Managerial Accounting Study Guide

advertisement

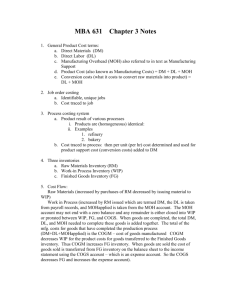

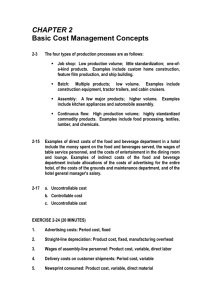

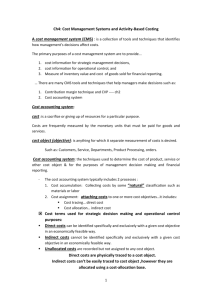

Managerial Accounting Study Guide Created by Kersten Foulds, Accounting and QA Peer Tutor Terms you should know: - Raw Material Inventory - Work in Process (WIP) Inventory - Finished Goods inventory Marginal Cost is the cost of making ONE unit The Value Chain Research & Development Design Production or Purchases Marketing Distribution Customer Service Formulas: Direct Materials $ + Direct Labor $ + Manufacturing Overhead $ = Inventoriable product cost $ *MOH includes indirect materials, indirect labor, and other indirect manufacturing overhead Prime Costs = Direct Materials + Direct Labor Conversation Costs = Manufacturing Overhead + Direct Labor Total Costs = Total Fixed Cost + (Variable cost per unit x # of units) Average Cost per unit = Total cost/# of units **Important: the average cost per unit is valid only at ONE level of output; NEVER use average costs to forecast costs at different output levels Process Costing vs. Job Costing Process: used by companies that produce large numbers of identical units in a continuous fashion; factory/assembly line production Job: assigns cost to a specific unit or to a small batch of products; companies that produce products to the customer’s specifications Steps to Allocating Manufacturing Overhead to Jobs: 1. Allocation base common denominator that links indirect manufacturing overhead costs to the cost objects 2. Predetermined MOH rate = (Total estimated MOH costs) (Total estimated quantity of the MOH allocation base) 3. MOH allocated to a job = Predetermined MOH rate x Actual quantity of the allocation base used by the job This handout is provided by the CLR. Equivalent Units used to express the amount of work done during a period in terms of fully completed units of output Activity-Based Costing (ABC) Focuses on ACTIVITIES as the fundamental cost objects Steps: 1. Identify the activities 2. Estimate the total indirect costs associated with each activity 3. Identify the allocation base for each activity’s indirect costs (primary cost driver) 4. Estimate the quantity of each allocation base 5. Compute the cost allocation rate for each activity: Activity cost allocation rate = Estimated total indirect costs of activity Estimated total quantity of cost allocation base 6. Obtain the actual quantity of each allocation base used by the cost object 7. Allocate the costs to the cost object Allocated activity costs = activity cost allocation rate x Actual quantity of cost allocation based by the cost object **REMEMBER: When volume increases then total variable costs increases; fixed cost per unit of activity decreases When volume decreases then total variable costs decreases; fixed cost per unit of activity increases --Total variable cost (y) = variable cost per unit of activity (v) x volume of activity (x) -- Total fixed costs (y) = fixed amount over a period of time (f) -- Total mixed costs (y) = variable cost component (vx) + fixed cost component (f) Components of CVP Analysis (Cost-Volume-Profit) - Sales Price (the price charged for each unit) - Volume (the # of units sold) - Variable costs (such as the cost of the units from suppliers) - Fixed costs (such as the monthly charges/costs) - Profit/Loss (the operating income provided by the business *If you are missing one of these components, you can use CVP analysis to determine that part Contribution Margin Sales in Units = Fixed Expenses + Operating income Contribution Margin per unit Regression Analysis (use Excel information – y=b0x+b1) This handout is provided by the CLR.