D d ti Ed ti E Deducting Education Expenses

advertisement

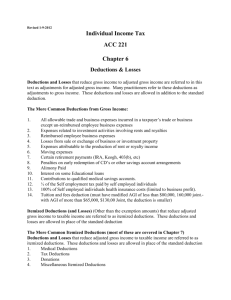

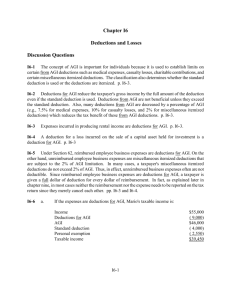

D d ti Education Deducting Ed ti Expenses E Presented by Michael Fontanello of Fontanello, Duffield and Otake, LLP 44 Montgomery Street, Suite 2019, San Francisco, CA 94104 (415) 983-0200 at University of California, California Berkeley Haas School of Business Introduction • Tax law can come from each of the three branches of government – Legislative: Internal Revenue Code (IRC) – Executive: Revenue Rulings, Revenue Procedures, and Letter Rulings from the Internal Revenue Service (IRS), a branch of the Treasury Department – Judicial: Court decisions regarding tax law can come from almost any court in the judicial system, with the Supreme Court being the highest authority Introduction • Income taxes are collected from businesses, individual taxpayers, and other entities • Individual taxpayers historically account for about 45% of annual tax revenues in any given year • Income tax rates for individuals are progressive (S S (See Supplemental l t l IInformation, f ti pg. 6 off handout) Introduction • Total tax liability for any taxpayer is calculated based on total income, taxable income, applicable exclusions, deductions, exemptions, and credits • Deductions from Adjusted Gross Income (AGI) are the greater of the two of either the standard deduction or itemized deductions Introduction • Deductions for AGI can include business expenses, property rental expenses, moving expenses, contributions to an IRA, other allowable deductions • IRS examinations • During an audit, audit taxpayers are asked to substantiate deductions, credits, or income items reported p on a tax return Deducting Education Expenses • Each taxpayer should take into account their specific facts and circumstances, the tax code, and d applicable li bl ttax llaw tto d decide id whether h th certain t i available deductions or credits are applicable to their individual situation Deducting MBA Education Expenses • Qualifying attributes for deductibility of education expenses – Enrolled at least half time in degree program – Citizenship – Un-reimbursed Un reimbursed business expenses Deducting MBA Education Expenses • Deductible education expenses can include: – – – – Tuition and fees Lab fees Required books and equipment Room and Board Case Law About Deductibility of MBA • Daniel r. Allemeier, Jr. v. Commissioner – Employee must typically have a particular degree before being hired – Deductions of education expenses have usually been disallowed when the education qualifies the taxpayer to enter a new trade or business – New titles or abilities do not necessarily equate to entering a new business Case Law About Deductibility of MBA • Singleton-Clarke v. Commissioner – IRS allowed a deduction of $14,787 in education expenses for obtaining an MBA – Taxpayer had worked as an RN for 24 years prior to seeking an MBA – Taxpayer paid the entire cost of her MBA out-ofp pocket Case Law About Deductibility of MBA • Singleton-Clarke v. Commissioner (cont.) – Performance of services as an employee p y constitutes a trade or business – An employee must not have the right to reimbursement of education expenses from an employer in order to deduct – Education expenses p are not deductible if they yq qualify y a taxpayer for a new trade or business Specific Deductions, Credits and Tax Benefits for Education • Specific deductions, credits, or tax benefits available relating to education expenses (See supplemental information) – Lifetime Learning Credit – Student St d t L Loan IInterest t t Deduction D d ti – Scholarships, Fellowships, Grants and Tuition Reductions – Employer Provided Educational Assistance – Education Exception on Early IRA Distributions