i-ch6 - Haas School of Business

advertisement

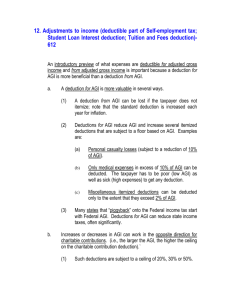

Chapter I6 Deductions and Losses Discussion Questions I6-1 The concept of AGI is important for individuals because it is used to establish limits on certain from AGI deductions such as medical expenses, casualty losses, charitable contributions, and certain miscellaneous itemized deductions. The classification also determines whether the standard deduction is used or the deductions are itemized. p. I6-3. I6-2 Deductions for AGI reduce the taxpayer's gross income by the full amount of the deduction even if the standard deduction is used. Deductions from AGI are not beneficial unless they exceed the standard deduction. Also, many deductions from AGI are decreased by a percentage of AGI (e.g., 7.5% for medical expenses, 10% for casualty losses, and 2% for miscellaneous itemized deductions) which reduces the tax benefit of these from AGI deductions. p. I6-3. I6-3 Expenses incurred in producing rental income are deductions for AGI. p. I6-3. I6-4 A deduction for a loss incurred on the sale of a capital asset held for investment is a deduction for AGI. p. I6-3 I6-5 Under Section 62, reimbursed employee business expenses are deductions for AGI. On the other hand, unreimbursed employee business expenses are miscellaneous itemized deductions that are subject to the 2% of AGI limitation. In many cases, a taxpayer's miscellaneous itemized deductions do not exceed 2% of AGI. Thus, in effect, unreimbursed business expenses often are not deductible. Since reimbursed employee business expenses are deductions for AGI, a taxpayer is given a full dollar of deduction for every dollar of reimbursement. In fact, as explained later in chapter nine, in most cases neither the reimbursement nor the expense needs to be reported on the tax return since they merely cancel each other. pp. I6-3 and I6-4. I6-6 a. If the expenses are deductions for AGI, Mario's taxable income is: Income Deductions for AGI AGI Standard deduction Personal exemption Taxable income $55,000 ( 9,000) $46,000 ( 4,000) ( 2,550) $39,450 I6-1 b. If the expenses are deductions from AGI, Mario's taxable income is: Income Deductions for AGI AGI Deductions from AGI Personal exemption Taxable income $55,000 ( 0 ) $55,000 ( 7,900)a ( 2,550) $44,550 a $9,000 - ($55,000 x .02) = $7,900. Note that the taxpayer loses the benefit of the standard deduction if the expenses are deductions from AGI. p. I6-4. I6-7 a. b. Factors used to determine whether an activity is profit- motivated include: 1. Whether the activity is conducted in a business-like manner, 2. The expertise of the taxpayer or his advisor, 3. The time and effort expended by the taxpayer in carrying on the activity, 4. Whether the assets used are expected to appreciate in value, 5. The taxpayer's success in carrying on other similar activities, 6. The history of income or losses with respect to the activity, 7. The amount of occasional profits, 8. The financial status of the taxpayer, and 9. Any elements of personal pleasure or recreation which the activity might involve. Whether an activity is profit-motivated or not depends upon the intent of the taxpayer. These factors provide an objective way of determining a taxpayer's intent. Expenses incurred in a profit-motivated activity are deductible, whereas, expenses incurred in a personal activity generally are not deductible (with certain exceptions). Thus, external indications of a taxpayer’s motive or intent are extremely important in determining the deductibility of an expenditure. p. I6-29. I6-8 No, it is not automatically deemed a hobby. The other factors mentioned in the Regulations can be relied upon to determine that the activity is, in fact, a business. The burden to prove it is not a hobby is generally on the taxpayer. However, meeting the 3 out of 5 year test shifts the burden of proof to the IRS. pp I6-29 and I6-30. I6-2 I6-9 It is important to determine whether the activity is a business or an investment since different tax consequences may result depending on the type of activity. For example, deductions incurred in a business are generally for AGI whereas investment expenses generally are from AGI deductions subject to various limitations. Losses incurred on business property are ordinary, whereas losses on investment property generally are capital losses and are subject to limitation. pp. I6-5 and I6-6. I6-10 An ordinary expense is an expense that bears a reasonable and proximate relationship to the income- producing activity or property. It must be customary or usual to the particular activity. Also, ordinary expenses are currently deductible as opposed to expenditures that must be capitalized. Necessary is defined as appropriate or helpful. However, an expense need not be indispensable in order to be necessary. The test here is whether a reasonable business person would have incurred the same expenditure. A reasonable expense is one that is reasonable in amount. It must not be excessive or unusual when compared to similar expenses made by similar businesses. p. I6-8. I6-11 Capital expenditures: 1. Add to the value of the property 2. Substantially prolong the useful life of the property, or 3. Adapt the property to a new or different use. A deductible expenditure generally keeps a business asset in a normal operating condition. pp. I6-9 and I6-10. I6-12 The disallowance for expenses related to tax-exempt income is to prevent the taxpayer from enjoying a double tax benefit. If expenses related to tax exempt income were deductible, the taxpayer would benefit by not paying tax on the income and at the same time would be able to deduct the expenses related to that income. pp. I6-11 and I6-12. I6-13 A bribe or kickback that is illegal under state law may be deducted by the taxpayer if the state law is not generally enforced. p. I6-12. I6-14 a. The entire $400 is deductible under Sec. 212 because it is incurred in the determination of a tax. However, all $400 is a miscellaneous itemized deduction (a from AGI deduction). Miscellaneous itemized deductions are only deductible to the extent they exceed 2% of AGI, and then only if the taxpayer itemizes deductions rather than taking the standard deduction. I6-3 b. Since $250 of the fee is attributable to Michelle's business, this amount is a for AGI deduction. The remaining $150 is a miscellaneous itemized deduction, subject to the limitation explained in part a. pp. I6-10 and I6-11. I6-15 a. Although Jennifer's lobbying expenses relate to her business, they are not deductible because they are not incurred in an attempt to influence local legislation. b. Yes. Now since the lobbying expenses relate to her business and are incurred in an attempt to influence local legislation, they are deductible. c. Yes. These are in-house expenditures that do not exceed $2,000 for the year. Thus, under the de minimis exception they are deductible. pp. I6-14 and I6-15. I6-16 a. Since Tom is already in the restaurant business, these expenses are incurred in the regular course of his business. As such, they are deductible in the year incurred (last year). b. Since Tom is not in the restaurant business when these expenses are incurred, they are not deductible as business expenses. However, they do qualify for amortization as start-up costs, beginning in the month Tom begins his restaurant business. The Sec. 195 amortization occurs over a 60-month period. Thus, this year Tom may deduct $1,100 [$6,000 total expenses amortized over 60 months equals $100 per month, multiplied by 11 months]. c. Since Tom is not in the restaurant business when these expenses are incurred, they are not deductible as business expenses. Furthermore, since he did not enter the restaurant business, they cannot be amortized and deducted under Sec. 195 either. p. I6-15. I6-17 For travel or entertainment expenses to be deductible, documentation such as account books, logs, receipts, statements of witnesses, etc., must exist. The documentation must substantiate the amount, the time and place, the business purpose, and the business relationship of the person entertained. pp. I6-16 and I6-17. I6-18 Generally, under the cash method of accounting the prepayment of expenses will not result in a current deduction if the expenditure creates an asset with a useful life which extends substantially beyond the close of the taxable year. However, prepaid interest paid in the form of points charged in connection with the improvement of the taxpayer's principal residence may be deducted in the year paid if (1) the loan is secured by the residence, (2) the payment of points is an established business practice, and (3) the amount of the prepayment does not exceed the amount generally charged. If the points are paid to purchase (as opposed to improve) the taxpayer's residence, two additional requirements are that (1) the closing agreement must clearly designate the amounts as points (e.g., a loan origination fee), and (2) the amount must be computed as a percentage of the amount of the loan. pp. I6-19 and I6-20. I6-19 Yes. Inventories must be accounted for using the accrual method. As a result, a cash method taxpayer who has inventory will use both methods of accounting. This constitutes a hybrid method. p. I6-20. I6-4 I6-20 a. Economic performance occurs as the taxpayer actually provides the property or services. b. Economic performance occurs when the property or services are actually provided to the taxpayer. c. For recurring liabilities, economic performance can be treated as having occurred in the year of accrual if all of the following tests are met: (1) The all-events test is met during the year. (2) Economic performance occurs within the shorter of (a) 8 1/2 months after the close of the tax year, or (b) a reasonable period after the close of the tax year. (3) The expense is recurring and the taxpayer consistently treats the item as incurred in the tax year. (4) Either (a) the item is not material or (b) the accrual of the item in the tax year results in a more proper matching against income than accruing the item in the tax year in which economic performance occurs. The recurring liability exception applies only to the following transactions: (1) Another person provides the taxpayer with property or services. (2) The taxpayer uses property. (3) The taxpayer must provide property or services to another person. (4) The taxpayer must make payments to another for rebates, refunds, awards or prizes, insurance or service contracts, and taxes. pp. I6-21 through I6-23. I6-21 Congress enacted the "wash sale" provisions to prevent taxpayers from generating artificial tax losses in situations where taxpayers do not intend to reduce their holdings in the stock or securities that are sold. pp. I6-24 and I6-25. I6-22 Judicial and administrative rulings have held that preferred stock of a corporation is not considered substantially identical to common stock of the same corporation. However, bonds of the same corporation that have maturity dates within a few months of each other have been held to be substantially identical. p. I6-25. I6-23 a. An individual's spouse, brothers and sisters, ancestors, and lineal descendants are considered members of the taxpayer's family for purposes of Sec. 267. b. The term "related parties" under Sec. 267(b) includes (1) an individual and a corporation in which the individual owns more than 50% of the value of the outstanding stock, (2) various relationships between grantors, beneficiaries, and fiduciaries of a trust, a corporation and a partnership if the same persons own more than 50% in value of the stock of the corporation and more than 50% of the partnership, and two corporations if the same persons own more than 50% in value of both corporations and at least one of the corporations is an S corporation. These relationships are I6-5 included because control or influence may be exerted which may keep transaction between the parties from being completely at arm's length. p. I6-26. I6-24 Congress has imposed the concept of constructive ownership to prevent attempts to circumvent the related party rules by dispersing ownership of a corporation while at the same time retaining economic control. p. I6-26. I6-25 On a subsequent sale of the property, the related purchaser may reduce a gain realized by the amount of the disallowed loss. However, the disallowed loss is allowable only to the extent of the gain recognized on the subsequent sale. pp. I6-27 and I6-28. I6-26 The $1,000 income from the hobby is included in Jill's gross income. Since hobby expenses are deductible up to the amount of the income from the hobby, $1,000 of the hobby expenses are potentially deductible. However, they are deductible as miscellaneous itemized deductions subject to the 2% of AGI limit. Thus, unfortunately none of the expenses of the hobby are deductible since they do not exceed this limit ($71,000 x .02) = $1,420. pp. I6-30 and I6-31. I6-27 Under Section 280A, a day of personal use of the vacation home includes any day that the property is used for personal purposes, (1) by the taxpayer or his family, (2) by any individual under a reciprocal-use arrangement, and (3) by an individual not paying a fair rental for the property. p. I632. I6-28 According to the IRS, expenses are allocated to the rental use of a vacation home by the following formula: rental use expenses = number of rental days x total number of days used. total expenses for year However, the Tax Court and the 9th and 10th circuit courts of appeal have held that the allocation of interest and taxes to the rental use is to be done by taking into account all the days in the year. Thus, the denominator in the allocation fraction would be 365 if this approach is used. The expenses allocated to rental use are deducted in the same order as expenses under the hobby loss rules: 1. Expenses that may be deducted even if not incurred in a trade or business or investment activity, 2. Other expenses that could be deducted if incurred in a business or investment activity but which do not reduce tax basis, I6-6 3. Expenses of the vacation home that could have been deducted if incurred in a trade or business or investment activity that do reduce tax basis in the asset. pp. I6-32 and I633. I6-29 If the vacation home is rented out for only 12 days, and if the taxpayer's personal use exceeds 14 days, no rental income and no expenses are reported. Expenses such as interest (if it qualifies as residential interest) and taxes may still be deducted as itemized deductions. If the taxpayer does not have enough personal-use days to qualify the property as a residence (14 days of personal use), the property may be either: (1) an investment or business; or (2) a hobby. pp. I6-32 and I6-33. Issue Identification Questions I6-30 The primary tax issue is whether the exercise equipment qualifies as a trade or business deduction, an unreimbursed employee expense, or is a personal nondeductible expense. A secondary issue is whether the cost of the equipment would be capitalized and depreciated or whether Sec. 179 would apply to permit an immediate write-off of the cost of the equipment (assuming that the equipment is business or employment-related). The facts in this question are similar to those in David A. Kelly, 1991 PH T.C. Memo ¶ 91,605, 62 TCM 1406 where the taxpayer, an employee of Arthur Young & Co., before the purchase of the equipment belonged to two health clubs, but after his long hours of work the facilities were often closed. The court held that despite his need to maintain a rigorous work schedule the health benefits were inherently personal in nature. The Tax Court compared the equipment with eye-glasses and business suits, stating that these too are necessary for business, but due to their personal nature, are not deductible. p. I6-5. I6-31 The primary tax issue is whether the $25,000 payment to the ex-girlfriend is deductible as an ordinary and necessary business expense. To be deductible under Sec. 162(a), an expense must be ordinary and necessary, and incurred in carrying on the taxpayer's trade or business. To be deductible under Sec. 212(1), an expense must be ordinary, necessary, and paid for the production of income. The facts in this question are similar to a tax court case Michael Harden, 1991 PH T.C. Memo ¶ 91,454, 62 TCM 756 in which the court held that the potential charges were personal in nature, rather than of a business nature. Thus, the payment was nondeductible. The threat of termination is a consequence of the personal matter. The taxpayer argued that he would never have paid the amount if the team had not threatened to fire him. However, the tax court held that the reason for the payment was of no consequence. pp. I6-6 and I6-7. I6-32 The primary tax issue is whether the payment of the mortgage interest by Kathleen is deductible as an itemized deduction. The facts in this question are similar to Kathleen M. Emmons, 1961 PH T.C. Memo ¶ 61,290, 20 TCM 1513 where Kathleen was not allowed an interest expense deduction because the indebtedness was not hers. The fact that Molly was Kathleen's dependent was irrelevant to the issue. p. I6-18. I6-7 I6-33 The primary tax issue is whether the activity is a business or a hobby. If the activity is determined to be a hobby, the tax issues focus upon the classification of the deductible amounts and the application of the hobby loss limitation rules. In this situation it appears that the taxpayer did not engage in the activities with the objective to make a profit. Thus, the activity should be characterized as a hobby. Promotional efforts were minimal and the taxpayer made no additional efforts or changes after suffering losses in the prior two years. The taxpayer did not attempt to acquire the expertise necessary to provide evidence that he was highly interested in becoming a professional photographer. pp. I6-5, I6-29, I6-30 and I6-37. I6-34 The primary tax issue is whether the activity is a business or a hobby. If the activity is deemed to be a business, the classification of the income and expenses and the deductibility of the losses needs to be considered. If the activity is deemed to be a hobby, the application of the hobby loss limitation rules needs to be considered. The facts in this situation are similar to Mark A. Stephens, 1991 PH T.C. Memo ¶ 91,383 62 TCM 430 where the activity was held to be a business. In this case, a loss deduction was allowed because the activity was engaged in for profit. The taxpayers conducted the activity like a business. They acquired training and advice from professionals and promoted the business. An accounting system was maintained and they operated the business at the times of demand. The court held that because the taxpayers find the activity enjoyable does not make it a hobby. Note that the company went out of business that year because the taxpayers were unable to obtain liability insurance. pp. I6-5, I6-29, I6-30 and I6-37. Problem I6-35 a. They are all deductible as miscellaneous itemized deductions from AGI. As such, the expenses are subject to the 2% of AGI limitation. Only $225 (0.50 x $450) of the client entertainment is deductible before the 2% limitation is applied. b. If reimbursed they are all for AGI deductions to the extent they are reimbursed. In such event, the 50% limitation on client entertainment applies to the employer. If the expenses exceed the amount of reimbursement the excess expenses are from AGI deductions subject to the 2% of AGI limitation. (See Chapter I9 for a discussion of the treatment of employees expenses.) c. All of the expenses are deductible for AGI because they are incurred in Jermaine's business. They are deductible on Schedule C. Again, only 50% of the client entertainment is deductible by Jermaine. p. I6-4. I6-8 I6-36 AGI Minus: Itemized deductions Medical Minus: 0.075 x $60,000 Taxes Interest Charitable contributions Net casualty losses Minus: 0.10 x $60,000 Miscellaneous itemized deductions Minus: 0.02 x $60,000 Minus: Personal exemption Taxable income $60,000 $5,000 (4,500) 2,000 (6,000) 1,800 (1,200) $ 500 2,000 3,000 1,500 -0600 ( 7,600) ( 2,650) $49,750 pp. I6-3 and I6-5. I6-37 Income: Salary Dividends Interest Rental income Minus: For AGI deductions Maintenance Property taxes Utilities Depreciation Insurance Loss on sale of stock Alimony AGI $57,000 600 1,000 $7,000 $ 300 800 2,400 1,500 600 Minus: Itemized deductions: Medical Minus: 0.075 x $50,000 Taxes Contributions Interest Casualty loss Minus: 0.10 x $50,000 Minus: Miscellaneous itemized deductions Minus: 0.02 x $50,000 Total itemized deductions Personal exemption Taxable income $3,000 (3,750) 6,100 (5,000) ( 100) 800 (1,000) (5,600) 1,400 ( 2,000) ( 8,000) $50,000 -03,000 1,500 4,000 1,000 -0( 9,500) ( 2,650) $37,850 I6-9 pp. I6-3 and I6-4. I6-10 I6-38 1. Replacement of roof - capitalize and depreciate. 2. Repainting of exterior - deduct as an expense. 3. Installation of locks - deduct as an expense. 4. Replacement of broken windows - deduct as an expense. 5. Replacement of crumbling sidewalks and stairs - capitalize and depreciate. pp. I6-9 and I6-10. I6-39 a. Sam may only deduct the $150 expended for the presentation to the county council since these expenses were incurred in direct connection with an appearance before a local council which was dealing with legislation that was of direct interest to Sam's business. The other expenditures are all nondeductible. Furthermore, they exceed the $2,000 de minimis exception. b. Sam may deduct all $2,100. As explained in (a), the $150 expended for the presentation to the county council is deductible under the local legislation exception. Furthermore, since the total of the other expenditures does not exceed $2,000 ($900 + $700 + $300 + $50 = $1,950) they are all deductible under the de minimis exception. pp. I6-14 and I6-15. I6-40 a. building. b. c. d. e. I6-11. Not deductible. The title search should be capitalized as part of the cost of the Deduction for AGI. This is an ordinary and necessary business expense. $400 is a deduction for AGI and $100 is a miscellaneous itemized deduction. Not deductible. This represents a personal expenditure. Deduction for AGI. This an ordinary and necessary business expense. pp. I6-10 and I6-41 Sales Minus: Cost of goods sold Gross Income Minus: Salaries Freight Lease Payments Interest Total Taxable income $500,000 (180,000) $320,000 $ 50,000 15,000 10,000 8,000 (83,000) $237,000 The bribes of $20,000 are not deductible. pp. I6-12 through I6-14. I6-11 I6-42 Taxable income is $320,000 ($500,000 - $180,000). Under Sec. 280E, expenses incurred in the illegal trafficking in a controlled substance are not deductible. Cost of goods sold is not a deduction but is used to compute gross income. pp. I6-12 through I6-14. I6-43 a. The payment is not deductible because it is an illegal bribe paid to a government employee. b. Not deductible if it is unlawful under the Foreign Corrupt Practices Act of 1977. c. Not deductible if the state law making the payment illegal is generally enforced. pp. I6-12 through I6-14. I6-44 a. The expenses are currently deductible because Mario is already in the business of operating entertainment galleries. b. The expenses are currently deductible because Mario is already in the business of operating entertainment galleries. c. Mario may deduct $400 ($3,000/60 x 8 months) in the current year under Sec. 195 which permits the amortization of business investigation expenditures over 60 months. p. I6-15. I6-45 a. The expenses are not deductible because Mario is not engaged in a trade or business. b. Under Sec. 195, Mario can elect to amortize the costs over a period not less than 60 months, starting with the month in which Mario opens the gallery. p. I6-15. I6-46 12-month lease payment ($12,000 x 2/12) Malpractice insurance premiums ($18,000 x 1/36) Drafting services Printing Total deductions $ 2,000* 500 5,000 1,000 $ 8,500 *Note: Following the Zaninovich case cited on p. I6-19 of the text a taxpayer could deduct the full $12,000. Perhaps this is possible in other jurisdictions also. p. I6-19. I6-47 a. Total deductions in the current year are $7,900 ($7,000 mortgage interest + $900 in points which represent interest). b. The other closing costs (appraisal fee and the title search) are added to the cost basis of the home. pp. I6-19 and I6-20. I6-12 I6-48 Date March 8, 1993 October 3, 1998 October 12, 1998 November 1, 1998 Transactions in Western Common Stock Amount Purchases 1,000 shares Purchases 300 shares Sells original 1,000 shares Purchases 500 shares $12,000 3,000 8,500 4,000 a. The recognized loss on the sale on October 12, 1998 is $700. [($8,500 - $12,000) = $3,500 loss x 0.80 = $2,800 disallowed, $700 allowed loss]. b. The basis in the 300 shares purchased October 3, 1998 is $4,050. [$3,000 purchase price + $1,050 (3/8 x $2,800 disallowed loss)]. The basis in the 500 shares purchased November 1, 1998 is $5,750. [$4,000 purchase price + $1,750 (5/8 x $2,800 disallowed loss)]. The holding period for both of these blocks of stock starts on March 8, 1993. c. Nonvoting, nonconvertible preferred stock is not substantially identical to common stock in the same corporation. Thus, the recognized loss would be $3,500. The basis would be the cost of the stock ($3,000 for the October 3 purchase and $4,000 for the November 1 purchase) and the holding period would begin on the date of purchase. pp. I6-24 and I6-25. I6-49 a. Bart's actual and constructive ownership of Apple Corporation stock is as follows: Percentage Ownership Bart (actual) From Bart's wife From Bart's brother Through Delta (1/3 x 35) Through Delta and Bart's brother (1/3 x 35) b. recognized. 10 10 10 11.67 11.67 53.34 Since under Sec. 267 Bart and Apple Corporation are related, none of the loss is Percentage Ownership c. Bart (actual) From Bart's wife Through Delta (1/3 x 35) 10 10 11.67 I6-13 31.67% A brother-in-law is not considered a related party under Sec. 267. The loss is allowed because Bart's actual and constructive ownership is 50% or less. pp. I6-26 and I6-27. I6-50 a. 1. 2. b. 1. 2. c. 1. 2. Jack must report the income in 1998. King Corporation must deduct the expense in the year ending January 31, 1999. Jack must report the income in the year ended December 31, 1999. King Corporation must deduct the expense in the year ending January 31, 1999. Jack must report the income in the year ended December 31, 1999. King must deduct the expense in the year ended January 31, 2000. pp. I6-27 through I6-29. I6-51 a. Since Delta Corporation and Shirley are related parties under Sec. 267, the $15,000 loss is disallowed. b. 1. Shirley will recognize no gain or loss. The $5,000 subsequent gain is reduced by the $15,000 disallowed loss. The entire disallowed loss cannot be used to create a loss on the subsequent sale. 2. There are no tax consequences to Delta Corporation upon the subsequent sale by Shirley. The remaining $10,000 loss is completely lost. c. Shirley will recognize a loss of $10,000 ($70,000 - $80,000 basis). The $15,000 previously disallowed loss is completely lost. d. Shirley will recognize a gain of $10,000 ($105,000 - $80,000 = $25,000 gain, reduced by the $15,000 disallowed loss). pp. I6-27 through I6-29. I6-52 a. The $40,000 ($90,000 - $50,000) realized loss is not recognized because of the Sec. 267 related party rules. James is deemed to own 80% of the Byte stock indirectly through his brother's interest (i.e., Philip owns 100% of ROM which owns 80% of Byte). b. Gain realized ($60,000 - $38,000) $22,000 Minus: Loss previously disallowed of $40,000 (limited to the realized gain) (22,000) Gain recognized by Byte $ -0pp. I6-27 through I6-29. I6-53 No election can be made. The election allows the year in question to remain open with respect to the activity until sufficient years have passed so that the presumptive test may be applied. The election must be made within 3 years after the due date for the year in which the taxpayer first engages in the activity. In this situation, the taxpayer has had losses four out of five years and the profits test is not met during those years. pp. I6-30 and I6-37. I6-14 I6-54 Gross income ($800 + $300) Minus: property taxes $1,100 ( 300) $ 800 Minus: feed and veterinary fees (limited to remaining income) ( 800) $ -0- a. $1,100 ($300 + $800). b. All of the expenses are deductions from AGI since the activity is a hobby. If Chuck itemizes his deductions, all of the property taxes may be deducted and all but $300 of the feed and veterinary expenses may be deducted subject to the 2% of AGI limit on miscellaneous itemized deductions. No depreciation is allowed. c. -0-. None of the depreciation was deducted so the basis of the hutches is not reduced. pp. I6-30 and I6-31. I6-55 Gross income ($1,200 + $300) = Minus: Property taxes Minus: Feed and veterinary fees Minus: Depreciation (limited to remaining income) $1,500 ( 300) $1,200 (1,100) ( 100) -0- a. $1,500 ($300 + $1,100 + $100). b. All of the expenses are deductions from AGI since the activity is a hobby. All of the property taxes and all the feed and veterinary expenses are deductible. However, the deduction for depreciation is limited to $100. The deduction for the feed, veterinary fees and depreciation are miscellaneous itemized deductions subject to the 2% of AGI limitation. c. The cost basis in the rabbit hutches is reduced only by the amount of the depreciation that is deducted, (i.e., $100). pp. I6-30 and I6-31. I6-56 a. b. c. $9,000. Interest and taxes of $3,000 (60/80 x $4,000) are for AGI deductions.* The remaining taxes of $250 and interest of $750 (if the interest is qualified residence interest) are deductions from AGI. Insurance (60/80 x $500) = $375 for AGI deduction. Repairs and Maintenance (60/80 x $700) = $525 for AGI deduction. Utilities (60/80 x $800) = $600 for AGI deduction. Depreciation of $4,500 for AGI deduction (60/80 x $8,000 = $6,000; but limited to $4,500 remaining income). The nondeductible part of the depreciation allocated to the rental ($1,500) may be carried over to the next year. Basis is reduced by $4,500. I6-15 *Note, however, that if the approach sanctioned in the Bolton case (see the discussion on page I6-40 and footnote I121 in the text) is used, $658 (60/365 x $4,000) of interest and taxes would be allocated to the rental portion leaving more of the second and third tier expenses to be deductible. pp. I6-31 through I6-34. I6-57 Since Kim used the condominium over 14 days during the year for personal purposes, it qualifies as a residence. The condo was rented out for less than 15 days during the year. Thus, Kim will report no income or deductions from the property. However, Kim may deduct the property taxes from AGI, and if Kim chooses the condominium as her second personal residence, she also can deduct the interest from AGI. pp. I6-31 through I6-34. I6-58 1. Since the building lot was sold to Bryce's brother, the $5,000 loss is disallowed. Bryce realized a $3,000 ($8,000 - $5,000) gain on the sale of Gold Corporation stock, a $4,000 loss ($5,400 - $9,400) on the sale of the Silver stock, and a $2,000 gain ($12,000 - $10,000) on the sale of the United stock. All $5,000 of the gain is recognized. However, since Bryce purchased 100 shares of Silver Corporation stock within 30 days before the sale of the Silver Corporation stock, one-half of the loss is disallowed. Thus, only $2,000 (0.50 x $4,000) of the loss is recognized. Bryce's fly-tying activities appear to be a hobby. Thus, the deductible expenses are limited to the gross income generated from the activity. Furthermore, they are all deductions from AGI. Gross Income Minus: Property Taxes $2,500 ( 125) $2,375 Other Expenses ($2,900 + $270 + $200 = $3,370; but limited to the remaining income) (2,375) $ -0- 2. Bryce's total itemized deductions are $7,500 ($125 taxes + $2,375 hobby deductions + $5,000 other). However, the itemized deductions (other than the property taxes) are reduced by 2% of Bryce's AGI. Bryce's AGI equals $85,500 ($80,000 + $3,000 net capital gain + $2,500 hobby income.) Thus, Bryce's total itemized deductions equal $5,790, computed as follows: Taxes Miscellaneous itemized deductions: Other Hobby expenses Minus: 0.02 x 85,500 3. $ 125 $5,000 2,375 $7,375 (1,710) 5,665 $5,790 Bryce's basis in the Silver stock is $4,800 ($2,800 + $2,000 disallowed loss). I6-16 pp. I6-24 through I6-26. Tax Form/Return Preparation Problems I6-59 (See Instructor's Guide) I6-60 (See Instructor's Guide) I6-61 (See Instructor's Guide) Case Study Problems I6-62 (See Instructor's Guide) I6-63 (See Instructor's Guide) Tax Research Problem I6-64 (See Instructor's Guide) I6-17