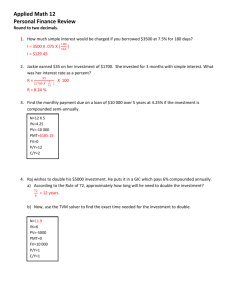

Finance Problems Practice Set: Interest, Loans, Annuities

advertisement

Finance Problems Practice Set. 1. Find the future value if $500 is placed in an account at 6% simple interest for 2 years. 2. Find the future value if $750 is placed into an account at 4.5% simple interest for 30 months. 3. Suppose $400 grew into $500 in 10 months time. Find the simple interest rate that achieves this. 4. $600 is deposited in an account at 5.1% APR for 3 years, compounded monthly. Find the future value. 5. Find the equivalent yield (APY) in problem 4. 6. How much is needed now so that in 45 months you will have $4,000 if you get a rate of 4.8% APR compounded monthly? 7. Same problem as in number 6, but this time you make monthly payments into a fund. Find the monthly payment. 8. You put $150 into a fund every month at 4.25% APR compounded monthly for 10 years. Find your future value. 9. How much interest did you earn in problem 8? 10. You buy a car. You finance $12,000 with an amortized loan at 6.8% APR compounded monthly, 72-month term. Determine your monthly payment. 11. Assume you make the minimum monthly payment in problem 10 for the entire 72 months. How much interest did you actually end up paying? 12. You’re now house hunting. You feel you can afford $1,100 for your monthly mortgage payment. You get pre-approved for a 30-year mortgage at 5.9% APR. What’s the largest amount of money you can borrow under these terms? Answers 1. 2. 3. Simple Interest: A = 500(1 + (0.06) ⋅ 2) = $560 30 Simple Interest: A = 750(1 + (0.045) ⋅ 12 ) = $834.78 Simple Interest. Note that interest is $100 and use the I = Prt formula: 10 100 = 400 ⋅ r ⋅ 12 ⇒ r = 0.3 = 30% 12×3 4. ⎛ 0.051 ⎞ Compound Interest: A = 600⎜1 + ⎟ 12 ⎠ ⎝ 5. ⎛ 0.051 ⎞ Yield: Y = ⎜1 + ⎟ − 1 = 0.0522... = 5.22% 12 ⎠ ⎝ = $698.97 12 45 6. 7. 8. 9. 10. 11. 12. ⎛ 0.048 ⎞ Compound Interest: 4000 = P⎜1 + ⎟ ⇒ P = $3,542.28 12 ⎠ ⎝ ⎛ ⎛ 0.048 ⎞ 45 ⎞ ⎜ ⎜1 + ⎟ − 1⎟⎟ ⎜⎝ 12 ⎠ ⎠ ⇒ 4000 = pmt (49.196...) ⇒ pmt = $81.31 Annuity: 4000 = pmt ⎝ ⎛ 0.048 ⎞ ⎜ ⎟ ⎝ 12 ⎠ ⎛ ⎛ 0.0425 ⎞120 ⎞ ⎜ ⎜1 + ⎟ − 1⎟⎟ ⎜⎝ 12 ⎠ ⎠ ⇒ A = $22,381.09 Annuity: A = 150 ⎝ ⎛ 0.0425 ⎞ ⎜ ⎟ ⎝ 12 ⎠ You paid $150 for 120 months: 150 x 120 = $18,000, so the rest is interest: 22,381.09 − 18,000 = $4,381.09 . ⎛ ⎛ 0.068 ⎞ 72 ⎞ ⎜ ⎜1 + ⎟ − 1⎟⎟ 72 ⎜ 12 ⎠ ⎛ 0.068 ⎞ ⎝⎝ ⎠ ⇒ pmt = $203.44 Amortization: 12000⎜1 + ⎟ = pmt 12 ⎠ ⎛ 0.068 ⎞ ⎝ ⎜ ⎟ ⎝ 12 ⎠ You paid $203.44 for 72 months: 203.44 x 72 = $14,647.68, so you paid $2,647.68 interest above the $12,000 principal. ⎛ ⎛ 0.059 ⎞ 360 ⎞ ⎜ ⎜1 + ⎟ − 1⎟⎟ 360 ⎜ 12 ⎝ ⎠ ⎛ 0.059 ⎞ ⎝ ⎠ ⇒ P = $185,454.78 Amortization: P⎜1 + ⎟ = 1,100 12 ⎠ ⎛ 0.059 ⎞ ⎝ ⎜ ⎟ ⎝ 12 ⎠