Test Your Knowledge

advertisement

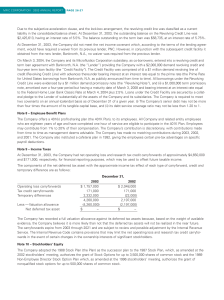

A B C Question 1 Credit is an arrangement whereby A • You owe something, typically money, or something is due. • You receive goods, services, or money in exchange for a promise to repay at a later date. • You set money aside that you can access quickly for unexpected expenses. Question 2 The opportunity cost of using credit is the A • Purchasing power of future money for past purchases. B • The previous earning power of money spent on interest and fees. C • Current purchases, interest, and fees. Question 3 The type of credit that you get when a lender allows you to borrow an amount for a specific purpose for a specific amount of time at a given interest rate is called A • Installment/term credit. B • Noninstallment/service credit. C • Revolving credit. Question 4 The price that you pay for the use of money you borrow from a lender is called A •Principal. B •Interest. C •Loan term. Question 5 The annual percentage rate (APR) is A • The total cost of credit to the lender. B • Finance charge expressed as an monthly rate. C • The interest rate for the whole year. Question 6 A credit card is A • A type of credit that requires full payment by a specified date. B • A credit tool with a limited number of monthly transactions. C • A high-interest, revolving, unsecured loan. Question 7 A credit report is A • A summary of loan and bill payments kept by a credit bureau. B • A profile of your nationality, educational attainment, and credit obligations. C • An active data file kept by the credit bureau for 10 years. Question 8 Also known as your “financial GPA,” a credit score is A • An annualized number that measures how you handle your financial obligations. B • A snapshot of your level of risk to a lender at a specific point in time. C • A single factor used to make lending decisions. Question 9 The two components that make up the greatest percentage of the total credit score are A • Length of credit history and overall credit. B • New credit and types of credit used. C • Payment history and amounts owed. Question 10 Having an accurate credit report is important because A • Positive information increases credit opportunities and decreases the cost of borrowing. B • Negative information reduces credit opportunities, increases the cost of borrowing, can impact service credit, and can eliminate some job offers. C • All of the above. Thank you for participating in “Test Your Knowledge”