Sen. Appropriations

advertisement

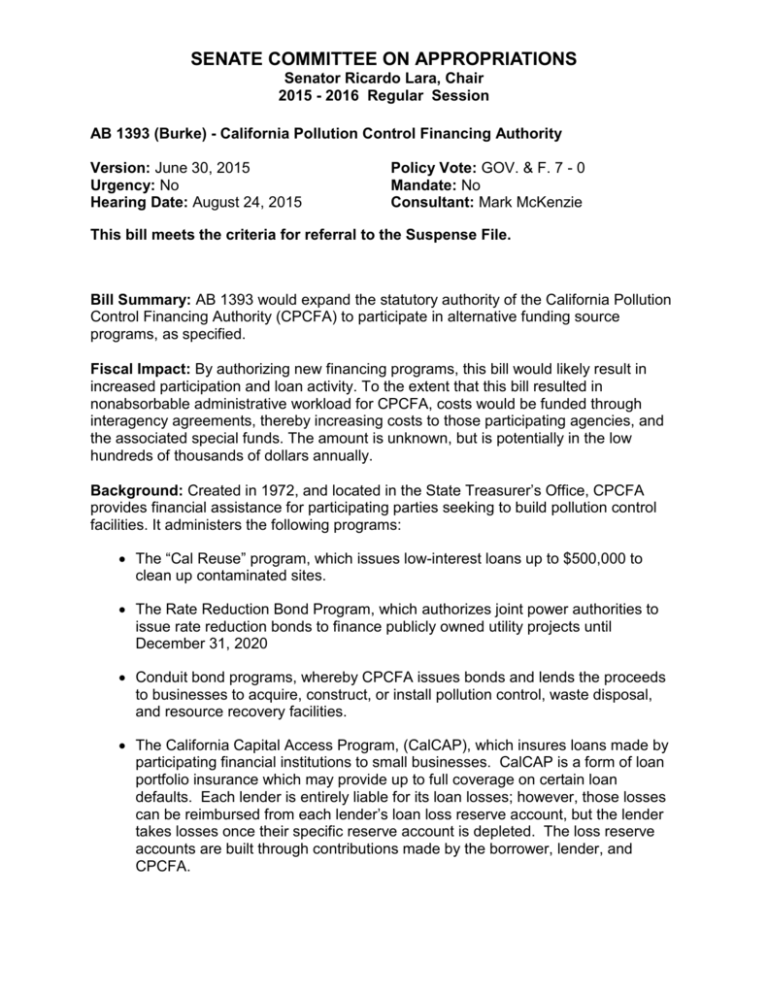

SENATE COMMITTEE ON APPROPRIATIONS Senator Ricardo Lara, Chair 2015 - 2016 Regular Session AB 1393 (Burke) - California Pollution Control Financing Authority Version: June 30, 2015 Urgency: No Hearing Date: August 24, 2015 Policy Vote: GOV. & F. 7 - 0 Mandate: No Consultant: Mark McKenzie This bill meets the criteria for referral to the Suspense File. Bill Summary: AB 1393 would expand the statutory authority of the California Pollution Control Financing Authority (CPCFA) to participate in alternative funding source programs, as specified. Fiscal Impact: By authorizing new financing programs, this bill would likely result in increased participation and loan activity. To the extent that this bill resulted in nonabsorbable administrative workload for CPCFA, costs would be funded through interagency agreements, thereby increasing costs to those participating agencies, and the associated special funds. The amount is unknown, but is potentially in the low hundreds of thousands of dollars annually. Background: Created in 1972, and located in the State Treasurer’s Office, CPCFA provides financial assistance for participating parties seeking to build pollution control facilities. It administers the following programs: The “Cal Reuse” program, which issues low-interest loans up to $500,000 to clean up contaminated sites. The Rate Reduction Bond Program, which authorizes joint power authorities to issue rate reduction bonds to finance publicly owned utility projects until December 31, 2020 Conduit bond programs, whereby CPCFA issues bonds and lends the proceeds to businesses to acquire, construct, or install pollution control, waste disposal, and resource recovery facilities. The California Capital Access Program, (CalCAP), which insures loans made by participating financial institutions to small businesses. CalCAP is a form of loan portfolio insurance which may provide up to full coverage on certain loan defaults. Each lender is entirely liable for its loan losses; however, those losses can be reimbursed from each lender’s loan loss reserve account, but the lender takes losses once their specific reserve account is depleted. The loss reserve accounts are built through contributions made by the borrower, lender, and CPCFA. AB 1393 (Burke) Page 2 of 3 Prior to 2010, CalCAP was funded from small business assistance fees collected from its bond issuance; however, the Legislature appropriated $6 million to the program from the General Fund in 2010. CalCAP loans can be used to buy land, construct or renovate buildings, purchase equipment, and fund other projects and working capital. Maximum loan amounts are $2.5 million. In recent years, CalCAP has grown significantly due to federal funding under the State Small Business Credit Initiative: CPCFA received $27.8 million in 2011, the same amount again in 2013, and is likely to receive the same amount for the third time in 2015. In 2014, CalCAP recruited 10 new lenders to participate in the various programs, and 43 lenders enrolled loans. CalCAP lenders enrolled 3,491 loans totaling $247 million in 2014, an increase of about 8 percent in the number of loans and 20 percent in the amount of money loaned compared with 2013. CPCFA also administers a loan loss reserve program funded by the Air Resources Board (ARB) to assist owners and operators of small fleets of heavy-duty diesel trucks achieve early compliance with ARB’s Statewide Truck and Bus Regulation designed to reduce diesel particulate matter emission. Additionally, the California Energy Commission selected CPCFA to provide financial incentives to both lenders and borrowers to purchase and install electric vehicle charging stations at California businesses. The program provides rebates to borrowers who participate, and may provide lenders with up to 100 percent coverage on certain loan defaults. Proposed Law: This bill would (1) specify that CPCFA can provide financial assistance in the form of loans, grants, credit enhancement, and any other incentive to leverage private capital, and (2) authorize CPCFA to provide loan loss reserves to any person, company, corporation, public agency, partnership, or firm engaged in activities in furtherance of a public or quasi-public entity’s policy objectives in the state that require financing. As part of its participation with financial institutions to provide loan loss reserves, the measure would allow CPCFA to adopt the policies of those financial institutions, which it must adopt publicly. Staff Comments: CPCFA is one of nine independent financing authorities, is chaired by the State Treasurer, and was part of the broader modernization of the State Treasurer's Office under Jesse Unruh. With the Tax Reform Act of 1986 and the rise in the use of private activity bonds, CPCFA played a major role in establishing a costeffective means for using tax exempt bonds to fund important pollution control projects and facilities. More recently, however, pollution control private activity bonds are not as much in demand and its own annual reports indicate that CPCFA's work on brownfields has lessened. The most active program at the CPCFA is CalCAP. This bill would leverage CalCAP's current statutory authority and financing expertise to help other public and private entities meet their respective financing needs. In implementing these statutory changes, CPCFA would obtain broad program authority in order to respond to current and potential future financial opportunities. CalCAP was statutorily established in 1994 for the purpose of incentivizing financial institutions to provide small businesses with the capital to maintain and grow their business. The program uses a portfolio-based credit enhancement model, whereby a loss reserve fund is established with the participating lender to offset potential losses of enrolled small business loans. AB 1393 (Burke) Page 3 of 3 Unlike a loan guarantee which ensures payment in the case of default on a certain percentage of the value of the loan, under the loss reserve fund model, the lender has access to the full loss reserve account and can recover 100 percent of the default, if the account has sufficient funds. The model encourages lenders to maintain good underwriting practices because using the loss reserve often can quickly draw-down the reserve leaving little for other potential defaults within the portfolio. The State Treasurer is sponsoring this bill to authorize CPCFA to develop another financial arrangement with ARB. Specifically, CPCFA would administer an alternative funding source program involving residential customers. Under CPCFA's current statutory structure, the alternative funding source program could narrowly be interpreted to only allow small business loss reserve programs with only minor alternation. The bill would provide CPCFA with greater program flexibility to assist the ARB and other public and private entities. However, to the extent that increased workload results, increased CPCFA administration costs would be funded via interagency agreements, thus increasing costs to the corresponding partnering agencies, and the special funds associated with programs whose activities are funded through CPCFA.. -- END --