Accounting Based Equity Valuation Model: One Period

advertisement

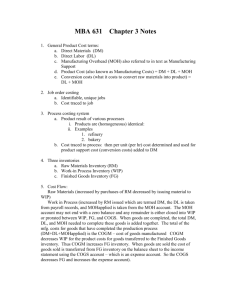

ACCT 2302 Fundamentals of Accounting II Spring 2011 Lecture 8 Professor Jeff Yu Review: CVP Analysis Expected profit (NOI) may change due to: a change in fixed expenses a change in CM per unit (=price - VC/unit) a change in sales volume: once the break-even point has been reached, NOI will increase by CM per unit for each additional unit sold. Two approaches to predict profit using CVP analysis: 1)Income Statement approach 2)Incremental approach: ΔNOI = ΔCM – ΔFE Review Margin of Safety (units, sales, percentage) Degree of Operating Leverage Sales Mix and Break-even Analysis Midterm Exam Information Monday, February 21: class time & in the classroom. The exam will cover lectures 1 through 8 and chapters 2, 3, 5, and 6. Please plan to arrive 10 minutes earlier. The exam will start when everyone in the room has an exam packet and will stop promptly after 100 minutes or the end of the class, whichever comes earlier. Please spread out as much as possible when you get seated. I may ask you to change seats if I determine that you sit too close to the other student. Your cooperation will expedite the exam handout process so that all students will have more time to work on the exam. This is a closed-book exam and you may not use any cheat sheet. I may choose not to answer your question during the exam, to be fair. You will need a non-programmable calculator. Please bring one! Type of questions Multiple Choice Questions (6%) No partial credit Problems (94%) Show your work with legible and carefully labeled computations so that I can assign partial credit. If I cannot understand your computations, I will not assign partial credit. Similar to practice problems in the lecture notes and HW problems. Practice exam questions (based on past years’ exam) posted on the class website for your information only. (warning: this year’s exam questions may be different!) Studying for the exam • • • • • Carefully study lecture notes Re-work problems in the lecture notes Re-work HW and quiz problems Work on practice exam questions on the class website If you need more practice, use the review problem at the end of each chapter in the textbook. • Don’t look at the solutions before you have made at least one serious attempt to solve each problem. • Come to TA’s or my office hours to clarify difficult materials. TA office hours this Thursday 2:30pm-4pm Additional office hours? There will be no office hour on Monday, Feb 21 (to be fair with section 1 students) After the exam • I will post the exam solutions on the class website • I will try my best to post your exam grades on Blackboard ASAP. Please understand that it takes a lot of time to assign partial credits and I will be working extremely hard to ensure that I grade your exam consistently and fairly. • I will return the graded test to you ASAP. Grade disputes procedure is written in detail on the syllabus. Review: what do managers do and how MA can help Formulating long-and short-term plans Begin (Planning) Comparing actual to planned performance (Controlling) Decision Making Implementing plans (Directing and Motivating) Measuring performance (Controlling) MA provides information that help managers make decisions throughout the planning and control cycle. Review: Managerial vs. Financial Accounting Financial Accounting Users Time Focus Emphasis Verifiability and Precision Subject The whole Organization Follow GAAP Requirement Managerial Accounting Review: cost behavior __________ per unit does NOT change when activity level changes. Total ____________ does NOT change when activity level changes. ________________ increases when activity level increases. ________________ decreases when activity level increases. ________________ is the range of activity within which the assumptions about cost behavior are valid. Review: cost classification for decision making ______________ are costs that differ between two (or more) alternatives. ______________ is the value of the next best alternative foregone as the result of making a decision. ______________ is a cost that has already been incurred and cannot be changed by any decision made now or in the future. ______________ is not a differential cost and should be ignored when making decisions. Review: cost terms under Absorption Costing Manufacturing Costs = ________ Costs Direct Material Direct Labor Marketing/ Selling Costs Manufacturing Overhead Administrative Costs Nonmanufacturing Costs = _______ Costs Review: Manufacturing Cost Flows Costs Balance Sheet Inventories Income Statement Expenses Raw Material Purchases Direct Labor Manufacturing Overhead Goods Sold How to show product cost flows using T-accounts? Review: Job-order costing vs. Process costing A firm making built-to-order products typically use ___________ costing. A firm mass-producing a single product typically use _________ costing. Under job-order costing, product costs are accumulated by _______ to get the average product cost for each unit. Under process costing, product costs are accumulated by _______ to get the average product cost for each unit. Service companies typically use ______________ costing. Both job-order costing and process costing are _______ costing systems. Review: MOH Application in job-order costing Manufacturing overhead is applied (allocated) to individual jobs (work-in-process) based on a ___________ rate (POHR). At the ________ of the period, calculate: POHR = Estimated total MOH cost / __________ total activity level ________ the period, calculate: Applied MOH = POHR * ________ activity level At the _______ of the period, calculate: _______ MOH - Applied MOH to determine whether MOH was underapplied or overapplied. Review: Job-Order Costing 1. If Applied MOH>Actual MOH, then MOH is ________ for the period. If Applied MOH<Actual MOH, then MOH is __________ for the period. 2. What is the journal entry to apply MOH to jobs during the period? 3. What is the adjusting journal entry to close the overapplied (underapplied) MOH to CGS at the end of the period? Review: Product Cost Flow in Job-order Costing Direct Materials Direct Labor Applied MOH Work-in-Process (JOB) Finished Goods Cost of Goods Sold Review: Cost Behavior True Variable Cost (a=0, b>0) Total cost: Y=bX, increases with X Average cost: Y/X=b, constant Fixed Cost (a>0, b=0) Total cost: Y=a, constant Average cost: Y/X=a/X, decreases with X Mixed Cost (a>0, b>0) Total cost: Y=a+bX, increases with X Average cost: Y/X=a/X + b, decreases with activity level X. Review: Cost Function & High-low Method Cost Function: Y = a + bX (1) Select the highest- & the lowest- activity levels: Xh, Xl (2) Fit a line through the two data points: (Xh, Yh), (Xl, Yl) Yh =a + bXh Yl =a + bXl b=(Yh - Yl)/(Xh - Xl) a= ? The slope of the line: b = Variable Cost per unit The intercept of the line: a = Total Fixed Cost Review: The Contribution Format Income Statement Used primarily for external reporting Used primarily for Managerial Decision making Review: The Contribution Margin Method Break - even Point in Units Fixed Expenses CM per Unit Break - even Point in Sales Dollars Units sales to attain Target Profit Fixed Expenses CM Ratio Fixed Expenses Target Profit CM Per Unit Review: The Equation Method Let B.E.P. in units = X Sales – Variable Expenses – Fixed Expenses = NOI Price * X VC/unit * X $$$ B.E.P in sales dollars = B.E.P. in Units * Price $0