First Nations Market Housing Fund - Oct 24

advertisement

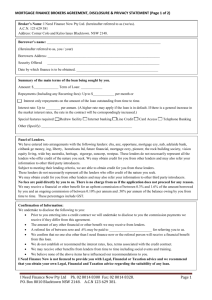

Housing Investments in First Nation Click to add Communities title Click to add First Nation Click to add date Southern TC and Large/Unaffiliated First Nations Meeting - Rama, Ontario October 24-25th 2012 1 ©2008 FNMHF Our Vision EVERY FIRST NATION FAMILY HAS THE OPPORTUNITY TO HAVE A HOME ON THEIR OWN LAND IN A STRONG COMMUNITY 2 ©2008 FNMHF About the Fund… • Launched May 5, 2008 • Designed to support market housing arrangements between First Nations and lenders • $300 million federal investment • Intended to leverage $3 billion in on reserve housing investment across Canada • Goal is to create 25,000 new homes on reserve • More than 80 First Nations have applied to date 3 ©2008 FNMHF # of First Nation Applications Received by the Fund / Total # of FNs in each Prov./Territories (October1, 2012) 0/0 5/14 0/29 LB 16/202 6/63 6/47 6/75 4/40 34/134 5/35 4 ©2008 FNMHF Success to Date • 82 applications received from First Nations • 33 applications approved for Credit Enhancement and Capacity Building • 17 First Nations approved for Capacity Development only • 8 lenders approved to participate 5 ©2008 FNMHF …about the Fund • New tool to create more on reserve housing Homeownership Rental units Renovations • Respects communal ownership of reserve lands • Only First Nations can apply • Developed with input from AFN, First Nation communities and organizations across Canada 6 ©2008 FNMHF How does the Fund support investments? • 10% backstop for housing loans guaranteed by First Nation governments • Leverage to negotiate with lenders - lower interest rates - reduced program access fees - risk sharing - administrative arrangements • Capacity Development 7 ©2008 FNMHF Building Investment Readiness Financial Land Tenure Administrative, HR, Housing & Ec Dev Policies and Laws Management FN Community System Commitment Education & Awareness Governance at Management & Leaders Level 8 ©2008 FNMHF Building on the success of Innovative FN Communities • Gives FN a powerful means to attract investment in other areas such as schools, water and other infrastructure – at competitive rates • Contributes to sustainability of housing –where individuals pay – thus allowing FN funding to be targeted elsewhere. • Housing as an Economic Driver – creates individual wealth, jobs, improves quality of life 9 ©2008 FNMHF Access Criteria Supports Greater Investment Readiness • • Access Criteria are based on principles, not rules and separated into three main pillars: 1. Financial Management 2. Good Governance 3. Community Commitment and Evidence of Demand for Market-Based Housing First Nation chooses how they best satisfy each principle 10 ©2008 FNMHF Each First Nation makes choices within parameters: • Housing loan types • Loan characteristics – amortization periods • Maximum loan amounts • Lenders • Guarantee conditions 11 ©2008 FNMHF 1st Fund-backed home -Membertou 2011 12 ©2008 FNMHF Interior Reno Project - 2012 13 ©2008 FNMHF FN Renovations Project - 2012 14 ©2008 FNMHF Profile of First Nations approved to date for Credit Enhancement • More than $430 million of housing investment over 5 years - 33 First Nations • Homeownership contemplated in all – plus some with renovations, rentals, elders and foster homes • Rural, remote, urban locations • Small to large size populations – a few hundred to several thousand members 15 ©2008 FNMHF CAPACITY DEVELOPMENT 16 ©2008 FNMHF FNMHF Capacity Development Program • Provides support for First Nation communities that want to use the Fund and meet most criteria but have areas which require strengthening • The Fund’s Capacity Development Program focuses on the three pillars of the Access Criteria. • 50 communities approved so far 17 ©2008 FNMHF Outcomes of Capacity Development • Stronger regulatory framework, embraced by citizens, that guides the delivery of programs and services by a First Nation government and attracts investments • Stronger workforce with skills, knowledge and attributes needed to serve First Nation citizens • Better informed citizens understanding how their actions impact their community, making informed decisions 18 ©2008 FNMHF What types of services will be delivered? • Developing a Regulatory Framework that includes: • Updating and implementing housing and finance policies • Developing land use by-laws, codes, registries, and security of tenure • Accredited training for staff including financial, technical, housing, economic development & land management • Home ownership and rental training sessions 19 ©2008 FNMHF How are capacity development needs assessed? • First Nation performs a self-assessment as part of the application process • Fund and First Nation will agree upon needs and a development plan • Delivery will be completed by Aboriginal contractors whenever possible 20 ©2008 FNMHF What happens when a First Nation is approved for Capacity Development? • Letter of Agreement signed, good for up to 3 years • Identifies areas of financial support from the Fund in financial management, governance and community commitment • As First Nation has time to work on specific initiatives, the deliverables and timelines are identified and costed 21 ©2008 FNMHF Sample of Current CD Support • Managerial Training for FN Staff • Customized Sage ACCPAC Training - FN level • AFOA Course Tuition Fees – First Grad • Arrears Management process and system • Toast Masters – Public speaking • Updating Financial Administration Policies • Updating and creating new Housing Policies • Water and Sewer Technical Training – Community College • Lot Surveys for Market Based Housing. 22 ©2008 FNMHF Land Tenure - CD Initiatives • Capital Planning – Engineering studies – • Land Management Development – Land Management System Land - FNs own registry system Land staff training – on-site - NALMA Matrimonial Real Property Law • Comprehensive Community Planning – • Property Management – Construction Standards and zoning policies/by-laws 23 ©2008 FNMHF FN announced for Credit Enhancement as at Oct 1, 2012 • Miawpukek NF • Moose Cree ON • Membertou NS • Serpent River ON • Lac La Ronge SK • Hiawatha ON • Batchewana ON • M’Chigeeng ON • Onion Lake SK • St. Mary’s BC • Atikameksheng • Mississauga ON Anishnawbek ON • Siksika Nation AB • Whitefish River ON • Tit’q’et BC • Champagne & Aishihik YK • Neskonlith BC • Sagamok ON • Nipissing ON • Seabird Island BC • Wikwemikong ON • Tk’emlups BC 24 ©2008 FNMHF Benefits to First Nation • Expands housing options for First Nations • Complements existing programs and helps strengthen systems • Attracts more private financing and encourages competition among lenders • No Ministerial Loan Guarantees • Promotes creation of a housing market 25 ©2008 FNMHF Summary of FNMHF Approach • No fees or service charges for what we do • Strength for policies, process and people • Tools are available to improve investment readiness across the First Nation • Land Tenure a key feature of a sustainable approach • Investments – loan backing and capacity development funding • Supports the First Nation’s goals 26 ©2008 FNMHF Interested in learning more about the Fund? Visit our website www.fnmhf.ca Talk to participating First Nations Invite us to present to your leadership and senior staff or to future gatherings we accept all First Nation invitations 27 ©2008 FNMHF First Nations Testimonials • “The Market Housing Fund is an important step for our people. TIB is always looking at innovative solutions towards meeting sustainable housing for our membership.”— Chief Shane Gottfriedson (Dec 2010) • “We are excited to see our citizens and Community keep moving forward towards healthier and harmonious families.” — Chief Shining Turtle (July 2011) • “The First Nations Market Housing Fund is the next opportunity in addressing our housing back log. This is another option for community membership who want to buy, build, or renovate. It’s more than just a program, it will strengthen our housing and indeed our community.” — Chief Sandra Moore (July 2011) • “The Seabird Island Band is looking forward to working with the First Nations Market Housing Fund on another avenue for housing. It has been needed for a long time.”— Chief Clem Seymour (December 2010) 28 ©2008 FNMHF THANK YOU! Miigwetch! 1-866-582-2808 1-866-582-2808 Direct Line: 1-613-740-9931 Direct Line: 1-613-740-1381 info@fnmhf.ca info@fnmhf.ca www.fnmhf.ca www.fnmhf.ca dtaylor@fnmhf.ca ecommand@fnmhf.ca 29 ©2008 FNMHF