chapter 7

advertisement

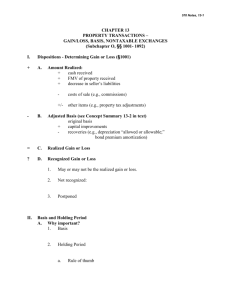

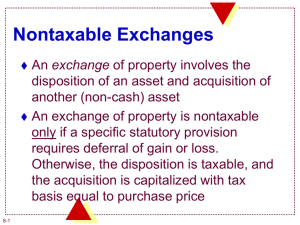

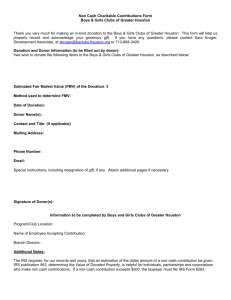

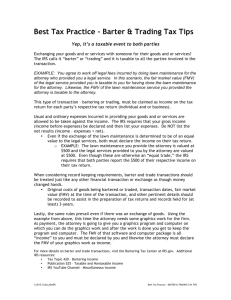

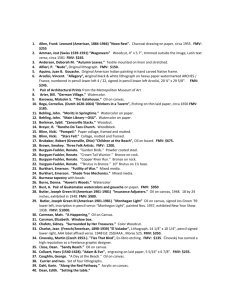

Dr. Bob’s 460 Notes, 7-1 CHAPTER 7 PROPERTY TRANSACTIONS – GAIN/LOSS, BASIS, NONTAXABLE EXCHANGES I. Dispositions - Determining Gain or Loss Amount Realized Minus Adjusted Basis Equals Realized Gain or Loss Realized vs. Recognized Gain or Loss Not recognized Postponed II. Basis and Holding Period. Why important? A. Basis A. Holding Period Rule of thumb Dr. Bob’s 460 Notes, 7-2 III. Determining Basis – Different Methods of Acquisition A. Purchases 1. Cost basis includes cash, FMV of other property given, debt, and transactions costs incurred in the acquisitsion. 2. Allocation of basis for multiple assets acquired in a single purchase based on relative FMVs (property tax values also acceptable). Example: Purchase a building (and the land upon which it sits) for $250,000. Property tax assessment values the land at $20,000 and the building at $180,000. B. Self-Constructed Assets 1. Uniform capitalization rules are mandated for inventory and certain other property. 2. Construction period interest must be capitalized for certain “long useful life” property. C. Taxable Exchanges 1. Basis determined by: 2. D. Holding period starts: Nontaxable Exchanges Rules to remember: Basis Holding Period Dr. Bob’s 460 Notes, 7-3 Examples of Nontaxable Exchanges 1. Stock Dividends - Allocate basis of original holding to all shares now held. 2. Stock Rights - Allocation of a nontaxable stock right received is mandatory only if the right has a FMV 15% of the FMV of the underlying stock. Allocation of basis to other nontaxable stock rights is elective. Example: You own 1,000 shares of ABC common stock with a basis of $10,000 and a FMV of $20,000. 1,000 rights, worth $5 each ($5,000 total) allow you to purchase 1,000 shares of stock at $15 per share. 3. Like-Kind Exchanges Example: Old truck (adjusted basis = $15,000, FMV = $17,000) traded and $10,000 cash given for new truck. Basis of new = 4. a. Transfers to Business Entities Proprietorships & Partnerships, LLCs c. Corporations (C & S) Dr. Bob’s 460 Notes, 7-4 E. Disallowed Losses 1. Related Party Sales 2. Wash Sales F. Converting Personal Use Property to Business Use 1. Lower of adjusted basis or FMV at date of conversion. Example: Convert personal residence (basis = $80,000, FMV = $70,000) to rental. G. Gifts 1. FMV > Donor Basis a. Donee’s basis = Donor basis + the portion of any gift tax paid (by donor) that is the property’s appreciation relative to the taxable gift. Example: Donor basis = $30,000, FMV = $50,000. Donor pays $10,000 gift tax. Donee basis = 2. FMV < Donor Basis a. Dual Basis results: Gain basis = donor (transferred) basis Loss basis = FMV at gift date Example: Donor basis = $50,000, FMV = $30,000. Donor pays $6,000 gift tax. Donee basis = H. Inheritances 1. Basis is FMV at date of death or alternate valuation date (6 months after date of death). 2. Holding period is always deemed to be long-term. Dr. Bob’s 460 Notes, 7-5 IV. Like-Kind Exchanges (§1031) A. General Rule. 1. NO GAIN OR LOSS recognized on an exchange of like-kind property EXCEPTION –GAIN recognized if boot is received. 2. Property must be held for investment or for use in a trade or business. Treatment is mandatory. B. Like-Kind Property Defined 1. Exchanged property must be of the same class (i.e. personal property for personal and real property for real). Personal property must be within the same General Business Asset Class or within the same Product Class. 2. Inventory and securities do not qualify for like-kind exchange treatment. C. Direct Exchange Must Occur EXCEPTION for qualified real estate transactions (45 days after sale to identify replacement property, 180 days to close). D. Receipt of Boot 1. Gain is recognized to the extent of boot received, limited by the realized gain. 2. No loss is ever recognized on a like-kind exchange. 3. What is Boot? 4. If both properties are encumbered with debt, the mortgages are offset to determine if there is net boot. E. Basis of Property Received 1. Basis = basis of property given up (including boot) less boot received plus gain recognized. 2. This may also be computed as: FMV of new property less any gain NOT recognized or plus any loss NOT recognized 3. The basis of non-qualifying property (boot) is always the property's fair market value. Dr. Bob’s 460 Notes, 7-6 F. Holding Period for Property Received 1. The holding period of like-kind property received includes the holding period of the like-kind property given up, WHY??? 2. The holding period for non-qualifying property (boot) begins with the date of the exchange. G. EXAMPLES 1. X and Y exchange like-kind property. FMV of each is $20,000. X's basis is $25,000; Y's basis is $15,000. X Y Received: Gave: Gain(Loss) Realized: Gain(Loss) Recognized: Basis of new asset: 2. X and Y exchange like-kind property. X's has a FMV of $18,000 and a basis of $25,000; Y's has a FMV of $20,000 and a basis of $15,000. X pays Y $2,000 in cash to even the deal. X Y Received: Gave: Gain(Loss) Realized: Gain(Loss) Recognized: Basis of new asset: Dr. Bob’s 460 Notes, 7-7 3. X and Y exchange like-kind property. X's has a FMV of $12,000 and a basis of $25,000; Y's has a FMV of $22,000, a basis of $15,000, and is subject to a debt of $10,000, which X assumes. X Y Received: Gave: Gain(Loss) Realized: Gain(Loss) Recognized: Basis of new asset: 4. X and Y exchange real property. X gives up a building with a FMV of $90,000 and a basis of $27,000. Y gives up a building with a FMV of $82,000 and a basis of $64,000. Y also gives up stock with a FMV of $8,000 and a basis of $10,000. X Y Received: Gave: Gain(Loss) Realized: Gain(Loss) Recognized: Basis of new asset: Dr. Bob’s 460 Notes, 7-8 V. Involuntary Conversions (§1033) A. General Rule. 1. Gains are deferred if the full amount of the proceeds is invested in qualifying replacement property within a certain period. 2. Losses are recognized. B. Involuntary Conversion Defined 1. Includes theft, seizure, requisition, condemnation, or destruction of property. C. Determination of Gain and Basis 1. Gain is recognized to the extent proceeds (e.g., insurance recovery) > cost of qualifying replacement property, limited to realized gain. 2. Adjusted basis of replacement property is cost less unrecognized gain. 3. EXAMPLE: A taxpayer receives $160,000 of insurance proceeds from an involuntary conversion; basis in the property was $110,000. Replacement property was purchased for $140,000. D. Replacement Property 1. Generally, replacement property is required to be similar or related in service or use to the converted property. EXAMPLE: A stolen delivery truck used in the taxpayer's trade or business would need to be replaced with some type of delivery vehicle to qualify for gain deferral. 2. If real property used in a trade or business or held for investment is condemned, it may be replaced under the less restrictive like-kind standard. E. Time Requirements for Replacement 1. The normal replacement period is two years after the end of the tax year in which the involuntary conversion gain is realized. 2. Condemned real property can be replaced within three years after the end of the tax year in which the involuntary conversion gain is realized. Dr. Bob’s 460 Notes, 7-9 VI. Sale of Principal Residence by Individuals - Exclusion of Gain A. Exclusion of gain up to $250,000 ($500,000 for married, joint returns). B. Requirements: 1. Must have owned and used the property as a principal residence for at least 2 years during the 5-year period ending on the date of sale. 2. Exclusion allowed on each sale, but no more than once every 2 years. 3. Exception to the use and limit of once every 2 years: Prorated exclusion allowed if either of the 2-year requirements not met if caused by reason of a change in place of employment, health, or other unforeseen circumstances. Exclusion Ratio = Shorter of: (1) Actual ownership & use; or (2) time since most recent excluded sale 2 years Example: Mr. and Ms. Jones purchased and occupied a principal residence in 2009. Exactly one year later, Ms. Jones is transferred by her employer to another city and the Jones move. They sell their home at a $200,000 gain. What is their exclusion? 4. Exception for “nonqualified use,” defined as any period of time after 2008 that the house is not used as the principal residence. Example: Bob buys a second home January 1, 2005, then moves into it as his principal residence on January 1, 2011, and sells it on January 1, 2013. He meets the 2-out-of-5 year requirement, but 2 years of ownership (2009 and 2010) is not qualified use, so twoeighths of any gain is not eligible for the exclusion. 5. Rules for married individuals: a. MFJ taxpayers can exclude up to $500,000 if (1) either meets the ownership test; (2) both meet the use test; and (3) neither is ineligible because of a prior sale within 2 years. b. On the other hand, each spouse can exclude $250,000. Thus, if H marries W, who sold her home in the prior year, H could still get a $250,000 exclusion. 6. Depreciation recapture occurs for any business use of the home for periods after 5/6/97. a. Business use includes home office & rental.