Chapter_3_Notes

advertisement

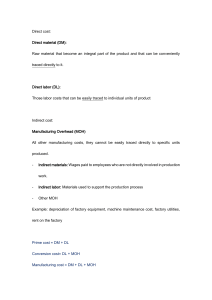

MBA 631 Chapter 3 Notes 1. General Product Cost terms: a. Direct Materials (DM) b. Direct Labor (DL) c. Manufacturing Overhead (MOH) also referred to in text as Manufacturing Support d. Product Cost (also known as Manufacturing Costs) = DM + DL + MOH e. Conversion costs (what it costs to convert raw materials into product) = DL + MOH 2. Job order costing a. Identifiable, unique jobs b. Cost traced to job 3. Process costing system a. Product result of various processes i. Products are (homogeneous) identical: ii. Examples 1. refinery 2. bakery b. Cost traced to process: then per unit (per hr) cost determined and used for product support cost (conversion costs) added to DM 4. Three inventories a. Raw Materials Inventory (RM) b. Work-in Process Inventory (WIP) c. Finished Goods Inventory (FG) 5. Cost Flow: Raw Materials (increased by purchases of RM decreased by issuing material to WIP) Work in Process (increased by RM issued which are termed DM, the DL is taken from payroll records, and MOHapplied is taken from the MOH account. The MOH account may not end with a zero balance and any remainder is either closed into WIP or prorated between WIP, FG, and COGS. When goods are completed, the total DM, DL, and MOH needed to complete these goods is added together. The total of the mfg. costs for goods that have completed the production process (DM+DL+MOHapplied) is the COGM – cost of goods manufactured COGM decreases WIP for the product costs for goods transferred to the Finished Goods inventory. Thus COGM increases FG inventory. When goods are sold the cost of goods sold is transferred from FG inventory on the balance sheet to the income statement using the COGS account – which is an expense account. So the COGS decreases FG and increases the expense account). MBA 631 Ch. 3 Notes 6. Job cost sheet a. Used to estimate costs for job to set bid price and used to accumulate costs as job processes through system i. Lists: DM, DL, MOH 7. Cost drivers How to apply costs other than DM + DL (that is the Manufacturing overhead or support costs) Cost driver rate = Cost of Support Activity/Level of Cost Driver You use the estimates of expected costs and levels of usage to calculate the rate. Then you take that rate and multiply it times the actual level of usage to calculate the amount of the manufacturing overhead (support costs) to be applied to the production. Examples on next page 2 MBA 631 Ch. 3 Notes Examples 3-24) a. 60,000/4000 = $15 per DLH (direct labor hour) b. Assembly = DLH 35,000/3000 = $11.67 per DLH Cutting = Machine Hours (MH) 25,000/4000 = $6.25 per MH Why a? Ease of use Why b? Cost flow estimation better In class example illustrative data Job costing: JOB107 If single rates $606.24 126.00 180.00 $912.24 DM: 48 board ft @ 12.63 per ft. DL: 12 hours @ 10.50 /hr MOH: $15 per DLH ($15 * 12) Manufacturing Cost Additional Data 8 machine hours for job107 in Cutting 4 DL hours for job107 in Assembly If multi rates $606.24 126.00 46.68 50.00 $828.92 DM: same as above DL: same as above MOH assembly: ($11.67 * 4DLH) MOH cutting: ($6.25 * 8 MH) Manufacturing Cost Problem on next page.. 3 MBA 631 Ch. 3 Notes 3-27 200,000/10 = 20,000 Baddy $412,000 (DM $232000 + DL $120000 + MOH $60000) + 20,000 Baddy cost 432,000 Mfg costs 432,000/200,000 = $2.16 lb of Goody (cost per lb) 4