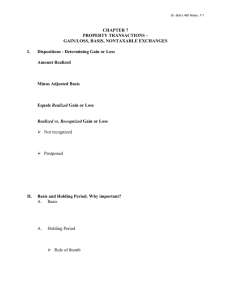

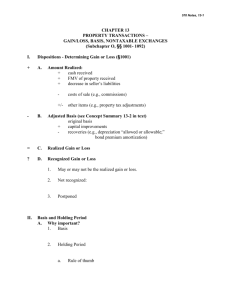

Federal Income Taxation Chapter 5 Capital Appreciation Professors Wells Presentation:

Presentation:

Federal Income Taxation

Chapter 5 Capital Appreciation

Professors Wells

September 9, 2015

CH 2-4 Capital Appreciation

Tax Basis Recovery p.225

§61(a)(3) – gross income includes gains derived from dealing in property;

Reg. §1.61-3(a) (sales less cost of goods sold).

Reg. §1.61-6 (sales price less basis to determine “gain”)

§1001- determining the amount of gain (amount realized less tax basis)

§1012 – identifying “cost basis” -

Should a person recover “investment” in a property without gross income inclusion? 2

Windfall Gains p.225

Eisner v. Macomber

Discuss Facts

Lay out majority and dissenting opinions

Analyze opposing views and implications

Who was right?

3

Helvering v. Bruun p.261

Landlord owns tenant’s improvements to property at expiration of the lease.

Gross income? Timing – when improvements made? Periodically as lease runs? Expiration of the lease? At subsequent time of property sale? (& impact in interim?)

Note Code §§ 109 and 1019 (no GI inclusion and no basis adjustment).

4

Cottage Savings Assn. –

Loan Packages p.265

Facts: 1. Financial institution exchanges one group of residential mortgage loans with another financial institution for another package of residential mortgage loans. A swap of “participation interests” occurs. Long-term low interest mortgages had declined in value because of the significant increase in market interest rates.

2.

Seller did not want to record the losses on its “books” (i.e., reporting for regulatory and financial accounting purposes).

Issue: Does tax disposition event occur only if properties are

"materially different"?

Holding: This exchange does cause realized losses for federal income tax purposes. Cf., inclusion of income based merely on appreciation, i.e., an accretion to wealth.

5

Post-Cottage Savings p.274

“Significant Debt Modifications”

Tax community became concerned that Cottage Savings created a

“hair-trigger” realization event analysis. The Treasury Department responded with regulations under §1.1001-3.

Is the modification of a debt a realization event? Reg. §1.1001-3(b) states a “significant modification” of a debt instrument is an exchange.

Consider change in (1) term, (2) interest rate, (3) other (e.g., priority)? Exception for a “unilateral option.”

6

Deemed Realization: §1259 p.274

Gain or loss arises on the “sale or exchange of a capital asset.” See Code §1222.

How postpone sale/gain recognition?

“Short against the box”:

(1) owning securities, (2) borrow similar securities,

(3) sell the borrowed securities (short), thereby terminating risk on investment; (4) then close transaction - deliver original shares.

Code §1259 – gain on doing this transaction.

Long 100 shares

Este Lauder Transaction

Short 100 shares

Stock

Lender

Loan

100 shares

Lauders $10 million

100 shares of ABC Stock

Basis $10,000

FMV $10 million

Buyer

The “Box”

Shares

7

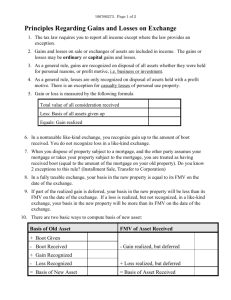

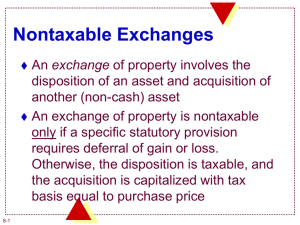

Non-recognition Rules p.277

Like-Kind Exchanges §1031

Under Code §1001(c) gain is recognized – except as otherwise provided.

Like-kind exchanges can enable gain recognition postponement - Code §1031.

No gain recognition is required on a “like-kind” property exchange, except for the receipt by taxpayer of “boot”

§1031(b) .

What is the rationale for this provision? valuation difficulty? lack of liquidity?

8

Alloy

Alderson v. Commissioner p.277

Orange

(Escrow Agent)

5/21/1957

Buena Park Pty

+ $19,000

1.40)

9/3/1957

Salinas Pty 9/3/1957

$172,871.40

$191,871.40

9/3/1957

Salinas Pty

115.32 acres (FMV=$190,000)

Salinas Title

(Escrow Agent)

Delayed receipt of exchange property – relying on creditworthiness of the exchanging party.

A §1031 exchange? See §1031(a)(3) specifying 45 day and 180 day limits. What if interest

charge equivalent credited to replacement property purchase?

9

Rev. Rul. 79-143 p.283

FACTS: Exchange of United States gold coins for African

Krugerrand gold coins.

Held: Not like kind.

Like-kind exchange treatment permitted:

1) Different types of real estate? (PLR 200203033).

2) Auto trade-ins?

3) Computer for a printer?

See limits in §1031(a)(2).

10

Jordan Marsh Co. v. Commissioner p.285

FACTS: Sale of property for $2.3 million and lease-back for 30 years.

John Marsh

Taxpayer claims loss equal to difference between $2.3 million and adjusted basis.

IRS: Claims that the sale-leaseback is a like-kind exchange subject to Section 1031(c)’s prohibition on recognizing losses.

Tax Court: Agreed with IRS.

Second Circuit: Held not a like-kind exchange but a cash sale.

11

How Assure “Exchange” Status?

§1031 does not permit deferral with receipt of cash and then reinvestment in a new property.

How arrange exchange when one party is providing cash?

- multi-party transactions;

- §1031 exchange facilities

Cf., tenancy in common ownership arrangements

12

How is the Gain Potential Retained for Tax

Purposes?

Tax basis for replacement property is:

1) same as tax basis for property transferred;

2) decreased by boot received;

3) increased by gain recognized on the exchange.

See §1031(d) providing for a transferred tax basis.

13

Like Kind Exchanges with

No “Boot” Received

Example One: Exchange of Property A worth 10x, basis 4x, for like-kind Property B, also fmv 10x.

Inclusion of gain of 6x is postponed.

Tax basis for the replacement property is 4x (to preserve the income tax potential on 6x deferred gain). Code

§1031(d).

14

Like-kind Exchanges, cont.

Boot Received

Example Two: Transfer of Property A worth 10x (basis

4x, appreciated gain is 6x) in exchange for replacement

Property B, fmv 8x, and additional cash is received of 2x

(i.e., “boot”).

Code §1031(b) - 6x gain is realized. Gain is to be recognized to the extent of the 2x “boot”.

Tax basis for replacement Property B (fmv 8x) is 4x (2x has been recognized; 4x is not recognized). Tax basis for

2x cash received is (obviously) 2x.

15

Like-kind Exchanges, cont.

Boot

Exceeds

Gain

Example Three: Transfer of Property A worth 10x

(basis 4x; 6x appreciation) for replacement Property B, fmv 3x, plus cash (boot) received in the amount of 7x.

Code §1031(b) - 6x gain is to be recognized (i.e., only to the extent of gain realized).

Basis for Property B is 3x (all gain has been recognized).

Basis for the cash is 7x.

16

Loss - Like-kind Exchange Provision

Is Not Elective

Example Four: Transfer of Property A worth 10x (basis

12x, i.e., loss property) for replacement Property B, fmv

10x (i.e., same FMV).

No loss can be recognized. Code §1031(a).

Basis for Property B received is 12x (i.e., the 2x loss potential is retained in the replacement property for future loss recognition when sold, unless subsequent appreciation).

See Jordan Marsh Co. v. Commissioner.

17

Loss - Like-kind Exchange Provision

Is Not Elective

Example Five (loss exchange & boot received ): Transfer of Property A worth 10x (basis 12x, i.e., loss property) for replacement Property B, fmv 8x, and 2x cash boot received by “seller.”

No loss can be recognized. Code §1031(c).

Tax basis for Property B is 10x (basis is reduced by 2x cash); 2x loss potential is retained (8x fmv for Property

B); and, 2x tax basis for the cash received.

18

Like-kind Exchange –

Boot Received in Kind

Example Six: Transfer of Property A worth 10x (tax basis is 4x, 6x appreciation) for (1) replacement Property

B, fmv 8x and (2) other property (e.g., stock) worth 2x.

Code §1031(b) - 6x gain is realized, but recognition of gain only to extent of the “boot.”

Basis for Property B (fmv 8x) is 4x (2x of the 6x appreciation is recognized (& 4x gain potential) & 2x is tax basis for boot.

19

Like-kind Exchange –

Taxpayer Adds Cash Boot

Example Seven: Transfer of both Property A worth 10x

(basis 4x, with 6x appreciation) and 5x cash for acquiring replacement Property B with fmv 15x.

Code §1031(a) - 6x gain is realized but no gain is to be recognized.

Basis for (15x fmv) Property B is 9x (4x old basis plus 5x new cash from purchaser).

20

Involuntary Conversions p.288

§1033

§1033(a) Analysis

Step One: §1033(a) applies to property that is the subject of an involuntary conversion (destruction, theft, seizure, requisition or condemnation)

Step Two: Taxpayer receives

1.

replacement property (§1033(a)(1)) or

2.

money (§1033(a)(2)) that is used to purchase replacement property within 2 years of realization of any part of the gain (§1033(h) extends to 4 years for federal disaster areas),

Then, realized gain or loss is not recognized to the extent that the conversion proceeds are reinvested into replacement property.

Basis per §1033(b): Substitute Basis – Boot + Gain Recognized .

21

Sale of Home p.290

§121 excludes gain on sale of home of up to $250,000 ($500,000 for married filing jointly)

The benefits of this exclusion arguably changes taxpayer behavior on where they have their wealth. Is this a good thing?

The Tax Expenditure cost of this benefit is $17.5 billion.

22

Wash Sale Rules p.291

§1091

§1091(a) Analysis

In the case of any loss claimed to have been sustained from any sale or other disposition of shares of stock or securities where it appears that, within a period beginning 30 days before the date of such sale or disposition and ending 30 days after such date, the taxpayer has acquired (by purchase or by an exchange on which the entire amount of gain or loss was recognized by law), or has entered into a contract or option so to acquire, substantially identical stock or securities, then no deduction shall be allowed under section 165 unless the taxpayer is a dealer in stock or securities and the loss is sustained in a transaction made in the ordinary course of such business.

23

Deferred Sale: p.293

Bernice Patton Testamentary Trust v. U.S.

FACTS: in 1995, Pattons sold two closely-held businesses for cash

($317,140) plus Seller’s note ($507,424). Patton’s basis was $299,322.

Taxpayer used open transaction doctrine and reported gain of

$17,818 (cash in excess of basis).

Taxpayer note was reduced to $107,916, $23067 interest, and $2,914 default interest. Taxpayer ultimately received / was paid $14,116 (in

1995), $104,704 (in 1996), and $85,350 (in 1997) (total of $204,170).

IRS contended that note had ascertainable value of $202,344 and thus created long-term capital gain in 1995.

Fed. Cir.: Held that installment sale reporting was appropriate.

How did court decide valuation of the note?

24

Deferred Sale: p.293

Bernice Patton Testamentary Trust v. U.S.

Bernice'Patton'Testamentary'Trust'v.'United'States

Sales'price

Cash'(Year'1)

Note

'''''''''''''''''' 317,140

'''''''''''''''''' 507,424

Overall'Amount'Realized ''''' 824,564

Basis ''''' 299,322

Open'Transaction

Amount'Realized

Basis

Gain'in'Year'1

Installment'Sales

Amount'Realized

Basis

Gain

Year'1'Calculation

'''''''''''''''''' 317,140

'''''''''''''''''' 299,322

'''''''''''''''''''' 17,818

Later'Years

''''' 204,170

''''' 204,170

Year'1'Calculation Later'Years

'''''''''''''''''' 317,140

'''''''''''''' 115,124

'''''''''''''''''' 202,016

''''' 204,170

299,322'x'(317,140/824,564) ''''' 184,198

'''''''' 19,972

25

Installment Sales: §453

Supp. pp. 41-53

Hypo: Seller sells property worth $600x (Basis $400x) to Buyer in exchange for Buyer’s debt instrument pays $100x per year over the next 7 years. AFR=4%. Seller elects the installment method.

Tax Consequences to Seller

1.

§1274/§483 computes original issue price of $600x. Gain of $200 is realized (see Treas.

Reg. §1.1001-1(g)), but it is not recognized immediately if the installment method were elected.

2.

Receive $100x

• Step One: Interest First of $24x ($600x x 4%). See Treas. Reg. §15.a.453-1(b)(2)(ii)

• Step Two: Compute Included Gain per §453(c)

Included Gain = x Payment (other than interest)

(200/600 * 76x) = $25.3 gain

• Remaining payment of $50.7 is return of basis

3.

§453A modifies the above results in certain events, including if debt instrument were

pledged or if sale’s price > $5 million.

26